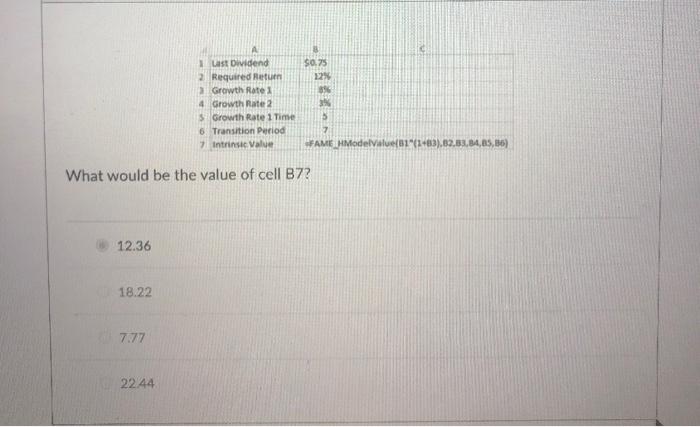

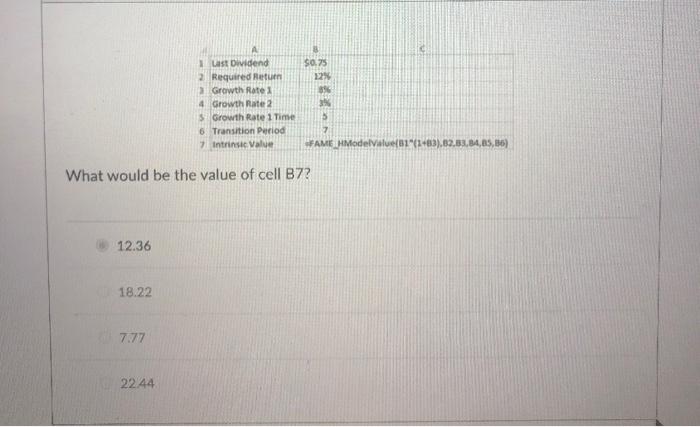

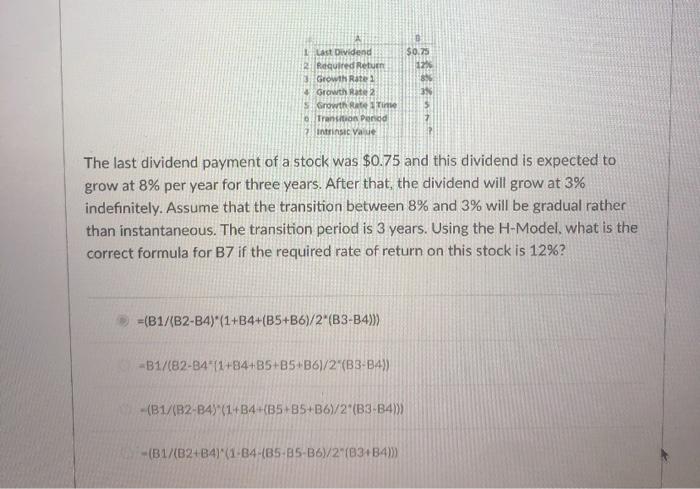

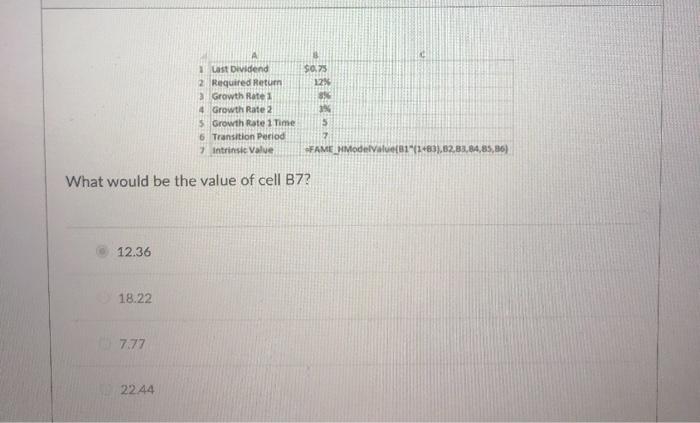

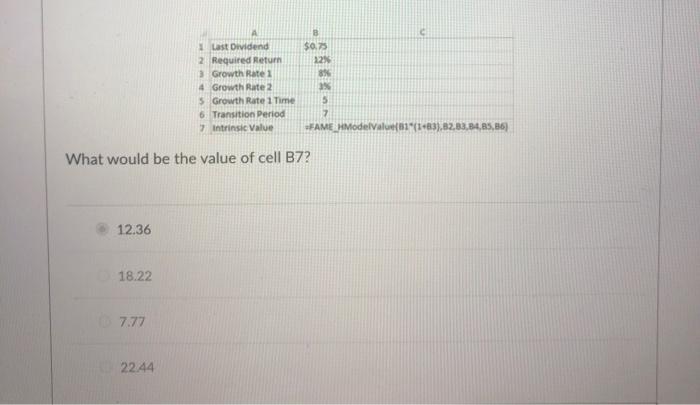

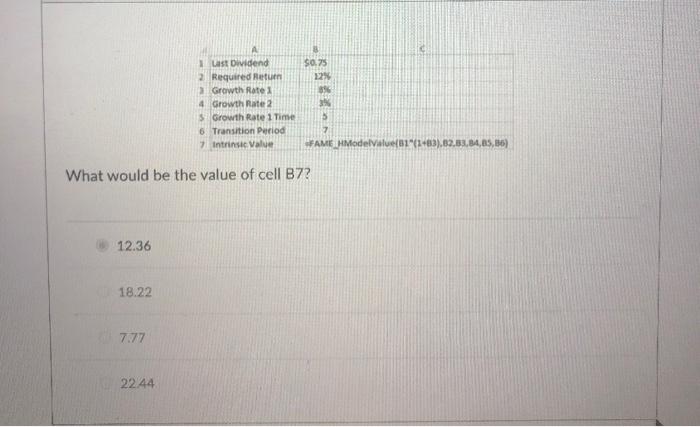

please solve both as they are part of the same problem

S0.75 22% 896 1st Dividend 2 Required Return Growth Rate 4 Growth Rate 2 5 Growth Rate 1 Time 6 Transition Period 7 Intrinsic Value 5 7 FAME HModelValue(31"{2+63).82.33,34,85,186) What would be the value of cell B7? 12.36 18.22 7.77 22.44 $0.75 12% L Last Dividend Required Return Growth Rate Growth Rate 2 5 Growth Rate Time 0 Transition Period Intrinsic Valve 3 The last dividend payment of a stock was $0.75 and this dividend is expected to grow at 8% per year for three years. After that, the dividend will grow at 3% indefinitely. Assume that the transition between 8% and 3% will be gradual rather than instantaneous. The transition period is 3 years. Using the H-Model, what is the correct formula for B7 if the required rate of return on this stock is 12%? =(B1/(B2-B4) (1+B4+(B5+B6)/2"(B3-B4)) -B1/(82-84*11+84+B5+85.361/2"(B3-B4)) -(B1/(B2-B4) (1+B4-85-85+B6Y/2"(B3-B4))) -(B1/B2+4)*(1-84-85-85-B6)/2"(3+34) Last Dividend 2 Required Return Growth Rate 1 4 Growth Rate 2 5 Growth Rate 1 Time 6 Transition Period Intrinsic Valve $0.75 12 s! 196 S 7 FAME ModelValue31"[1483),B2,83,84,85,36) What would be the value of cell B7? 