Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve everything because every options are1 question already. Portfolio Optimization You are considering investing in four stocks, and have collected the following information on

please solve everything because every options are1 question already.

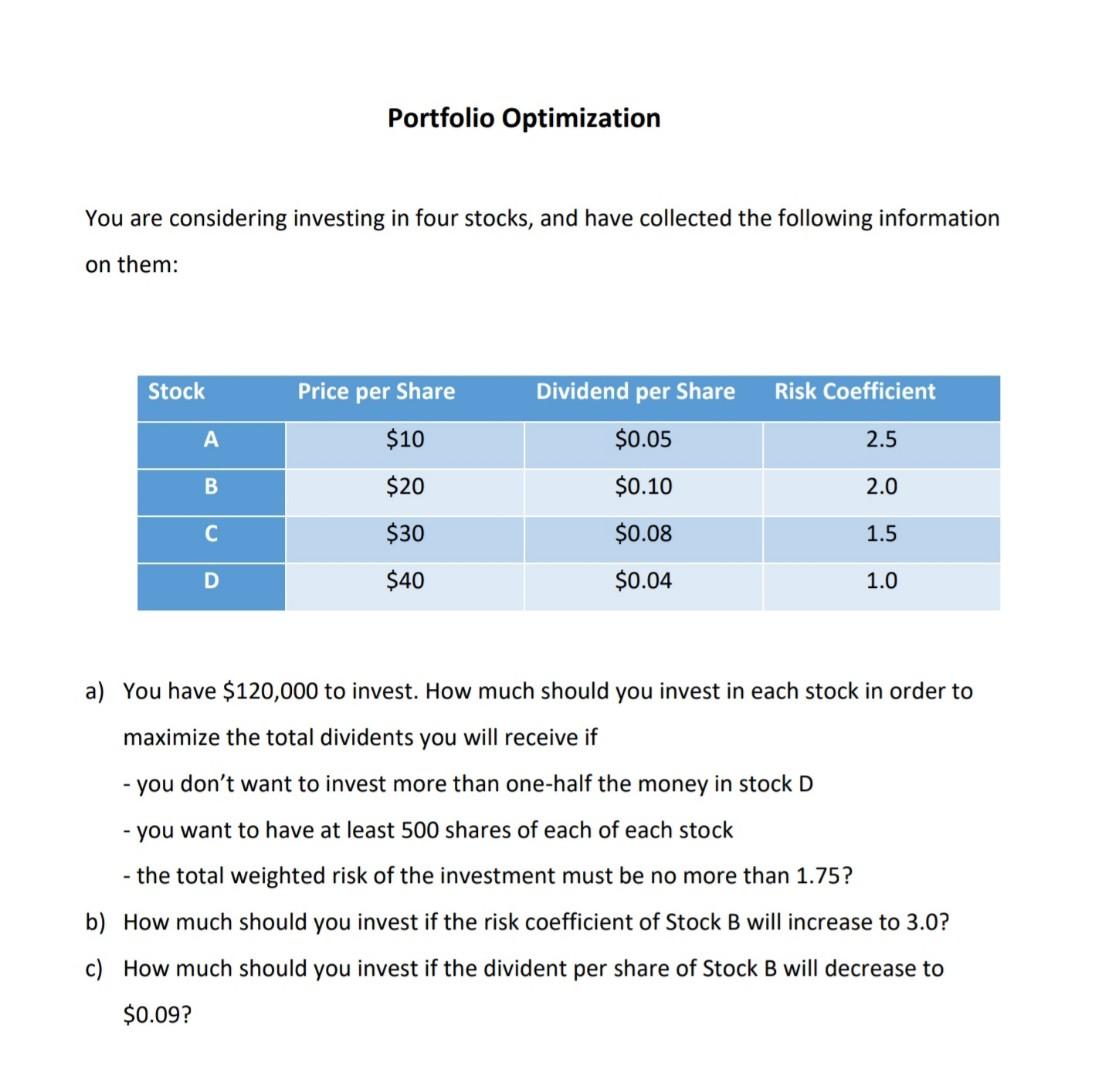

Portfolio Optimization You are considering investing in four stocks, and have collected the following information on them: Stock Price per Share Dividend per Share Risk Coefficient A $10 $0.05 2.5 B $20 $0.10 2.0 C $30 $0.08 1.5 D $40 $0.04 1.0 a) You have $120,000 to invest. How much should you invest in each stock in order to maximize the total dividents you will receive if - you don't want to invest more than one-half the money in stock D - you want to have at least 500 shares of each of each stock - the total weighted risk of investment must be no more than 1.75? b) How much should you invest if the risk coefficient of Stock B will increase to 3.0? c) How much should you invest if the divident per share of Stock B will decrease to $0.09Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started