Please solve for B and C not A. Thank you.

Please solve for B and C not A. Thank you.

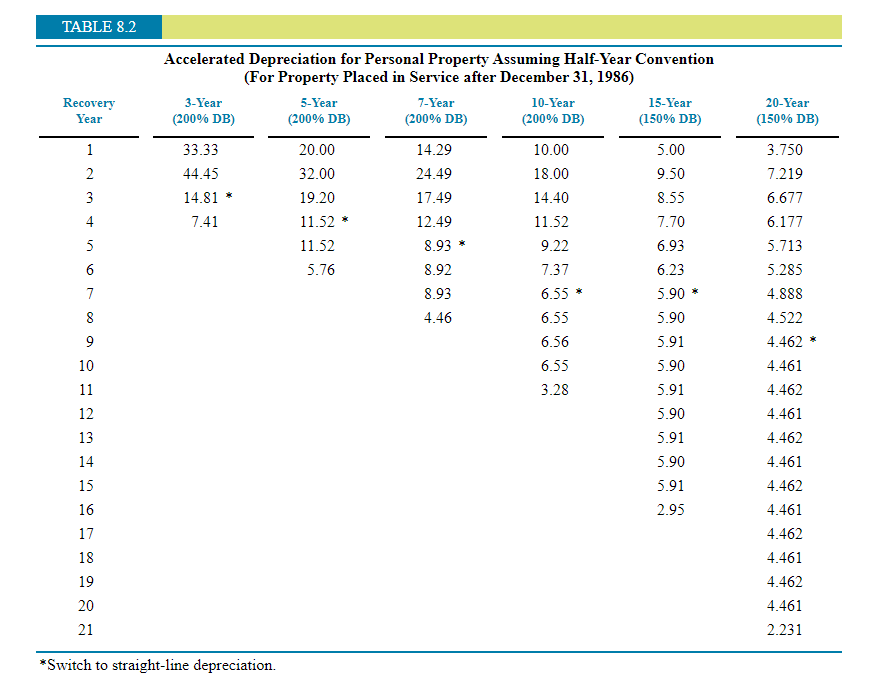

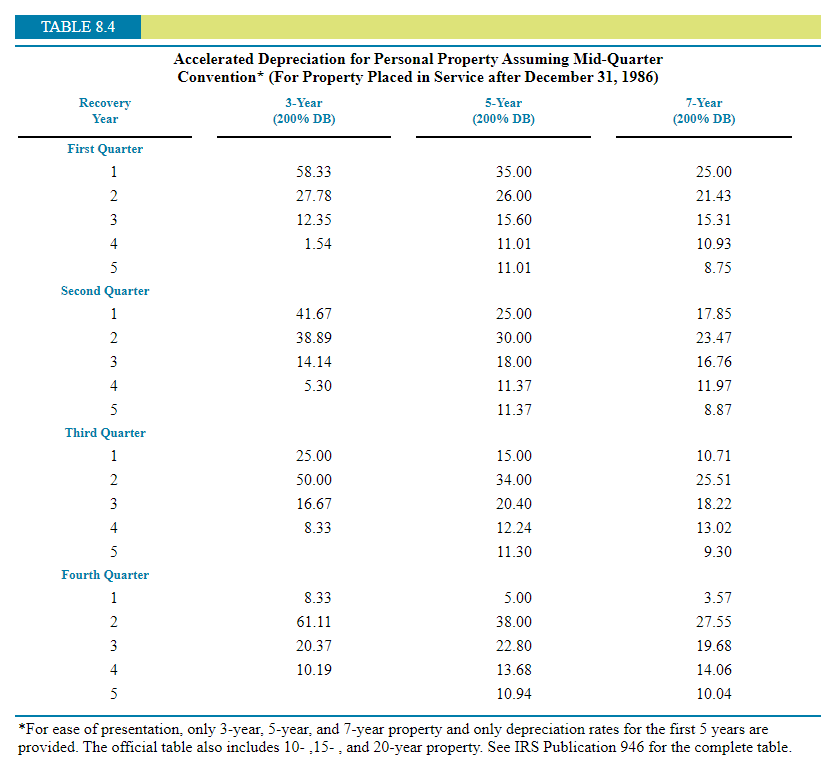

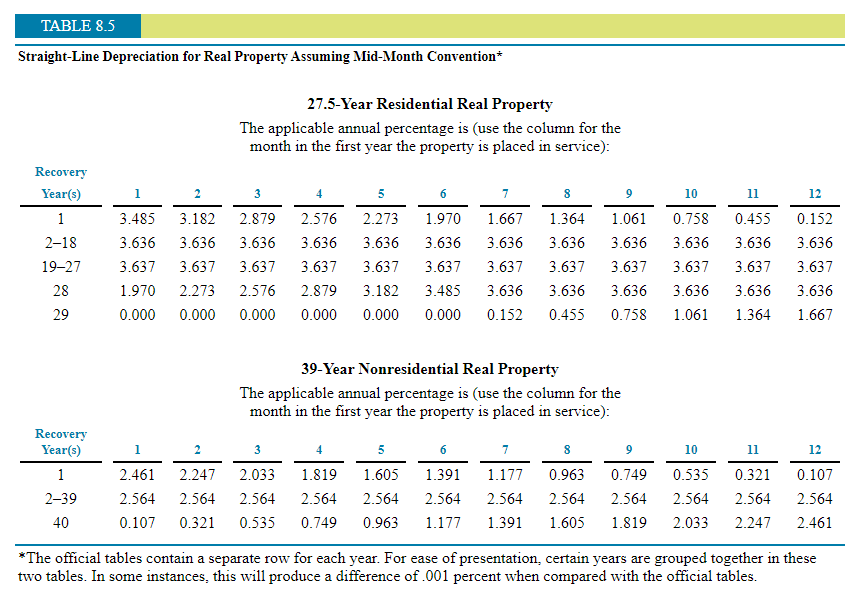

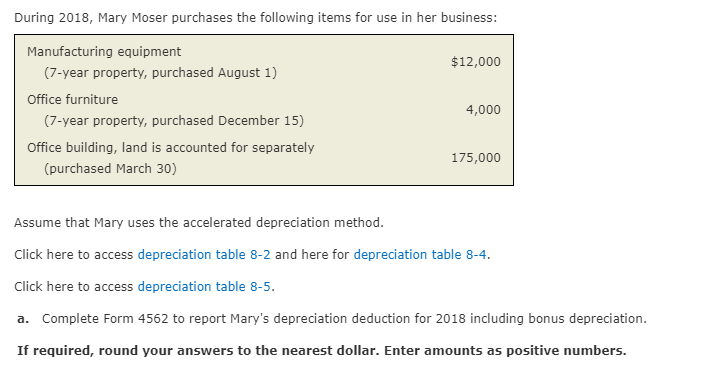

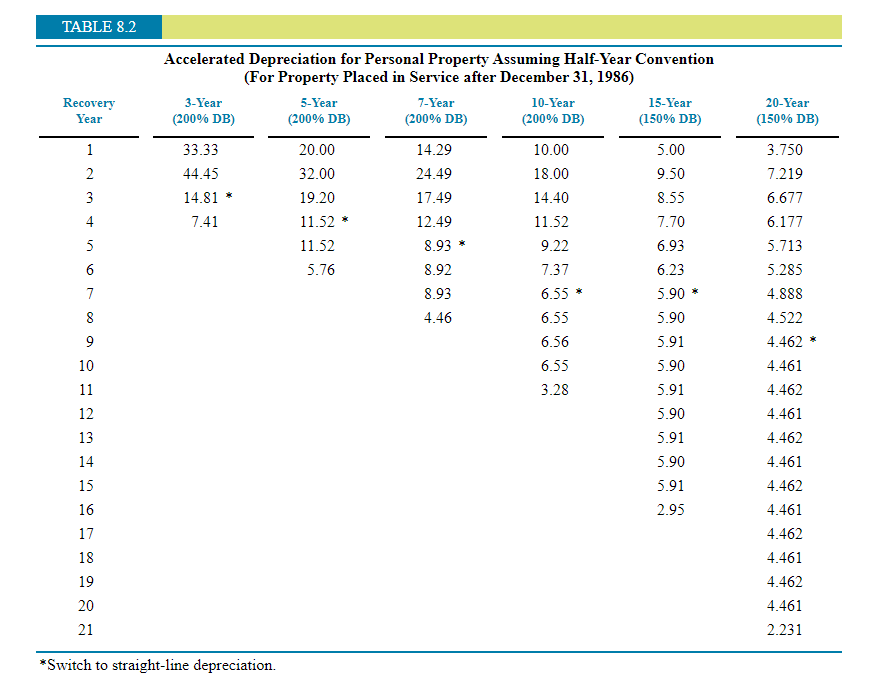

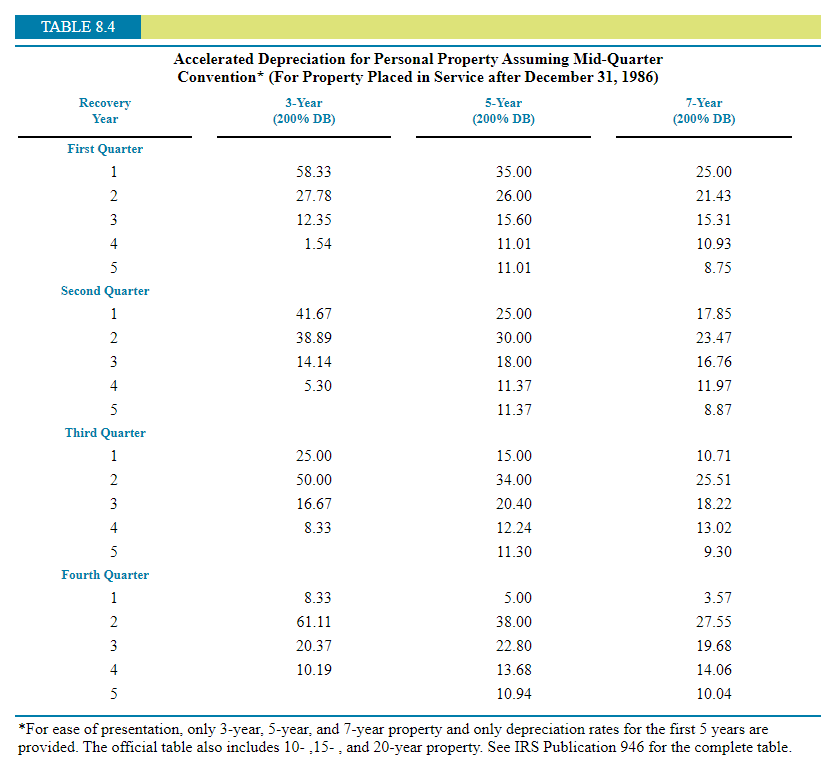

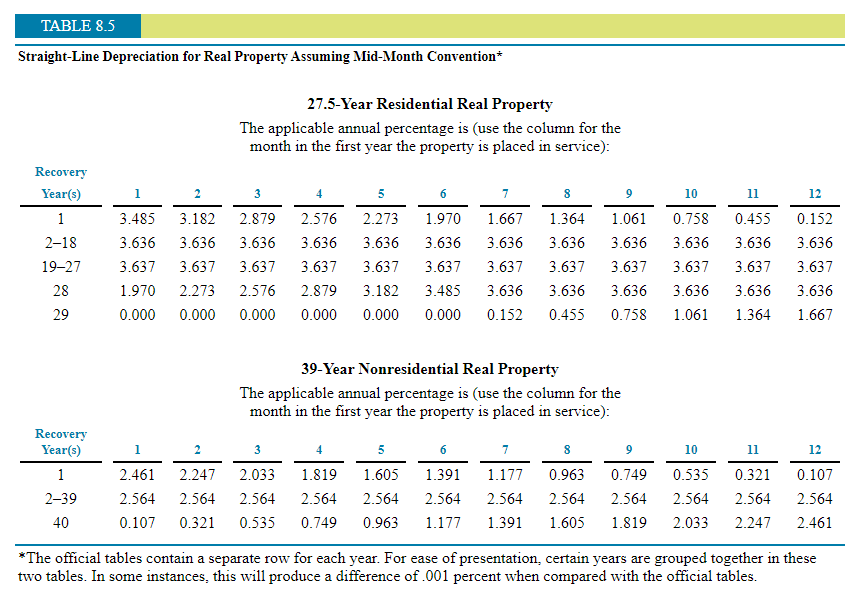

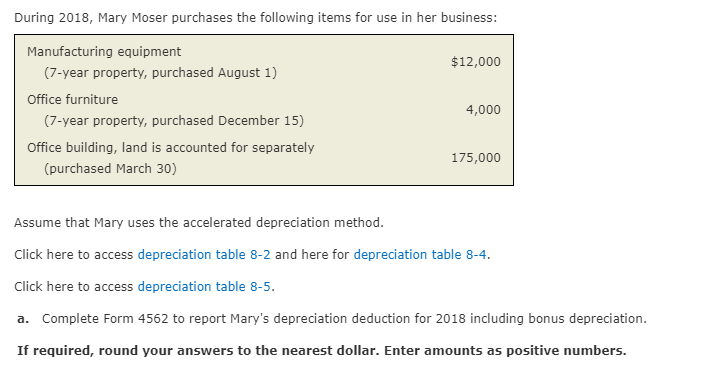

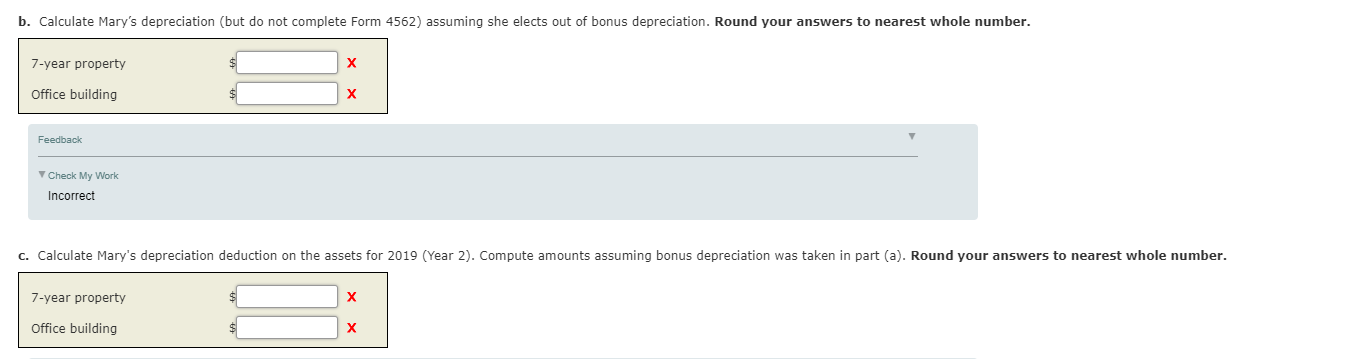

TABLE 8.2 Accelerated Depreciation for Personal Property Assuming Half-Year Convention (For Property Placed in Service after December 31, 1986) 3-Year 5-Year 7-Year 10-Year 15-Year (200% DB) (200% DB) (200% DB) (200% DB) (150% DB) Recovery Year 20-Year (150% DB) 14.29 5.00 33.33 44.45 14.81 % 7.41 24.49 17.49 20.00 32.00 19.20 11.52 % 11.52 5.76 10.00 18.00 14.40 11.52 9.50 8.55 7.70 12.49 8.93 * 8.92 9.22 6.93 7.37 6.23 5.90 * 8.93 6.55 * 6.55 3.750 7.219 6.677 6.177 5.713 5.285 4.888 4.522 4.462 * 4.461 4.462 4.461 4.462 4.461 4.46 5.90 6.56 6.55 3.28 5.91 5.90 5.91 5.90 5.91 5.90 5.91 4.462 4.461 4.462 4.461 4.462 4.461 2.231 *Switch to straight-line depreciation. TABLE 8.4 Accelerated Depreciation for Personal Property Assuming Mid-Quarter Convention* (For Property Placed in Service after December 31, 1986) 3-Year 5-Year (200% DB) (200% DB) Recovery Year 7-Year (200% DB) First Quarter 35.00 25.00 58.33 27.78 12.35 26.00 21.43 