Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve both parts urgently...time limit is very short... I'll give you up thumb definitely Question 3 (19 Marks) Sony Classic Ltd purchased a new

please solve both parts urgently...time limit is very short... I'll give you up thumb definitely

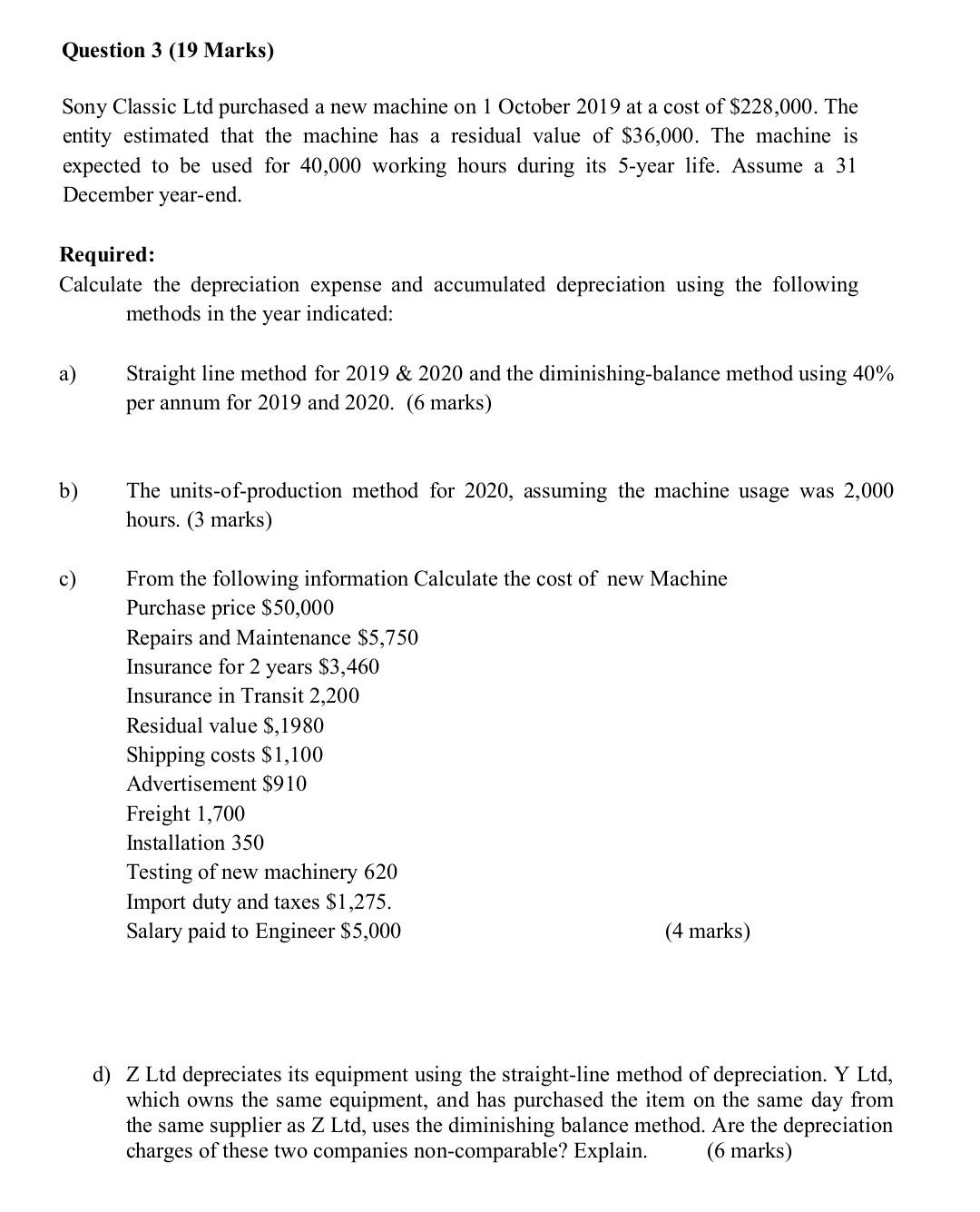

Question 3 (19 Marks) Sony Classic Ltd purchased a new machine on 1 October 2019 at a cost of $228, 000 . The entity estimated that the machine has a residual value of $36,000. The machine is expected to be used for 40,000 working hours during its 5-year life. Assume a 31 December year-end. Required: Calculate the depreciation expense and accumulated depreciation using the following methods in the year indicated: a) Straight line method for 2019&2020 and the diminishing-balance method using 40% per annum for 2019 and 2020 . (6 marks) b) The units-of-production method for 2020 , assuming the machine usage was 2,000 hours. (3 marks) c) From the following information Calculate the cost of new Machine Purchase price $50,000 Repairs and Maintenance $5,750 Insurance for 2 years $3,460 Insurance in Transit 2,200 Residual value $,1980 Shipping costs $1,100 Advertisement $910 Freight 1,700 Installation 350 Testing of new machinery 620 Import duty and taxes $1,275. Salary paid to Engineer $5,000 (4 marks) d) Z Ltd depreciates its equipment using the straight-line method of depreciation. Y Ltd, which owns the same equipment, and has purchased the item on the same day from the same supplier as Z Ltd, uses the diminishing balance method. Are the depreciation charges of these two companies non-comparable? Explain. (6 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started