please solve asap

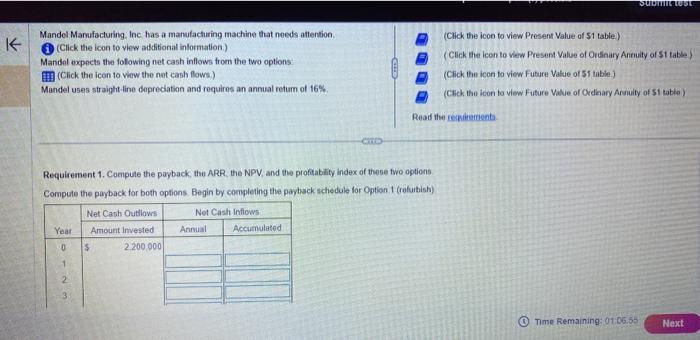

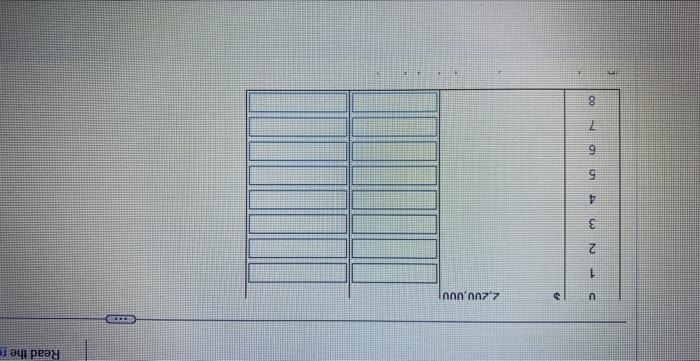

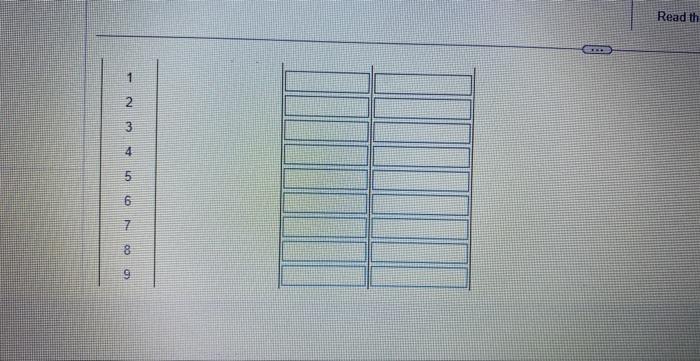

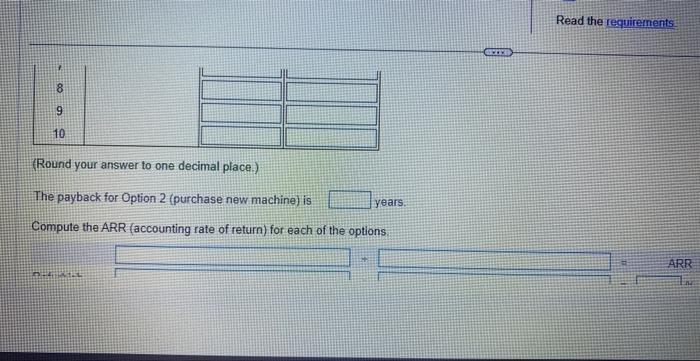

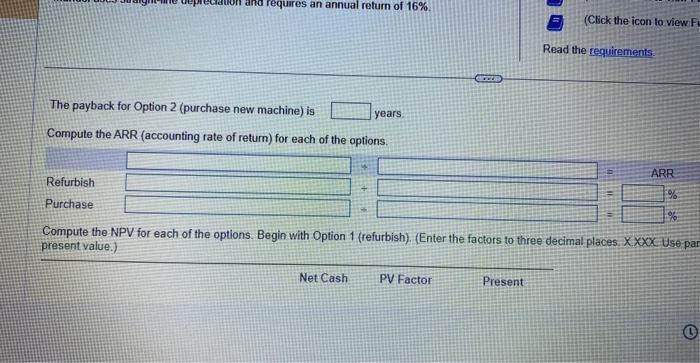

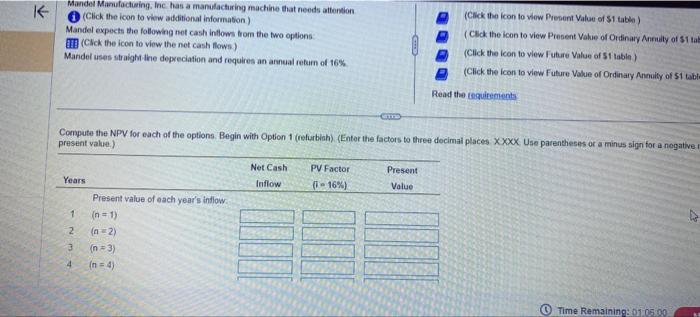

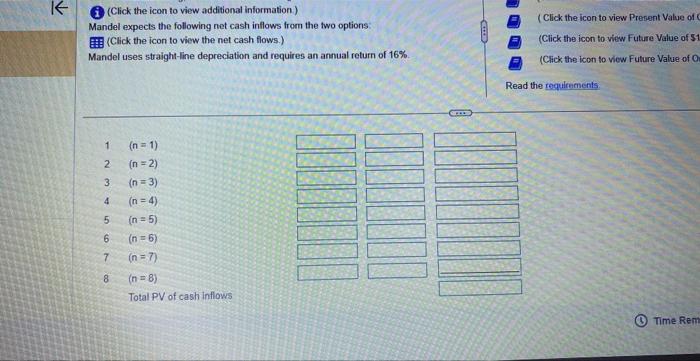

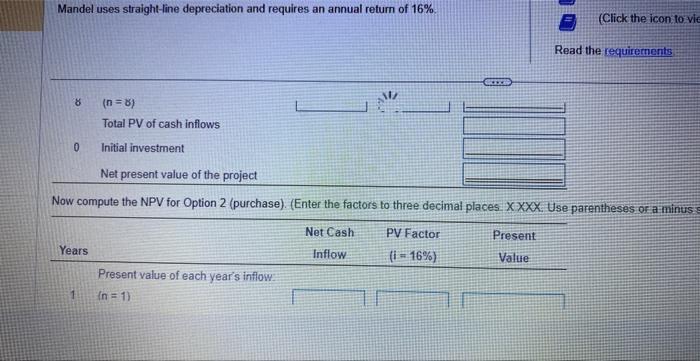

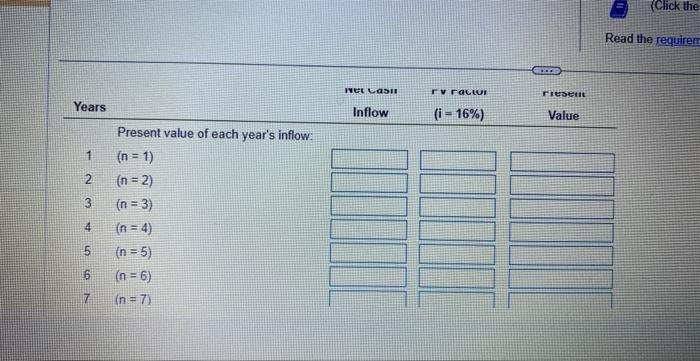

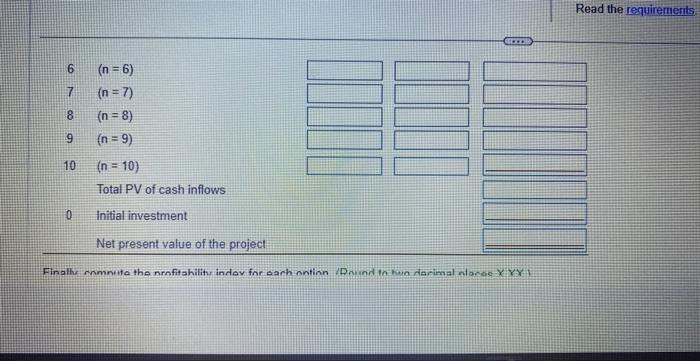

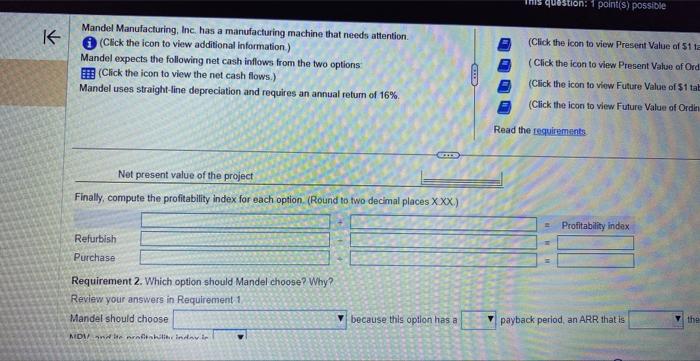

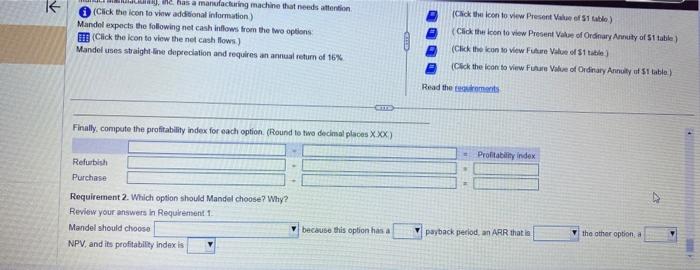

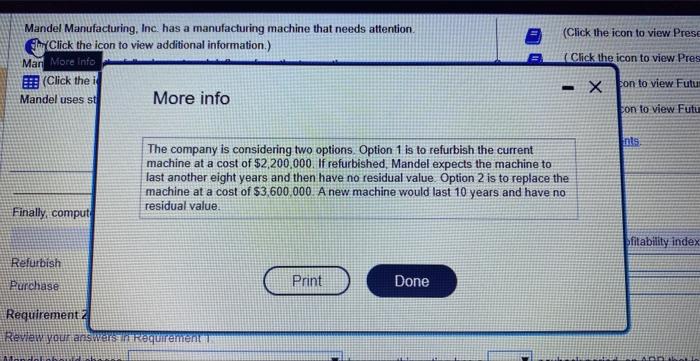

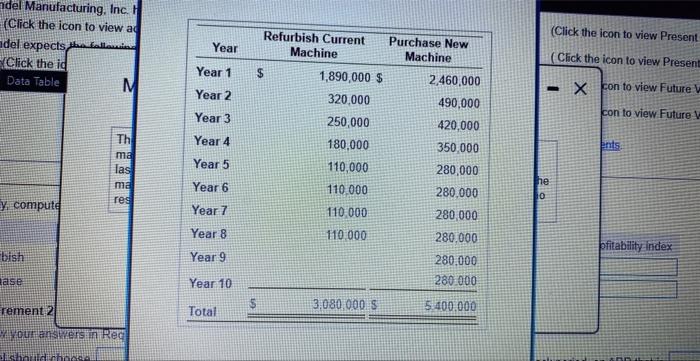

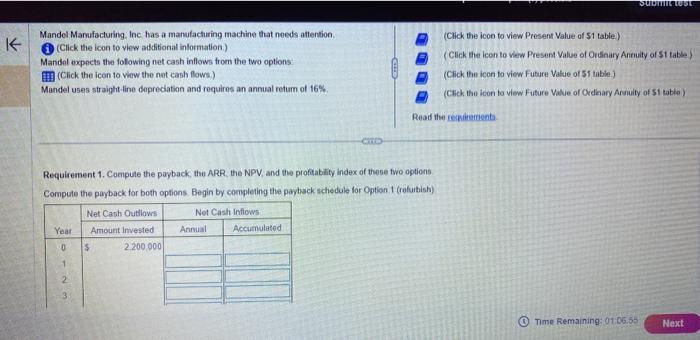

Mandel Marufacturing, Inc has a manufacturing machine that needs attention. (1) (Click the icon to view additional inlormation.) Mandal expects the following net cash inflows from the two options. (Click the icon to virw the net cash flows.) Mandel uses straight line dopreciation and requires an annual return of 16%. (Click the icon to view Present Value of 51 table) (Click the icen to vew Present Value of Ordinary Anrulty of 51 table) (Click the icon to view Future Value of 51 table.) (Ckick the icon to view Future Value of Ordenary Arenuity of 51 tablo) Read the reiniremente. Requirement 1. Compute the payback, the ARR, the NPV, and the profitablity index of theise two options. Compute the payback for both options. Begin by completing the payback schedule for Option. 