15.60 11.01 1.54 15.31 10.93 8.75 11.01 Second Quarter wwwwww 41.67 38.89 14.14 5.30 25.00 30.00 18.00 11.37 11.37 17.85 23.47 16.76 11.97 8.87 Third Quarter 25.00 50.00 16.67 15.00 34.00 20.40 12.24 11.30 10.71 25.51 18.22 13.02 9.30 8.33 Fourth Quarter 3.57 8.33 61.11 20.37 27.55 5.00 38.00 22.80 13.68 10.94 19.68 10.19 14.06 10.04 *For ease of presentation, only 3-year, 5-year, and 7-year property and only depreciation rates for the first 5 years are provided. The official table also includes 10-.15-, and 20-year property. See IRS Publication 946 for the complete table. TABLE 8.5 Straight-Line Depreciation for Real Property Assuming Mid-Month Convention* 27.5-Year Residential Real Property The applicable annual percentage is (use the column for the month in the first year the property is placed in service): Recovery Year(s) 218 19-27 28 29 1 3.485 3.636 3.637 1.970 0.000 2 3.182 3.636 3.637 2.273 0.000 3 2.879 3.636 3.637 2.576 0.000 4 5 2.576 2.273 3.636 3.636 3.6373.637 2.879 3.182 0.000 0.000 6 1.970 3.636 3.637 3.485 0.000 7 8 1.667 1.364 3.636 3.636 3.6373.637 3.636 3.636 0.152 0.455 9 1.061 3.636 3.637 3.636 0.758 10 0.758 3.636 3.637 3.636 1.061 11 0.455 3.636 3.637 3.636 1.364 12 0.152 3.636 3.637 3.636 1.667 39-Year Nonresidential Real Property The applicable annual percentage is (use the column for the month in the first year the property is placed in service): Recovery Year(s) 