Answered step by step

Verified Expert Solution

Question

1 Approved Answer

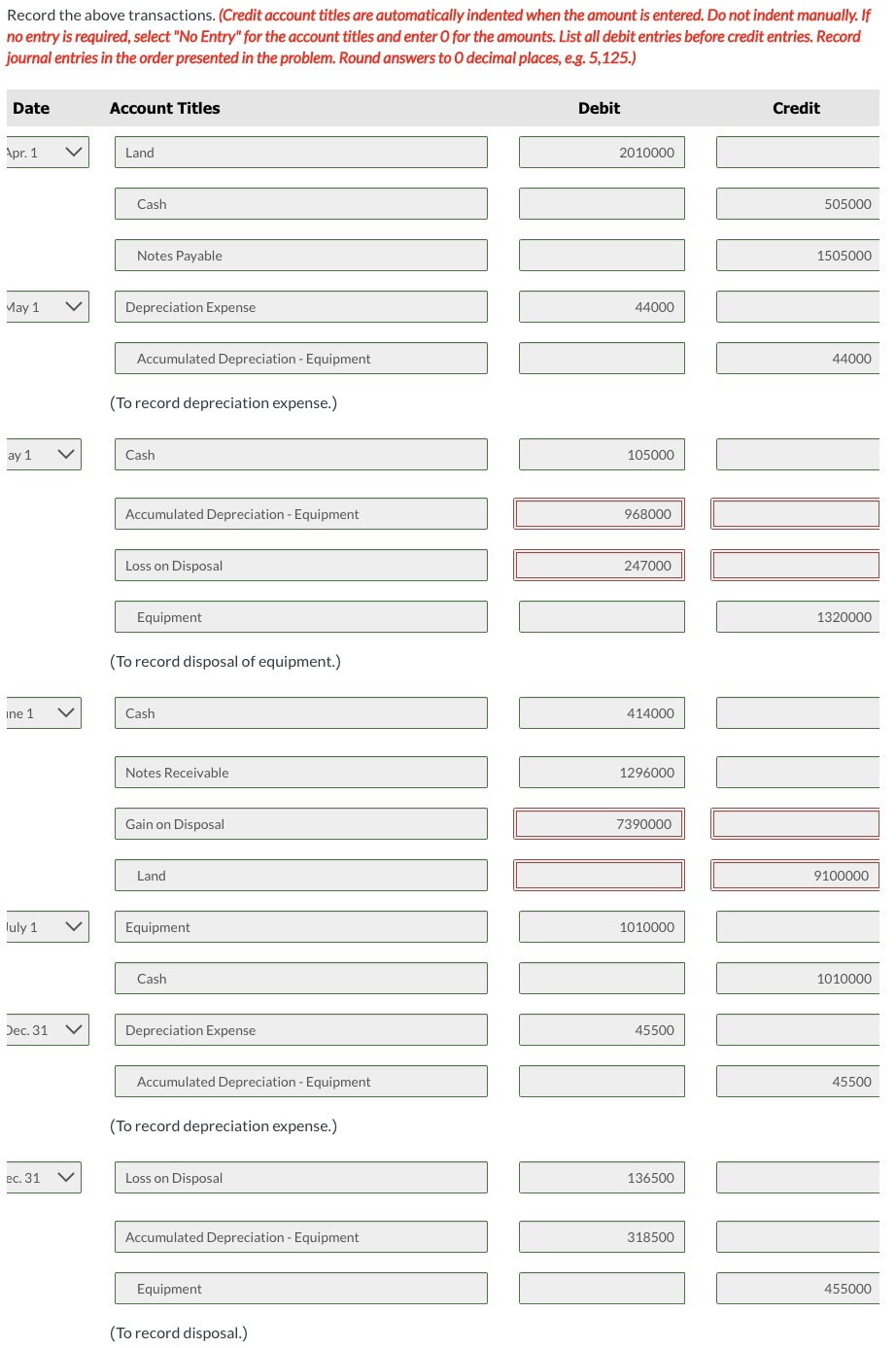

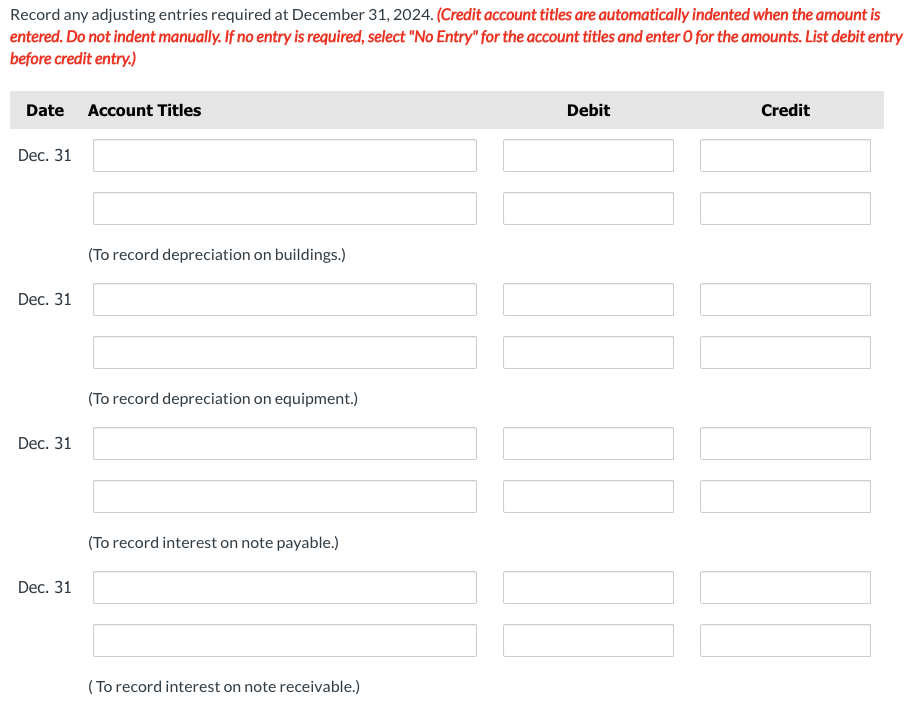

PLEASE SOLVE ASAP - Please record any journal entries required for December 31, 2024 in the above format (NOTE: red boxes in previous recorded transactions

PLEASE SOLVE ASAP - Please record any journal entries required for December 31, 2024 in the above format (NOTE: red boxes in previous recorded transactions are incorrect) Thanks

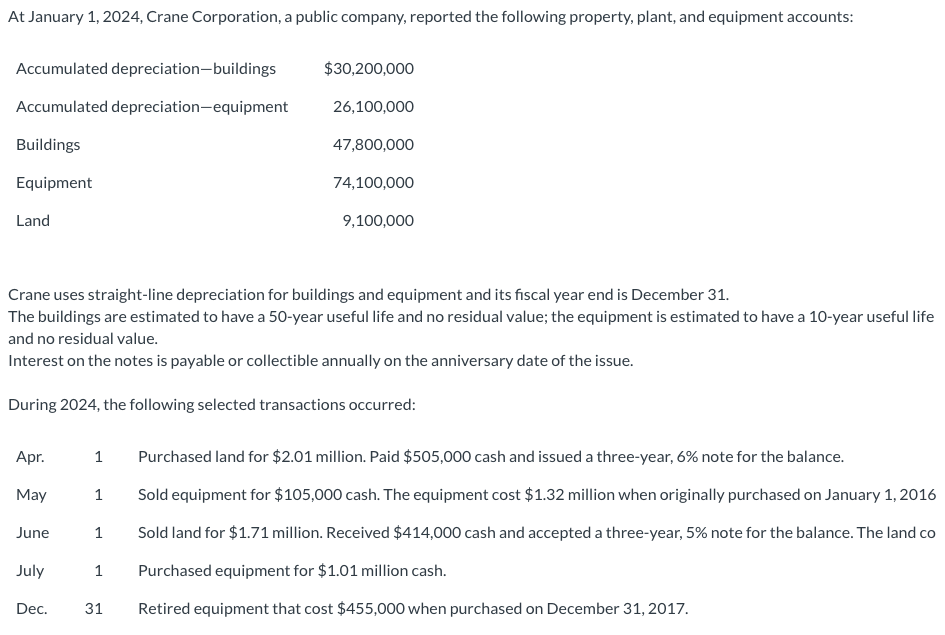

At January 1,2024 , Crane Corporation, a public company, reported the following property, plant, and equipment accounts: Crane uses straight-line depreciation for buildings and equipment and its fiscal year end is December 31. The buildings are estimated to have a 50-year useful life and no residual value; the equipment is estimated to have a 10 -year useful life and no residual value. Interest on the notes is payable or collectible annually on the anniversary date of the issue. During 2024, the following selected transactions occurred: Apr. 1 Purchased land for $2.01 million. Paid $505,000 cash and issued a three-year, 6% note for the balance. May 1 Sold equipment for $105,000 cash. The equipment cost $1.32 million when originally purchased on January 1,2016 June 1 Sold land for $1.71 million. Received $414,000 cash and accepted a three-year, 5% note for the balance. The land co July 1 Purchased equipment for $1.01 million cash. Dec. 31 Retired equipment that cost $455,000 when purchased on December 31, 2017. Record the above transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries. Record Record any adjusting entries required at December 31, 2024. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List debit entry before credit entry.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started