1 (refurbish) (Kound your answer to one decimal place.) The payback for Option 1 (refurbish current machine) is years. Now complete the payback schedule for Option 2 (purchase). 123456789 (Round your answer to one decimal place.) The payback for Option 2 (purchase new machine) is years. Compute the ARR (accounting rate of return) for each of the options: The payback for Option 2 (purchase new machine) is years. Compute the ARR (accounting rate of return) for each of the options. Compute the NPV for each of the options. Begin with Option 1 (refurbish). (Enter the factors to three decimal places X CIse par present value.) Mandes Manufocturing, Ine has a manulacturing machine that needs attention (1) (Click the icon to view arditional information) Mandel expects the following net cash intlows from the fwo options (CIck the icon to virw the net cash flows.) Mandel uses straight the depreciation and requires an annual return of 16%. (Click the icon to view Preseent Value of $1 table) ) ( CEick the icon to view Present Vahe of Ordinary Anenily of 51 tat (Click the icon to view Future Value of St lable.) (Click the icon to view Future Value of Ordinary Annuity of 51 wbli Read the cemuifements Compute the NPY for each of the options. Begin with Option 1 (refurbiah). (Enter the factors to threet decimal places x Use parentheses or a minus sign for a negative. present value.) (i) (Click the icon to view additional information.) Mandel expects