1 2.461 2.564 0.107 2 2.247 2.564 0.321 3 2.033 2.564 0.535 4 5 1.819 1.605 2.564 2.564 0.7490.963 6 1.391 2.564 1.177 7 1.177 2.564 1391 8 9 0.9630.749 2.564 2.564 1.605 1.819 10 0.535 2.564 2.033 11 0.321 2.564 2.247 12 0.107 2.564 2.461 2-39 40 *The official tables contain a separate row for each year. For ease of presentation, certain years are grouped together in these two tables. In some instances, this will produce a difference of .001 percent when compared with the official tables. During 2018, Mary Moser purchases the following items for use in her business: $12,000 Manufacturing equipment (7-year property, purchased August 1) Office furniture (7-year property, purchased December 15) Office building, land is accounted for separately (purchased March 30) 4,000 175,000 Assume that Mary uses the accelerated depreciation method. Click here to access depreciation table 8-2 and here for depreciation table 8-4. Click here to access depreciation table 8-5. a. Complete Form 4562 to report Mary's depreciation deduction for 2018 including bonus depreciation. If required, round your answers to the nearest dollar. Enter amounts as positive numbers. b. Calculate Mary's depreciation (but do not complete Form 4562) assuming she elects out of bonus depreciation. Round your answers to nearest whole number. 