Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve complete requirement 2. You have been working as a treasurer at Citibank for the past five years and have previously used swaps, futures

please solve complete requirement

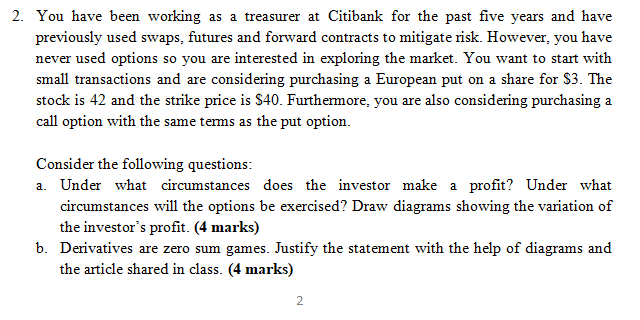

2. You have been working as a treasurer at Citibank for the past five years and have previously used swaps, futures and forward contracts to mitigate risk. However, you have never used options so you are interested in exploring the market. You want to start with small transactions and are considering purchasing a European put on a share for $3. The stock is 42 and the strike price is $40. Furthermore, you are also considering purchasing a call option with the same terms as the put option. Consider the following questions: a. Under what circumstances does the investor make a profit? Under what circumstances will the options be exercised? Draw diagrams showing the variation of the investor's profit. (4 marks) b. Derivatives are zero sum games. Justify the statement with the help of diagrams and the article shared in class. (4 marks) 2Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started