the following net cash inflows from the two options: Ii: (Click the icon to view the net cash flows.) Mandel uses straight-line depreciation and requires an annual return of 16%. ( Click the icon to view Present Value of (Click the icon to view Future Value of $1 (Click the icon to view Future Value of 0 Read the requiraments: Mandel uses straight-line depreciation and requires an annual return of 16%. Read the requirements Now compute the NPV for Option 2 (purchase). (Enter the factors to three decimal places XXXX. Use parentheses or a minus: Read the reguiren Finaliv momnite the noffitahility indev finr sarh antion :Dound in huin darimal nlocos X YY I Mandel Manufacturing, Inc. has a manufacturing machine that needs attention. 1. (Clck the icon to view additional information.) Mandel expects the following net cash inflows from the two options: (Click the icon to view the net cash flows.) Mandel uses straight-line depreciation and requires an annual return of 16%. (Click the icon to view Present Value of 51 ta (Click the icon to view Present Vahe of Ord (Click the icon to viow Future Value of $1 tak (Click the icon to view Future Value of Orden Read the feguiremeats. Net present value of the project Finally, compute the profitability index for each ontion. IRound to fwo rerimal nlanoe xx. Requirement 2. Which option should Mandel choose? Why? Review your answers in Requirement 1 letandel should choose hiply and the