7-year property Office building Feedback Check My Work Incorrect C. Calculate Mary's depreciation deduction on the assets for 2019 (Year 2). Compute amounts assuming bonus depreciation was taken in part (a). Round your answers to nearest whole number. 7-year property Office building TABLE 8.2 Accelerated Depreciation for Personal Property Assuming Half-Year Convention (For Property Placed in Service after December 31, 1986) 3-Year 5-Year 7-Year 10-Year 15-Year (200% DB) (200% DB) (200% DB) (200% DB) (150% DB) Recovery Year 20-Year (150% DB) 14.29 5.00 33.33 44.45 14.81 % 7.41 24.49 17.49 20.00 32.00 19.20 11.52 % 11.52 5.76 10.00 18.00 14.40 11.52 9.50 8.55 7.70 12.49 8.93 * 8.92 9.22 6.93 7.37 6.23 5.90 * 8.93 6.55 * 6.55 3.750 7.219 6.677 6.177 5.713 5.285 4.888 4.522 4.462 * 4.461 4.462 4.461 4.462 4.461 4.46 5.90 6.56 6.55 3.28 5.91 5.90 5.91 5.90 5.91 5.90 5.91 4.462 4.461 4.462 4.461 4.462 4.461 2.231 *Switch to straight-line depreciation. TABLE 8.4 Accelerated Depreciation for Personal Property Assuming Mid-Quarter Convention* (For Property Placed in Service after December 31, 1986) 3-Year 5-Year (200% DB) (200% DB) Recovery Year 7-Year (200% DB) First Quarter 35.00 25.00 58.33 27.78 12.35 26.00 21.43 15.60 11.01 1.54 15.31 10.93 8.75 11.01 Second Quarter wwwwww 41.67 38.89 14.14 5.30 25.00 30.00 18.00 11.37 11.37 17.85 23.47 16.76 11.97 8.87 Third Quarter 25.00 50.00 16.67 15.00 34.00 20.40 12.24 11.30 10.71 25.51 18.22 13.02 9.30 8.33 Fourth Quarter 3.57 8.33 61.11 20.37 