please solve fast and if there is any problem tell me in the comments

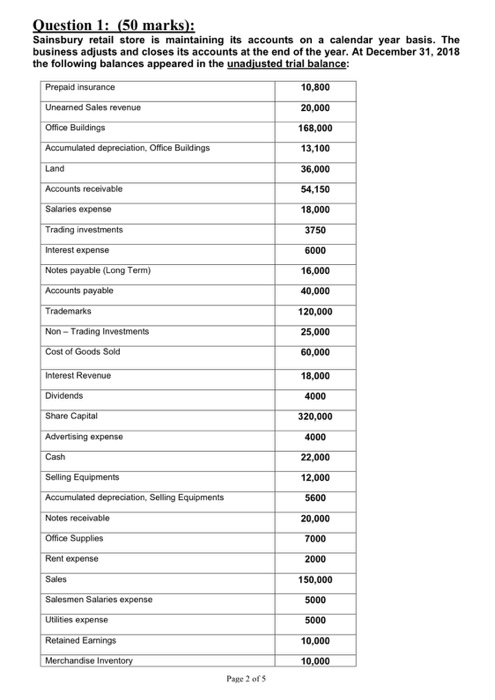

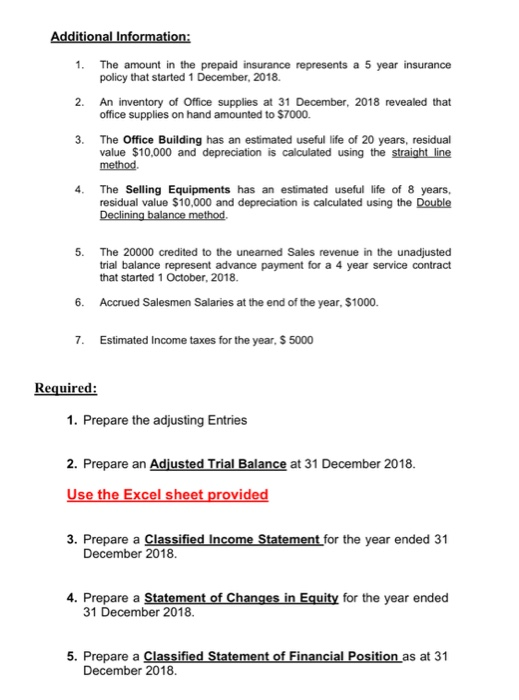

Question 1: (50 marks): Sainsbury retail store is maintaining its accounts on a calendar year basis. The business adjusts and closes its accounts at the end of the year. At December 31, 2018 the following balances appeared in the unadjusted trial balance: Prepaid insurance 10,800 Unearned Sales revenue 20,000 Office Buildings Accumulated depreciation Office Buildings 168,000 13,100 Land 36,000 Accounts receivable 54,150 Salaries expense 18,000 Trading investments 3750 6000 Interest expense Notes payable (Long Term) Accounts payable 16,000 40,000 Trademarks 120,000 Non-Trading Investments 25,000 Cost of Goods Sold 60,000 Interest Revenue 18,000 Dividends 4000 Share Capital 320,000 Advertising expense 4000 Cash 22,000 12.000 Selling Equipments Accumulated depreciation, Selling Equipments 5600 Notes receivable 20,000 Office Supplies 7000 Rent expense 2000 Sales 150,000 Salesmen Salaries expense 5000 Utilities expense 5000 Retained Earnings 10,000 Merchandise Inventory 10,000 Page 2 of 5 Additional Information: 1. The amount in the prepaid insurance represents a 5 year insurance policy that started 1 December, 2018 2. An inventory of Office supplies at 31 December, 2018 revealed that office supplies on hand amounted to $7000. 3. The Office Building has an estimated useful life of 20 years, residual value $10,000 and depreciation is calculated using the straight line method 4. The Selling Equipments has an estimated useful life of 8 years, residual value $10,000 and depreciation is calculated using the Double Declining balance method. 5. The 20000 credited to the uneared Sales revenue in the unadjusted trial balance represent advance payment for a 4 year service contract that started 1 October, 2018. 6. Accrued Salesmen Salaries at the end of the year, $1000. 7. Estimated Income taxes for the year. $ 5000 Required: 1. Prepare the adjusting Entries 2. Prepare an Adjusted Trial Balance at 31 December 2018. Use the Excel sheet provided 3. Prepare a Classified Income Statement for the year ended 31 December 2018 4. Prepare a Statement of Changes in Equity for the year ended 31 December 2018 5. Prepare a Classified Statement of Financial Position as at 31 December 2018 Question 1: (50 marks): Sainsbury retail store is maintaining its accounts on a calendar year basis. The business adjusts and closes its accounts at the end of the year. At December 31, 2018 the following balances appeared in the unadjusted trial balance: Prepaid insurance 10,800 Unearned Sales revenue 20,000 Office Buildings Accumulated depreciation Office Buildings 168,000 13,100 Land 36,000 Accounts receivable 54,150 Salaries expense 18,000 Trading investments 3750 6000 Interest expense Notes payable (Long Term) Accounts payable 16,000 40,000 Trademarks 120,000 Non-Trading Investments 25,000 Cost of Goods Sold 60,000 Interest Revenue 18,000 Dividends 4000 Share Capital 320,000 Advertising expense 4000 Cash 22,000 12.000 Selling Equipments Accumulated depreciation, Selling Equipments 5600 Notes receivable 20,000 Office Supplies 7000 Rent expense 2000 Sales 150,000 Salesmen Salaries expense 5000 Utilities expense 5000 Retained Earnings 10,000 Merchandise Inventory 10,000 Page 2 of 5 Additional Information: 1. The amount in the prepaid insurance represents a 5 year insurance policy that started 1 December, 2018 2. An inventory of Office supplies at 31 December, 2018 revealed that office supplies on hand amounted to $7000. 3. The Office Building has an estimated useful life of 20 years, residual value $10,000 and depreciation is calculated using the straight line method 4. The Selling Equipments has an estimated useful life of 8 years, residual value $10,000 and depreciation is calculated using the Double Declining balance method. 5. The 20000 credited to the uneared Sales revenue in the unadjusted trial balance represent advance payment for a 4 year service contract that started 1 October, 2018. 6. Accrued Salesmen Salaries at the end of the year, $1000. 7. Estimated Income taxes for the year. $ 5000 Required: 1. Prepare the adjusting Entries 2. Prepare an Adjusted Trial Balance at 31 December 2018. Use the Excel sheet provided 3. Prepare a Classified Income Statement for the year ended 31 December 2018 4. Prepare a Statement of Changes in Equity for the year ended 31 December 2018 5. Prepare a Classified Statement of Financial Position as at 31 December 2018