Please solve for every question. Please make sure to provide a answer for each question :)

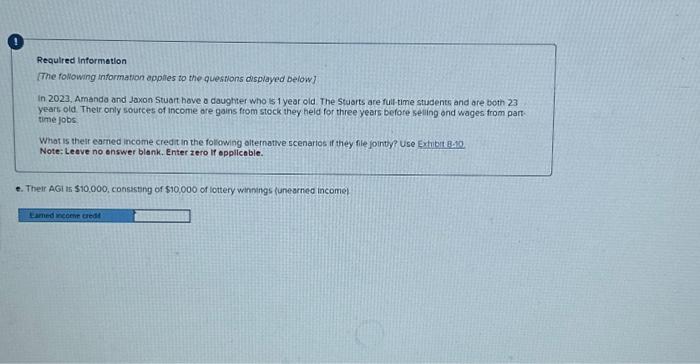

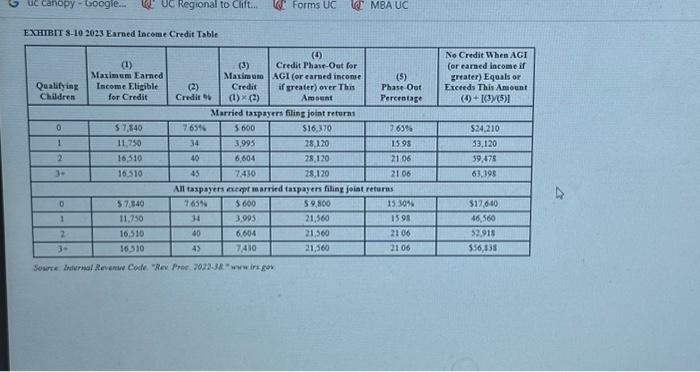

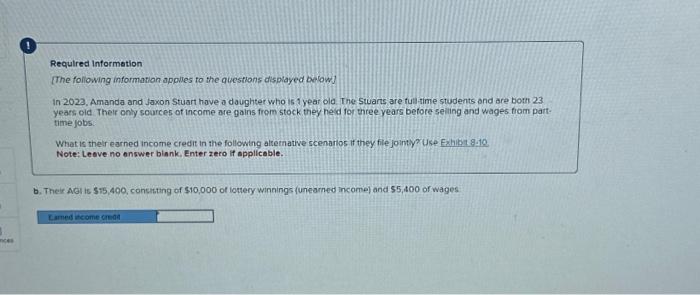

Required informetion [The following information applles to the questions cisplayed below] In 2023, Amanda and Jaxon Stuart hove o daughter who is 1 year old. The Stuarts are full-time students and are both 23 years old. Thetr only soutces of income are gains from stock they held for three years before selling ond wages from part. time jobs What is theit carned income credit in the following olternative scenarlos if they file jointy? Use frtibit Bate. Note: Leave no enswer blank. Enter zero if epplicable. e. Their AGi is $10,000, consasting of $10,000 of lottery winnings funearned income) Required information [The following information applies to the questions dispiayed below) In 2023, Amanda and Jaxon Stuart have a daughter who is 1 year oid The Stuarts are full-time students and are both 23 years old. Their only sources of income are gains from stock they held for three years before selling and wages from parttime jobs What is their earned income credit in the following alternative scenarios if they file jointly? Use Exhibr 8:10 Note: Leave no answer blonk. Enter zero If opplicable. c. Thetf AGI is $30,200, consisting of $23,100 of wages and $7,100 of lottery winnings (unearned income) Note: Round your Intermedlate calculations to the nearest whole dollar amount. Required Informetion The following information applies to the questions displayed below] In 2023. Amanda and Jaxon Stuart have a daughter who is 1 year old The Stuarts are fultime students and are both 23 years old. Their only sources of income are gains from stock they held for three years before seling and wages from parttime jobs What is theli earned income credit in the following alternative scenonos if they file jointly? Use Exhibit 8he Note: Leave no answer blonk. Enter zero if opplicoble. d. Their AGI is $30,200, consisting of $5,100 of wages and $25,100 of lottery winhings (unearned income) Note: Round your Intermediote calculations to the nearest whole dollar amount. EXHIBIT 8-102023 Earned Inceme Credit Table AII rapast excor married Required Informetion The following information appiles to the questions displayed below] In 2023, Amanda and Jaxon Stuart have a daughter who is 1 year ola. The Stuarts are fullime students ond are born 23 years oid. Their only soarces of income are gains from stock they heid for three years before seling and wages from parttime jobs: What is their earned income credit in the following alternative scenarlos if they file jointy? Use Fxhibit gito Note: Leave no answer biank. Enter zero if applicable. b. Their AGI is $15,400, consisting of $10,000 of lottery winnings (unearned income) and $5,400 of wages