27.55 5.00 38.00 22.80 13.68 10.94 19.68 10.19 14.06 10.04 *For ease of presentation, only 3-year, 5-year, and 7-year property and only depreciation rates for the first 5 years are provided. The official table also includes 10-.15-, and 20-year property. See IRS Publication 946 for the complete table. TABLE 8.5 Straight-Line Depreciation for Real Property Assuming Mid-Month Convention* 27.5-Year Residential Real Property The applicable annual percentage is (use the column for the month in the first year the property is placed in service): Recovery Year(s) 218 19-27 28 29 1 3.485 3.636 3.637 1.970 0.000 2 3.182 3.636 3.637 2.273 0.000 3 2.879 3.636 3.637 2.576 0.000 4 5 2.576 2.273 3.636 3.636 3.6373.637 2.879 3.182 0.000 0.000 6 1.970 3.636 3.637 3.485 0.000 7 8 1.667 1.364 3.636 3.636 3.6373.637 3.636 3.636 0.152 0.455 9 1.061 3.636 3.637 3.636 0.758 10 0.758 3.636 3.637 3.636 1.061 11 0.455 3.636 3.637 3.636 1.364 12 0.152 3.636 3.637 3.636 1.667 39-Year Nonresidential Real Property The applicable annual percentage is (use the column for the month in the first year the property is placed in service): Recovery Year(s) 1 2.461 2.564 0.107 2 2.247 2.564 0.321 3 2.033 2.564 0.535 4 5 1.819 1.605 2.564 2.564 0.7490.963 6 1.391 2.564 1.177 7 1.177 2.564 1391 8 9 0.9630.749 2.564 2.564 1.605 1.819 10 0.535 2.564 2.033 11 0.321 2.564 2.247 12 0.107 2.564 2.461 2-39 40 *The official tables contain a separate row for each year. For ease of presentation, certain years are grouped together in these two tables. In some instances, this will produce a difference of .001 percent when compared with the official tables. During 2018, Mary Moser purchases the following items for use in her business: $12,000 Manufacturing equipment (7-year property, purchased August 1) Office furniture (7-year property, purchased December 15) Office building, land is accounted for separately (purchased March 30) 4,000 175,000 Assume that Mary uses the accelerated depreciation method. Click here to access depreciation table 8-2 and here for depreciation table 8-4. Click here to access depreciation table 8-5. a. Complete Form 4562 to report Mary's depreciation deduction for 2018 including bonus depreciation. If required, round your answers to the nearest dollar. Enter amounts as positive numbers. b. Calculate Mary's depreciation (but do not complete Form 4562) assuming she elects out of bonus depreciation. Round your answers to nearest whole number. 7-year property Office building Feedback Check My Work Incorrect C. Calculate Mary's depreciation deduction on the assets for 2019 (Year 2). Compute amounts assuming bonus depreciation was taken in part (a). Round your answers to nearest whole number. 7-year property Office building

Please solve for B and C not A. Thank you.

Please solve for B and C not A. Thank you.