Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve everything wspecially part C Consider the following model of a partnership between two people. The firm's profit, which the partners share equally, depends

please solve everything wspecially part C

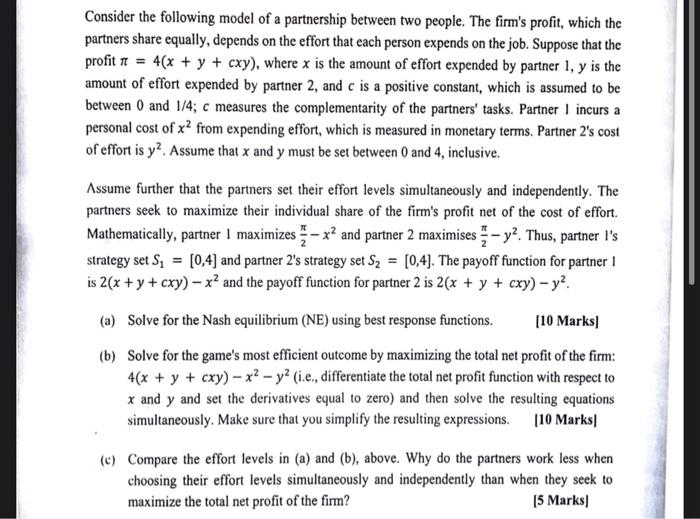

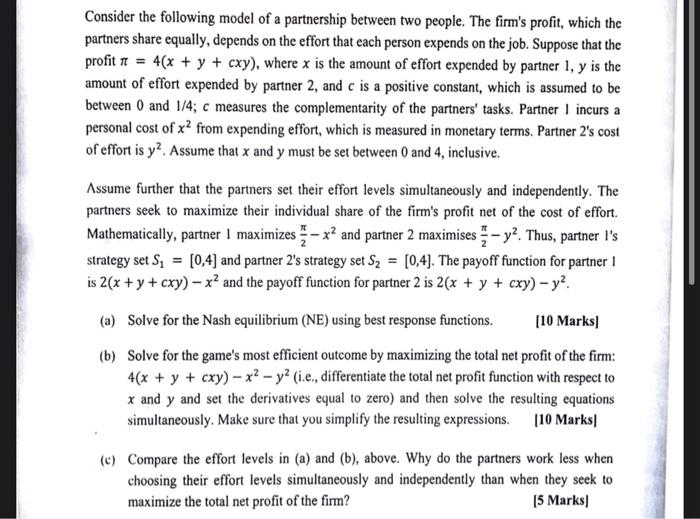

Consider the following model of a partnership between two people. The firm's profit, which the partners share equally, depends on the effort that each person expends on the job. Suppose that the profit Te = 4(x + y + cxy), where x is the amount of effort expended by partner 1, y is the amount of effort expended by partner 2, and c is a positive constant, which is assumed to be between 0 and 1/4; c measures the complementarity of the partners' tasks. Partner I incurs a personal cost of x2 from expending effort, which is measured in monetary terms. Partner 2's cost of effort is y. Assume that x and y must be set between 0 and 4, inclusive. Assume further that the partners set their effort levels simultaneously and independently. The partners seek to maximize their individual share of the firm's profit net of the cost of effort. Mathematically, partner I maximizes x? and partner 2 maximises y?. Thus, partner l's strategy set S; = [0,4] and partner 2's strategy set S2 = [0,4). The payoff function for partner is 2(x + y + cxy) - x? and the payoff function for partner 2 is 2(x + y + cxy) - y2. (a) Solve for the Nash equilibrium (NE) using best response functions. (10 Marks (b) Solve for the game's most efficient outcome by maximizing the total net profit of the firm: 4(x + y + cxy) x2 - y2 (i.e., differentiate the total net profit function with respect to x and y and set the derivatives equal to zero) and then solve the resulting equations simultaneously. Make sure that you simplify the resulting expressions. [10 Marks (c) Compare the effort levels in (a) and (b), above. Why do the partners work less when choosing their effort levels simultaneously and independently than when they seek to maximize the total net profit of the firm? 15 Marks Consider the following model of a partnership between two people. The firm's profit, which the partners share equally, depends on the effort that each person expends on the job. Suppose that the profit Te = 4(x + y + cxy), where x is the amount of effort expended by partner 1, y is the amount of effort expended by partner 2, and c is a positive constant, which is assumed to be between 0 and 1/4; c measures the complementarity of the partners' tasks. Partner I incurs a personal cost of x2 from expending effort, which is measured in monetary terms. Partner 2's cost of effort is y. Assume that x and y must be set between 0 and 4, inclusive. Assume further that the partners set their effort levels simultaneously and independently. The partners seek to maximize their individual share of the firm's profit net of the cost of effort. Mathematically, partner I maximizes x? and partner 2 maximises y?. Thus, partner l's strategy set S; = [0,4] and partner 2's strategy set S2 = [0,4). The payoff function for partner is 2(x + y + cxy) - x? and the payoff function for partner 2 is 2(x + y + cxy) - y2. (a) Solve for the Nash equilibrium (NE) using best response functions. (10 Marks (b) Solve for the game's most efficient outcome by maximizing the total net profit of the firm: 4(x + y + cxy) x2 - y2 (i.e., differentiate the total net profit function with respect to x and y and set the derivatives equal to zero) and then solve the resulting equations simultaneously. Make sure that you simplify the resulting expressions. [10 Marks (c) Compare the effort levels in (a) and (b), above. Why do the partners work less when choosing their effort levels simultaneously and independently than when they seek to maximize the total net profit of the firm? 15 Marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started