Answered step by step

Verified Expert Solution

Question

1 Approved Answer

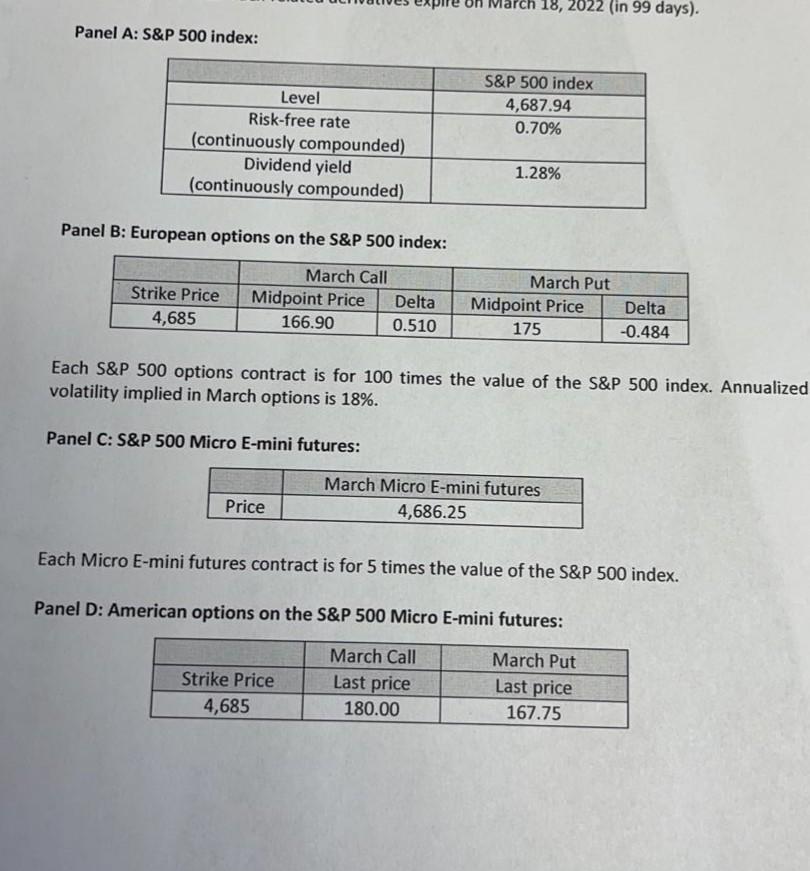

Please solve complete in 30 minutes i will Upvote you 18, 2022 (in 99 days). Panel A: S&P 500 index: S&P 500 index 4,687.94 0.70%

