Answered step by step

Verified Expert Solution

Question

1 Approved Answer

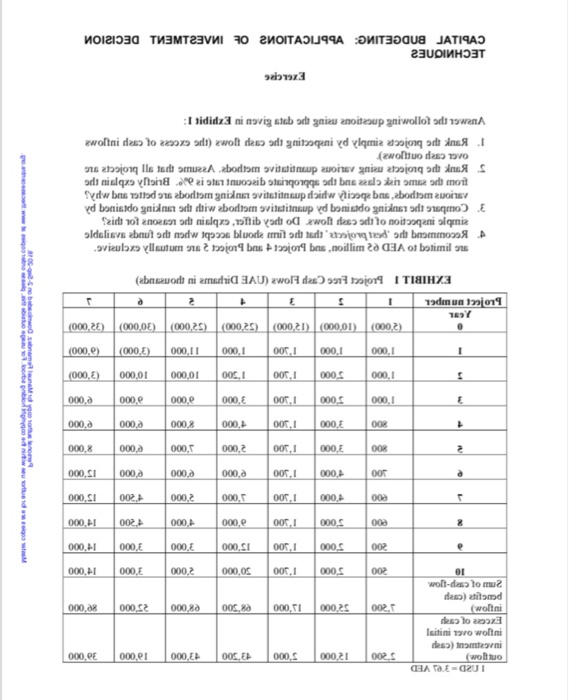

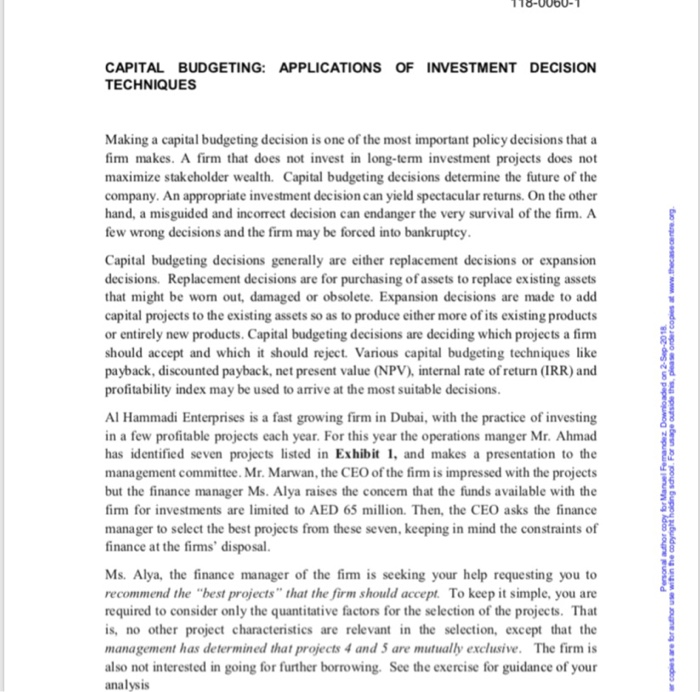

please solve CAPITAL BUDGETING: APPLICATIONS OF INVESTMENT DECISION TECHNIQUES Exercise 118-0060-1B This exercise was written by Manuel Fernandez (Skyline University College) It is intended to

