Answered step by step

Verified Expert Solution

Question

1 Approved Answer

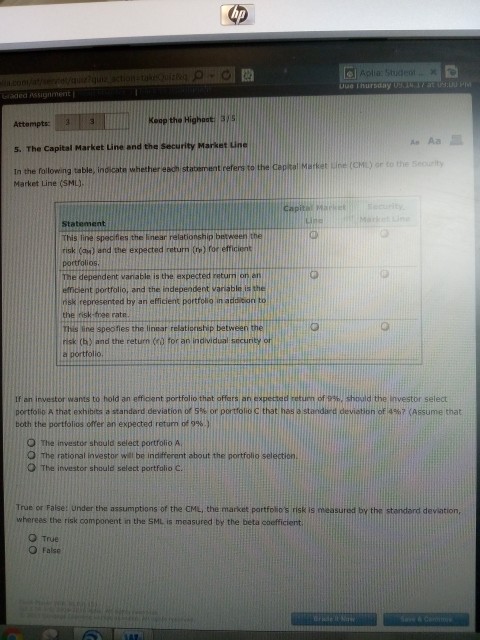

please solve completely and correctly Rolla: Stud-oi- hursday Attempts 5. The Capital Market Line and the Security Market ine Market Line (CHiL) or to the

please solve completely and correctly

Rolla: Stud-oi- hursday Attempts 5. The Capital Market Line and the Security Market ine Market Line (CHiL) or to the Security In the following table, indicate whether each statement refers to the C Market Line (SML), Statement This line specfies the linear relationship between the portrolios The dependent vanable is the expected retum on er emicient portfolio, and the independent varlable ia the rnsk represented by an efficient portfolio in addition to the isk free rate. This line speofies the linear relatioristip between the risk (h) and the return ed for an individual sicurity a portfolio, if an investor wants to hold an efficient portfolio that offers an expe tad return of 9%, should the investor select portfolio A that exhibits a standard deviation of S% or portfolio C that has a standard deviation of 4% (Assume trat both the portfolios offer an expected return of g%.) O The investor should select portfolio A, O The rational investor will be indifferent about the portfolio selection O The investor should select portfalio C. True or False: under the assumptions of the CML, the market portfolio's risk is measured by the stondard deviation wherees the risk component in the SML is measured by the beta coefficient O True O FalseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started