Please solve complete in 30 minutes i will Upvote you

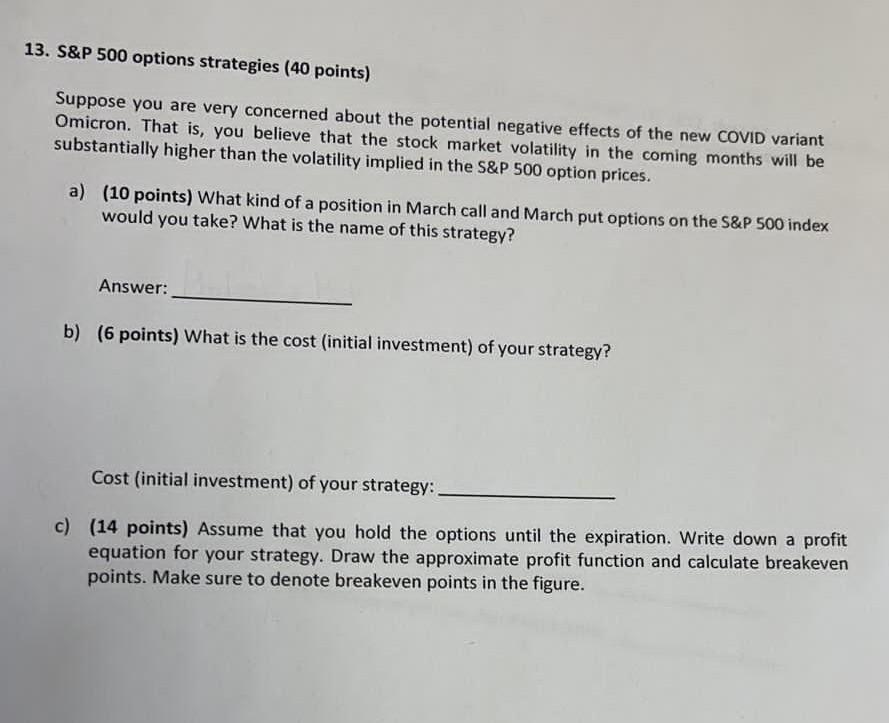

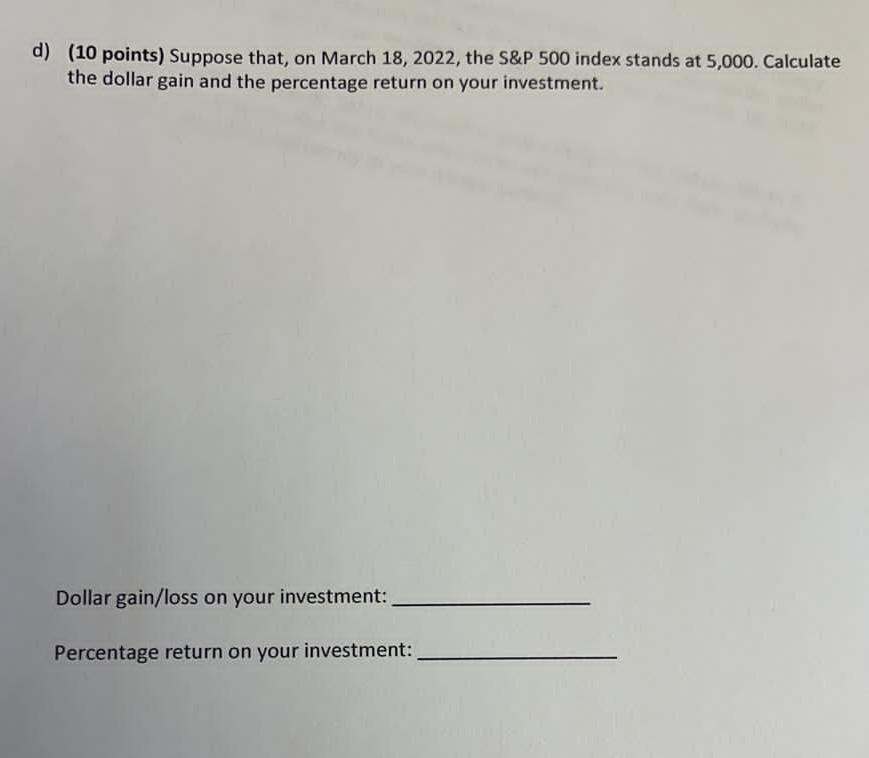

18, 2022 (in 99 days). Panel A: S&P 500 index: S&P 500 index 4,687.94 0.70% Level Risk-free rate (continuously compounded) Dividend yield (continuously compounded) 1.28% Panel B: European options on the S&P 500 index: Strike Price 4,685 March Call Midpoint Price Delta 166.90 0.510 March Put Midpoint Price 175 Delta -0.484 Each S&P 500 options contract is for 100 times the value of the S&P 500 index. Annualized volatility implied in March options is 18%. Panel C: S&P 500 Micro E-mini futures: March Micro E-mini futures 4,686.25 Price Each Micro E-mini futures contract is for 5 times the value of the S&P 500 index. Panel D: American options on the S&P 500 Micro E-mini futures: Strike Price 4,685 March Call Last price 180.00 March Put Last price 167.75 13. S&P 500 options strategies (40 points) Suppose you are very concerned about the potential negative effects of the new COVID variant Omicron. That is, you believe that the stock market volatility in the coming months will be substantially higher than the volatility implied in the S&P 500 option prices. a) (10 points) What kind of a position in March call and March put options on the S&P 500 index would you take? What is the name of this strategy? Answer: b) (6 points) What is the cost (initial investment) of your strategy? Cost (initial investment) of your strategy: c) (14 points) Assume that you hold the options until the expiration. Write down a profit equation for your strategy. Draw the approximate profit function and calculate breakeven points. Make sure to denote breakeven points in the figure. d) (10 points) Suppose that, on March 18, 2022, the S&P 500 index stands at 5,000. Calculate the dollar gain and the percentage return on your investment. Dollar gain/loss on your investment: Percentage return on your investment: 18, 2022 (in 99 days). Panel A: S&P 500 index: S&P 500 index 4,687.94 0.70% Level Risk-free rate (continuously compounded) Dividend yield (continuously compounded) 1.28% Panel B: European options on the S&P 500 index: Strike Price 4,685 March Call Midpoint Price Delta 166.90 0.510 March Put Midpoint Price 175 Delta -0.484 Each S&P 500 options contract is for 100 times the value of the S&P 500 index. Annualized volatility implied in March options is 18%. Panel C: S&P 500 Micro E-mini futures: March Micro E-mini futures 4,686.25 Price Each Micro E-mini futures contract is for 5 times the value of the S&P 500 index. Panel D: American options on the S&P 500 Micro E-mini futures: Strike Price 4,685 March Call Last price 180.00 March Put Last price 167.75 13. S&P 500 options strategies (40 points) Suppose you are very concerned about the potential negative effects of the new COVID variant Omicron. That is, you believe that the stock market volatility in the coming months will be substantially higher than the volatility implied in the S&P 500 option prices. a) (10 points) What kind of a position in March call and March put options on the S&P 500 index would you take? What is the name of this strategy? Answer: b) (6 points) What is the cost (initial investment) of your strategy? Cost (initial investment) of your strategy: c) (14 points) Assume that you hold the options until the expiration. Write down a profit equation for your strategy. Draw the approximate profit function and calculate breakeven points. Make sure to denote breakeven points in the figure. d) (10 points) Suppose that, on March 18, 2022, the S&P 500 index stands at 5,000. Calculate the dollar gain and the percentage return on your investment. Dollar gain/loss on your investment: Percentage return on your investmentStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started