Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve Exercise 4.1 Find the number of bonds y(1) and y(2) held by an investor during the first and second steps of a predictable

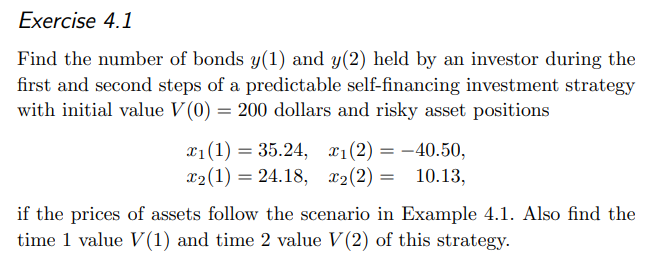

please solve Exercise 4.1

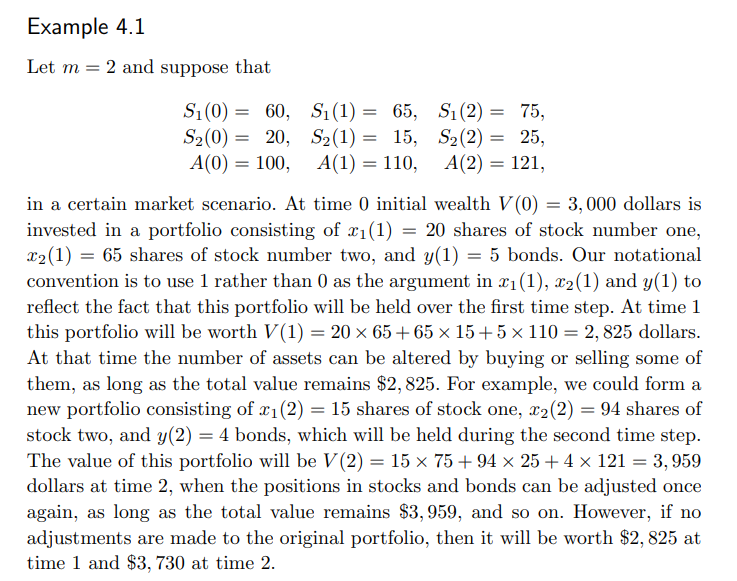

Find the number of bonds y(1) and y(2) held by an investor during the first and second steps of a predictable self-financing investment strategy with initial value V(0)=200 dollars and risky asset positions x1(1)=35.24,x2(1)=24.18,x1(2)=40.50,x2(2)=10.13, if the prices of assets follow the scenario in Example 4.1. Also find the time 1 value V(1) and time 2 value V(2) of this strategy. Let m=2 and suppose that S1(0)=60,S1(1)=65,S1(2)=75,S2(0)=20,S2(1)=15,S2(2)=25,A(0)=100,A(1)=110,A(2)=121, in a certain market scenario. At time 0 initial wealth V(0)=3,000 dollars is invested in a portfolio consisting of x1(1)=20 shares of stock number one, x2(1)=65 shares of stock number two, and y(1)=5 bonds. Our notational convention is to use 1 rather than 0 as the argument in x1(1),x2(1) and y(1) to reflect the fact that this portfolio will be held over the first time step. At time 1 this portfolio will be worth V(1)=2065+6515+5110=2,825 dollars. At that time the number of assets can be altered by buying or selling some of them, as long as the total value remains $2,825. For example, we could form a new portfolio consisting of x1(2)=15 shares of stock one, x2(2)=94 shares of stock two, and y(2)=4 bonds, which will be held during the second time step. The value of this portfolio will be V(2)=1575+9425+4121=3,959 dollars at time 2, when the positions in stocks and bonds can be adjusted once again, as long as the total value remains $3,959, and so on. However, if no adjustments are made to the original portfolio, then it will be worth $2,825 at time 1 and $3,730 at time 2Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started