please solve

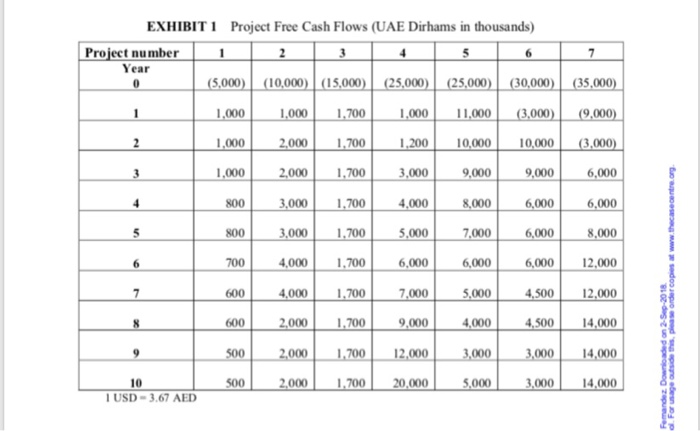

CAPITAL BUDGETING: APPLICATIONS OF INVESTMENT DECISION TECHNIQUES Exercise 118-0060-1B This exercise was written by Manuel Fernandez (Skyline University College) It is intended to be used as the basis for class discussion rather than to illustrate either effective or ineffective handling of a management situation The case was compiled from published sources 201 8, Skyine University College No part of this publication may be copied, stored, transmitted, reproduced or distributed in any form o medium whatsoever without the pemission of the copyright owner CAPITAL BUDGETING: APPLICATIONS OF INVESTMENT DECISION TECHNIQUES Making a capital budgeting decision is one of the most important policy decisions that a firm makes. A firm that does not invest in long-tem investment projects does not maximize stakeholder wealth. Capital budgeting decisions determine the future of the company. An appropriate investment decision can yield spectacular returns. On the other hand, a misguided and incorrect decision can endanger the very survival of the fim. A few wrong decisions and the firm may be forced into bankruptcy Capital budgeting decisions generally are either replacement decisions or expansion decisions. Replacement decisions are for purchasing of assets to replace existing assets that might be wom out, damaged or obsolete. Expansion decisions are made to add capital projects to the existing assets so as to produce either more of its existing products or entirely new products. Capital budgeting decisions are deciding which projects a firm should accept and which it should reject. Various capital budgeting techniques like payback, discounted payback, net present value (NPV), internal rate of return (IRR) and profitability index may be used to arrive at the most suitable decisions Al Hammadi Enterprises is a fast growing firm in Dubai, with the practice of investing in a few profitable projects each year. For this year the operations manger Mr. Ahmad has identified seven management committee. Mr. Marwan, the CEO of the firm is impressed with the projects but the finance manager Ms. Alya raises the concem that the funds available with the firm for investments are limited to AED 65 million. Then, the CEO asks the finance manager to select the best projects from these seven, keeping in mind the constraints of finance at the firms' disposal. projects listed in Exhibit 1, and makes a presentation to the Ms. Alya, the finance manager of the firm is seeking your help requesting you to recommend the "best projects" that the firm should accept. To keep it simple, you are required to consider only the quantitative factors for the selection of the projects. That is, no other project characteristics are relevant in the selection, except that the management has determined that projects 4 and 5 are mutually exclusive. The firm is also not interested in going for furt analysis her borrowing. See the exercise for guidance of your EXHIBIT 1 Project Free Cash Flows (UAE Dirhams in thousands) Project number Year 5,0001 1.000 1,000 1,000 800 (10,000)| 0.5,000)| (25,000)| (25,000) (30,000) 3,000 10,000 0,000 (3.000 35. ,000 11,000 1,000 1.700 2,000700 2,000,7003,000 3,000700 4 3,000700 4,000,7006,000 4,000 1.700 9,000 9,000 6,000 6,000 8,000 6,000 12.000 4.5002,000 4,500 14,000 4,000 9,000 4,000 5,000 7,000 6,000 5,000 4,000 800 700 7,000 000 1.700 9,000 10 2,000 1700 20,000 5,000 ,000 14,00 USD-3.67 AED CAPITAL BUDGETING: APPLICATIONS OF INVESTMENT DECISION TECHNIQUES Exercise 118-0060-1B This exercise was written by Manuel Fernandez (Skyline University College) It is intended to be used as the basis for class discussion rather than to illustrate either effective or ineffective handling of a management situation The case was compiled from published sources 201 8, Skyine University College No part of this publication may be copied, stored, transmitted, reproduced or distributed in any form o medium whatsoever without the pemission of the copyright owner CAPITAL BUDGETING: APPLICATIONS OF INVESTMENT DECISION TECHNIQUES Making a capital budgeting decision is one of the most important policy decisions that a firm makes. A firm that does not invest in long-tem investment projects does not maximize stakeholder wealth. Capital budgeting decisions determine the future of the company. An appropriate investment decision can yield spectacular returns. On the other hand, a misguided and incorrect decision can endanger the very survival of the fim. A few wrong decisions and the firm may be forced into bankruptcy Capital budgeting decisions generally are either replacement decisions or expansion decisions. Replacement decisions are for purchasing of assets to replace existing assets that might be wom out, damaged or obsolete. Expansion decisions are made to add capital projects to the existing assets so as to produce either more of its existing products or entirely new products. Capital budgeting decisions are deciding which projects a firm should accept and which it should reject. Various capital budgeting techniques like payback, discounted payback, net present value (NPV), internal rate of return (IRR) and profitability index may be used to arrive at the most suitable decisions Al Hammadi Enterprises is a fast growing firm in Dubai, with the practice of investing in a few profitable projects each year. For this year the operations manger Mr. Ahmad has identified seven management committee. Mr. Marwan, the CEO of the firm is impressed with the projects but the finance manager Ms. Alya raises the concem that the funds available with the firm for investments are limited to AED 65 million. Then, the CEO asks the finance manager to select the best projects from these seven, keeping in mind the constraints of finance at the firms' disposal. projects listed in Exhibit 1, and makes a presentation to the Ms. Alya, the finance manager of the firm is seeking your help requesting you to recommend the "best projects" that the firm should accept. To keep it simple, you are required to consider only the quantitative factors for the selection of the projects. That is, no other project characteristics are relevant in the selection, except that the management has determined that projects 4 and 5 are mutually exclusive. The firm is also not interested in going for furt analysis her borrowing. See the exercise for guidance of your EXHIBIT 1 Project Free Cash Flows (UAE Dirhams in thousands) Project number Year 5,0001 1.000 1,000 1,000 800 (10,000)| 0.5,000)| (25,000)| (25,000) (30,000) 3,000 10,000 0,000 (3.000 35. ,000 11,000 1,000 1.700 2,000700 2,000,7003,000 3,000700 4 3,000700 4,000,7006,000 4,000 1.700 9,000 9,000 6,000 6,000 8,000 6,000 12.000 4.5002,000 4,500 14,000 4,000 9,000 4,000 5,000 7,000 6,000 5,000 4,000 800 700 7,000 000 1.700 9,000 10 2,000 1700 20,000 5,000 ,000 14,00 USD-3.67 AED Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started