Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please solve fast i will surely mark helpful. The balance sheet of Cleanup Limited as on 31st March, 2021 is as follows: Rs in millions

Please solve fast i will surely mark helpful.

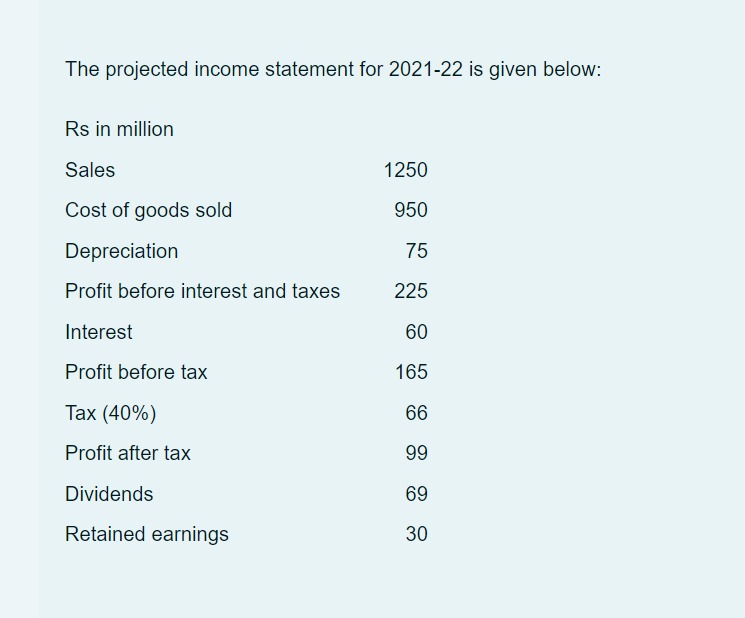

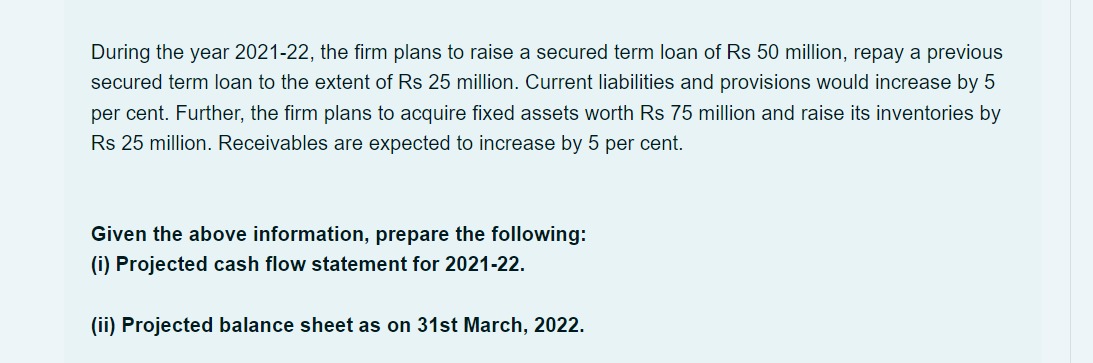

The balance sheet of Cleanup Limited as on 31st March, 2021 is as follows: Rs in millions Liabilities Assets Share capital 250Fixed assets 550 Reserves and surplus 200Investments 25 Current 200assets Secured loans Unsecured loans 150 Cash 50 Current liabilities 300Receivables 200 Provisions 50Inventories 325 1150 1150 The projected income statement for 2021-22 is given below: Rs in million Sales 1250 Cost of goods sold 950 75 Depreciation Profit before interest and taxes 225 Interest 60 Profit before tax 165 Tax (40%) 66 Profit after tax 99 Dividends 69 Retained earnings 30 During the year 2021-22, the firm plans to raise a secured term loan of Rs 50 million, repay a previous secured term loan to the extent of Rs 25 million. Current liabilities and provisions would increase by 5 per cent. Further, the firm plans to acquire fixed assets worth Rs 75 million and raise its inventories by Rs 25 million. Receivables are expected to increase by 5 per cent. Given the above information, prepare the following: (i) Projected cash flow statement for 2021-22. (ii) Projected balance sheet as on 31st March, 2022Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started