Please solve AS soon as possible

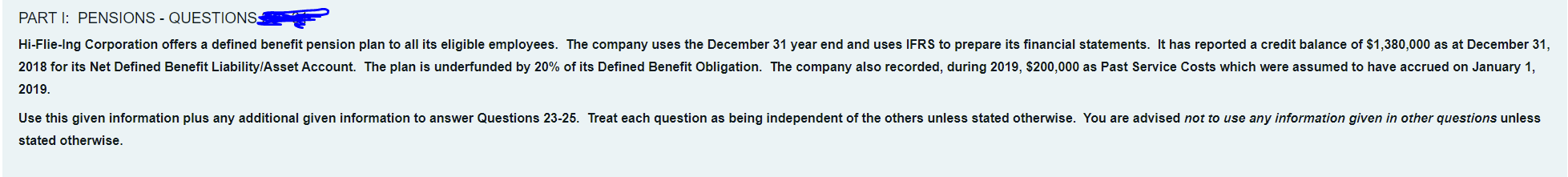

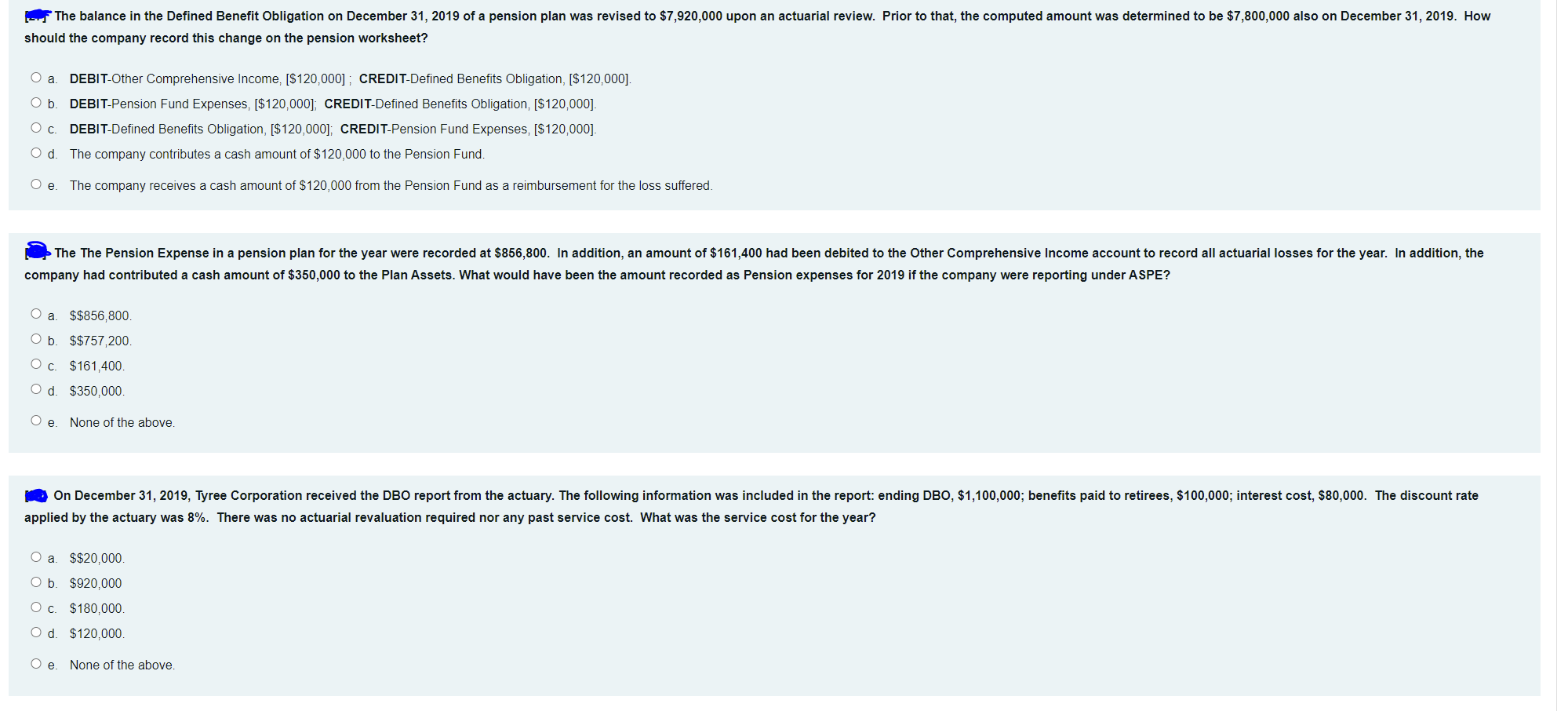

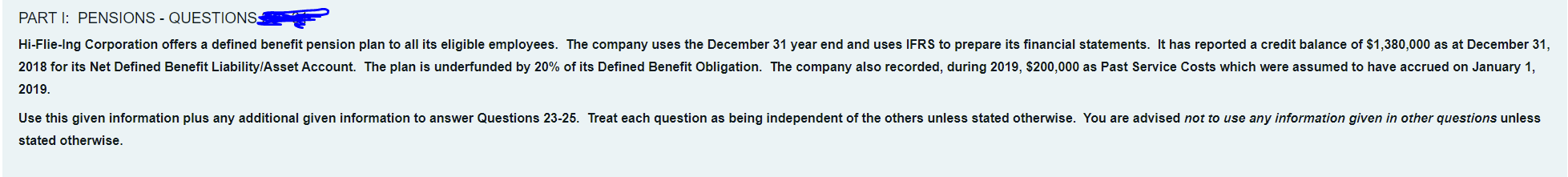

The balance in the Defined Benefit Obligation on December 31, 2019 of a pension plan was revised to $7,920,000 upon an actuarial review. Prior to that, the computed amount was determined to be $7,800,000 also on December 31, 2019. How should the company record this change on the pension worksheet? O a DEBIT-Other Comprehensive Income, ($120,000] ; CREDIT-Defined Benefits Obligation, ($120,000). Ob. DEBIT-Pension Fund Expenses, ($120,000); CREDIT-Defined Benefits Obligation, ($120,000). OC. DEBIT-Defined Benefits Obligation, ($120,000); CREDIT-Pension Fund Expenses, ($120,000). Od. The company contributes a cash amount of $120,000 to the Pension Fund. Oe. The company receives a cash amount of $120,000 from the Pension Fund as a reimbursement for the loss suffered. The The Pension Expense in a pension plan for the year were recorded at $856,800. In addition, an amount of $161,400 had been debited to the Other Comprehensive Income account to record all actuarial losses for the year. In addition, the company had contributed a cash amount of $350,000 to the Plan Assets. What would have been the amount recorded as Pension expenses for 2019 if the company were reporting under ASPE? a $$856,800. Ob $$757,200 Oc. $161.400 Od $350,000 Oe. None of the above. On December 31, 2019, Tyree Corporation received the DBO report from the actuary. The following information was included in the report: ending DBO, $1,100,000; benefits paid to retirees, $100,000; interest cost, $80,000. The discount rate applied by the actuary was 8%. There was no actuarial revaluation required nor any past service cost. What was the service cost for the year? . $$20.000 Ob. $920,000 Oc. $180,000. Od $120,000. Oe None of the above. PARTI: PENSIONS - QUESTIONS Hi-Flie-Ing Corporation offers a defined benefit pension plan to all its eligible employees. The company uses the December 31 year end and uses IFRS to prepare its financial statements. It has reported a credit balance of $1,380,000 as at December 31, 2018 for its Net Defined Benefit Liability/Asset Account. The plan is underfunded by 20% of its Defined Benefit Obligation. The company also recorded, during 2019, $200,000 as Past Service Costs which were assumed to have accrued on January 1, 2019. Use this given information plus any additional given information to answer Questions 23-25. Treat each question as being independent of the others unless stated otherwise. You are advised not to use any information given in other questions unless stated otherwise