nreftroblihy indev is because this option has a payback period, an ARR. that is (i) (Click the iccon to vinw addional information) Mandol expocts the following net cash inflows froen the two options: [Click the koon to view the net cash llows.] Mandel uses straight-line depreclation and requires an annual return of 16%. (Cick tive icon to view Present Value ef Si tablo) (Click the icon to viow Present Valse of Ordinary Arintity of 51 table) (Click the icon lo vitw Futue Valoe of 51 tathe) (CFick the icen to view FiAuie Vitie of Drdinary Annuly of $1 Lable) Read the ceenirnments: Finally. compute the orofitahility inrlev for aara. antion in. Requirement 2. Which option should Mandel choose? Why? Revievy your answers in Requtrentent 1 . Mandel should choose NPV, and its profitability index is Mandel Manufacturing, Inc. has a manufacturing machine that needs attention. MMr Click the icon to view additional information.) Mant More info (Click the is the icon to view Prese Mandel uses st MoreinfoThecompanyisconsideringtwooptions.Option1istorefurbishthecurrentmachineatacostof$2,200,000.Ifrefurbished,Mandelexpectsthemachinetolastanothereightyearsandthenhavenoresidualvalue.Option2istoreplacethemachineatacostof$3,600,000.Anewmachinewouldlast10yearsandhavenoresidualvalue. inally, comput (Glick the icon to view ad (Click the icon to view Present (Click the icon to view Present - con to view Future V con to view Future 1 Submit test