Answered step by step

Verified Expert Solution

Question

1 Approved Answer

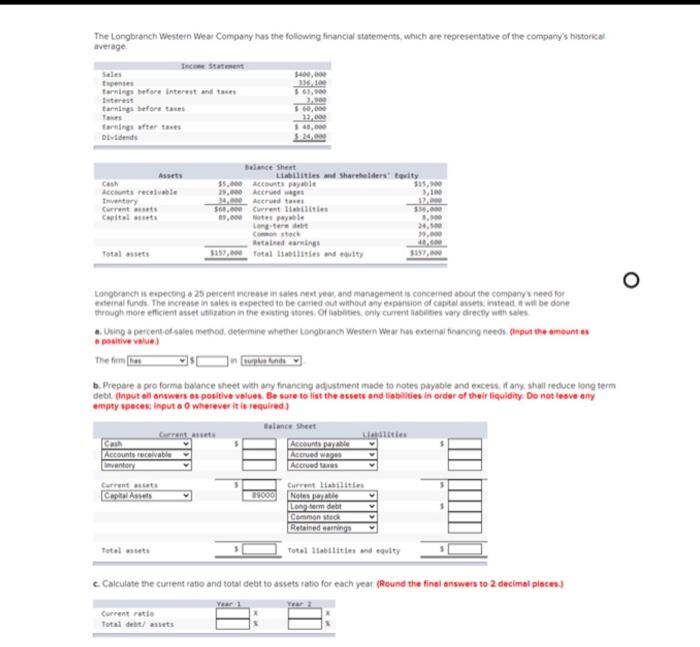

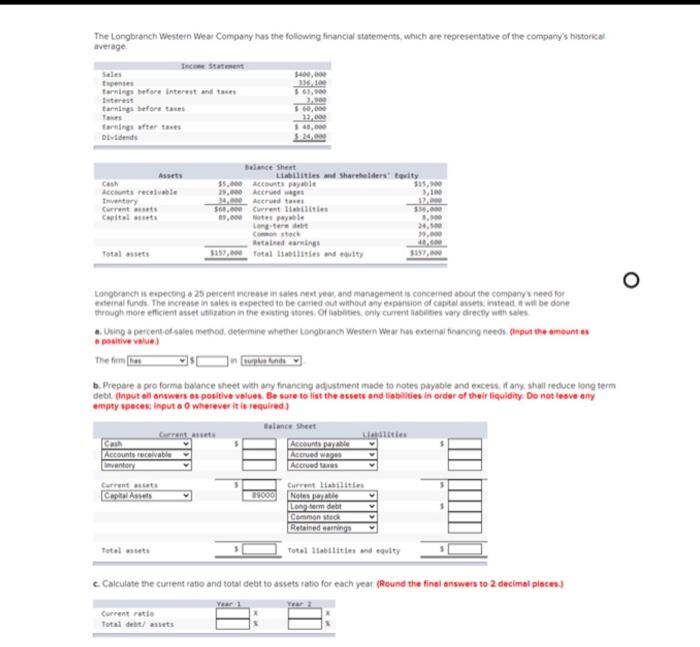

please solve asap The Longbranch Western Wear Company has the following financial statements, which are representative of the company's histoekal average. Longbranch is especting o

please solve asap

The Longbranch Western Wear Company has the following financial statements, which are representative of the company's histoekal average. Longbranch is especting o 25 peicent increale in iales nest yeal, and management is conceined about the company is need for exteinal funds. The increase in sales is espected to be carried out without any exparsion of capital assets. intead. It wat be done -. Using a petcent-of saies method, determine whether Longtoranch Westein Wear has extemaifinancing needs. flapot the ameunt su A positive value The fermit: 5 in b. Prepare a poro forma belance sheet with any financing adjustment made to notes payabie and exceis. it any, shail reduce long term debt. (input ell snswers es pesitive velues. Be sure to list the sesets and liabilities in order of their liesldity. Do not lesve any empty speces. input a 0 wherever it is requited c. Calculate the current rabo and total debt to assets ratio for each year (heund the final answers to 2 decimel pleces.) The Longbranch Western Wear Company has the following financial statements, which are representative of the company's histoekal average. Longbranch is especting o 25 peicent increale in iales nest yeal, and management is conceined about the company is need for exteinal funds. The increase in sales is espected to be carried out without any exparsion of capital assets. intead. It wat be done -. Using a petcent-of saies method, determine whether Longtoranch Westein Wear has extemaifinancing needs. flapot the ameunt su A positive value The fermit: 5 in b. Prepare a poro forma belance sheet with any financing adjustment made to notes payabie and exceis. it any, shail reduce long term debt. (input ell snswers es pesitive velues. Be sure to list the sesets and liabilities in order of their liesldity. Do not lesve any empty speces. input a 0 wherever it is requited c. Calculate the current rabo and total debt to assets ratio for each year (heund the final answers to 2 decimel pleces.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started