12.36 18.22 7.77 2244 $0.75 228 8% Last Dividend 2 Required Return 3 Growth Rate 4 Growth Rate 2 5 Growth Rate 1 Time 6 Transition Period 7 Intrinsic Value 5 7 FAME HModelValue1"/1-83),B2,B3,B4,B5,86) What would be the value of cell B7? 12.36 18.22 7.77 2244 S0.75 22% 896 1st Dividend 2 Required Return Growth Rate 4 Growth Rate 2 5 Growth Rate 1 Time 6 Transition Period 7 Intrinsic Value 5 7 FAME HModelValue(31"{2+63).82.33,34,85,186) What would be the value of cell B7? 12.36 18.22 7.77 22.44 $0.75 12% L Last Dividend Required Return Growth Rate Growth Rate 2 5 Growth Rate Time 0 Transition Period Intrinsic Valve 3 The last dividend payment of a stock was $0.75 and this dividend is expected to grow at 8% per year for three years. After that, the dividend will grow at 3% indefinitely. Assume that the transition between 8% and 3% will be gradual rather than instantaneous. The transition period is 3 years. Using the H-Model, what is the correct formula for B7 if the required rate of return on this stock is 12%? =(B1/(B2-B4) (1+B4+(B5+B6)/2"(B3-B4)) -B1/(82-84*11+84+B5+85.361/2"(B3-B4)) -(B1/(B2-B4) (1+B4-85-85+B6Y/2"(B3-B4))) -(B1/B2+4)*(1-84-85-85-B6)/2"(3+34) Last Dividend 2 Required Return Growth Rate 1 4 Growth Rate 2 5 Growth Rate 1 Time 6 Transition Period Intrinsic Valve $0.75 12 s! 196 S 7 FAME ModelValue31"[1483),B2,83,84,85,36) What would be the value of cell B7? 12.36 18.22 7.77 2244 $0.75 228 8% Last Dividend 2 Required Return 3 Growth Rate 4 Growth Rate 2 5 Growth Rate 1 Time 6 Transition Period 7 Intrinsic Value 5 7 FAME HModelValue1"/1-83),B2,B3,B4,B5,86) What would be the value of cell B7? 12.36 18.22 7.77 2244