Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please Solve B1S D A Journal 1 2 Credit Debit Account Date 3 4 5 6 7 1 2 3 4 5 7 1 Prob

Please Solve

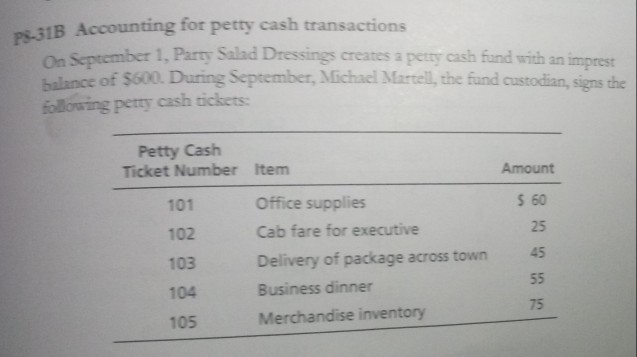

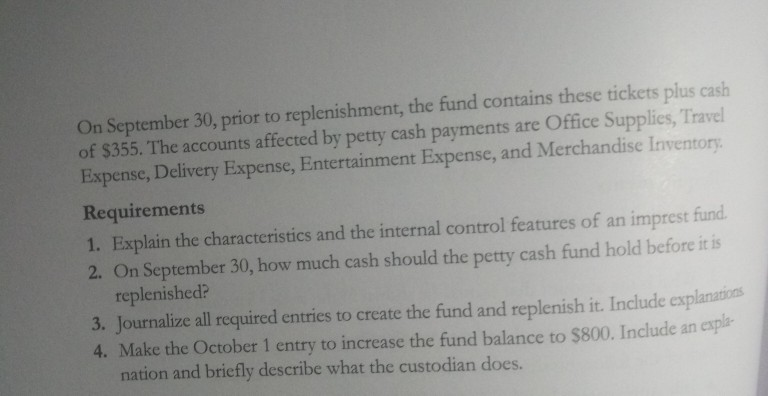

B1S D A Journal 1 2 Credit Debit Account Date 3 4 5 6 7 1 2 3 4 5 7 1 Prob 1 m ps-31B Accounting for petty cash transactions On September 1, Party Salad Dressings creates a petry cash fund with an imprest halance of $600. During September, Michael Martel, the fund custodian, signs the folowing petty cash tickets: Petty Cash Ticket Number Item Amount Office supplies 101 $ 60 Cab fare for executive 102 25 45 103 Delivery of package across town 55 Business dinner 104 75 Merchandise inventory 105 On September 30, prior to replenishment, the fund contains these tickets plus cash of $355. The accounts affected by petty cash payments are Office Supplies, Travel Expense, Delivery Expense, Entertainment Expense, and Merchandise Inventory Requirements 1. Explain the characteristics and the internal control features of an imprest fund. 2. On September 30, how much cash should the petty cash fund hold before it is replenished? 3. Journalize all required entries to create the fund and replenish it. Include explanations 4. Make the October 1 entry to increase the fund balance to $800. Include an exp nation and briefly describe what the custodian does

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started