Please solve for the answer in the highlighted yellow cells. Very important to make sure each cell shows how the solution was gotten by referencing the cell used in the calculation. Thanks

Please solve for the answer in the highlighted yellow cells. Very important to make sure each cell shows how the solution was gotten by referencing the cell used in the calculation. Thanks

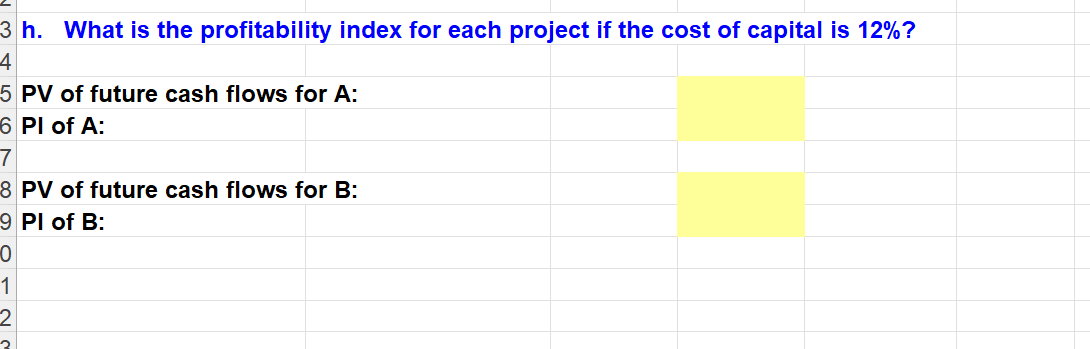

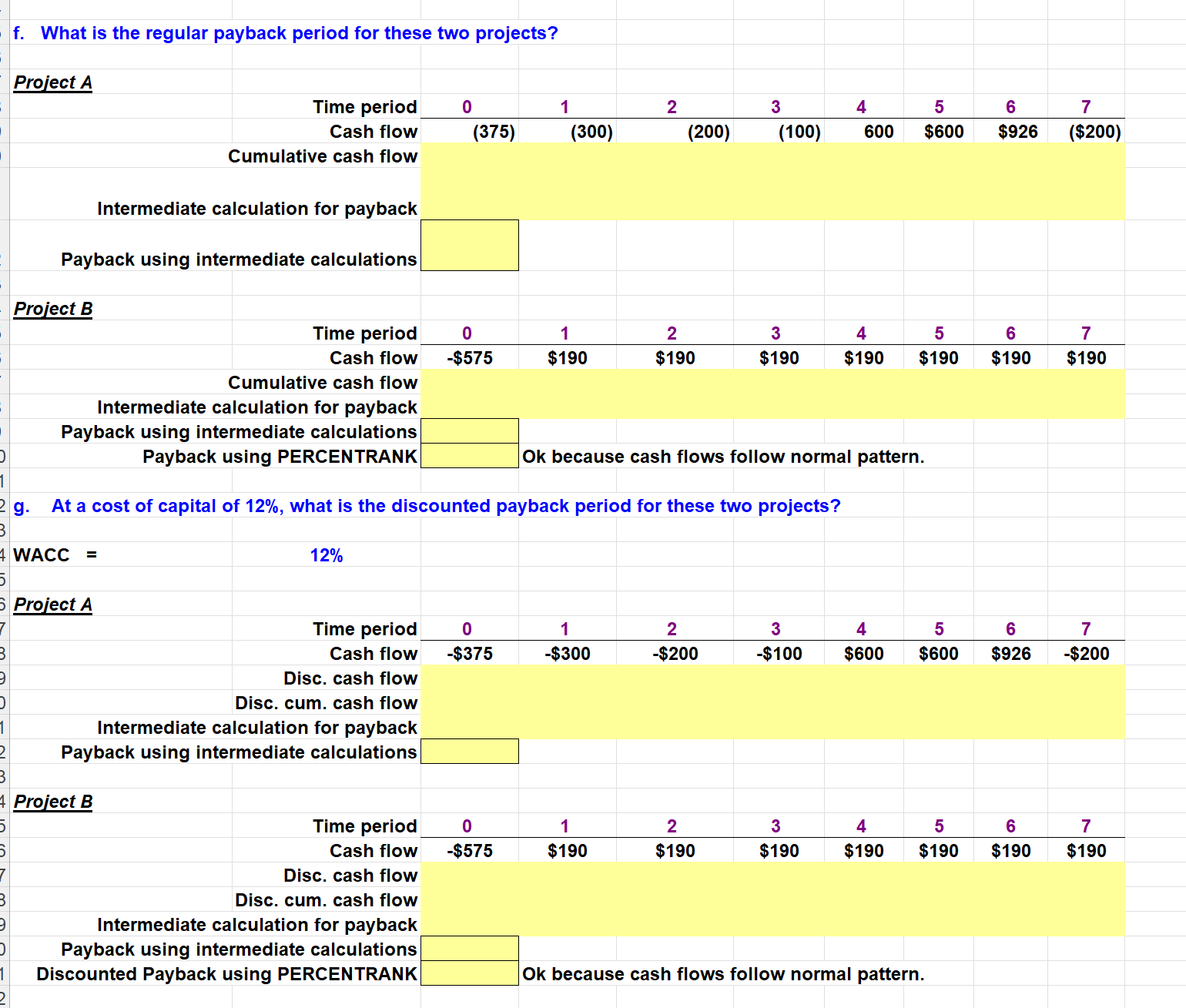

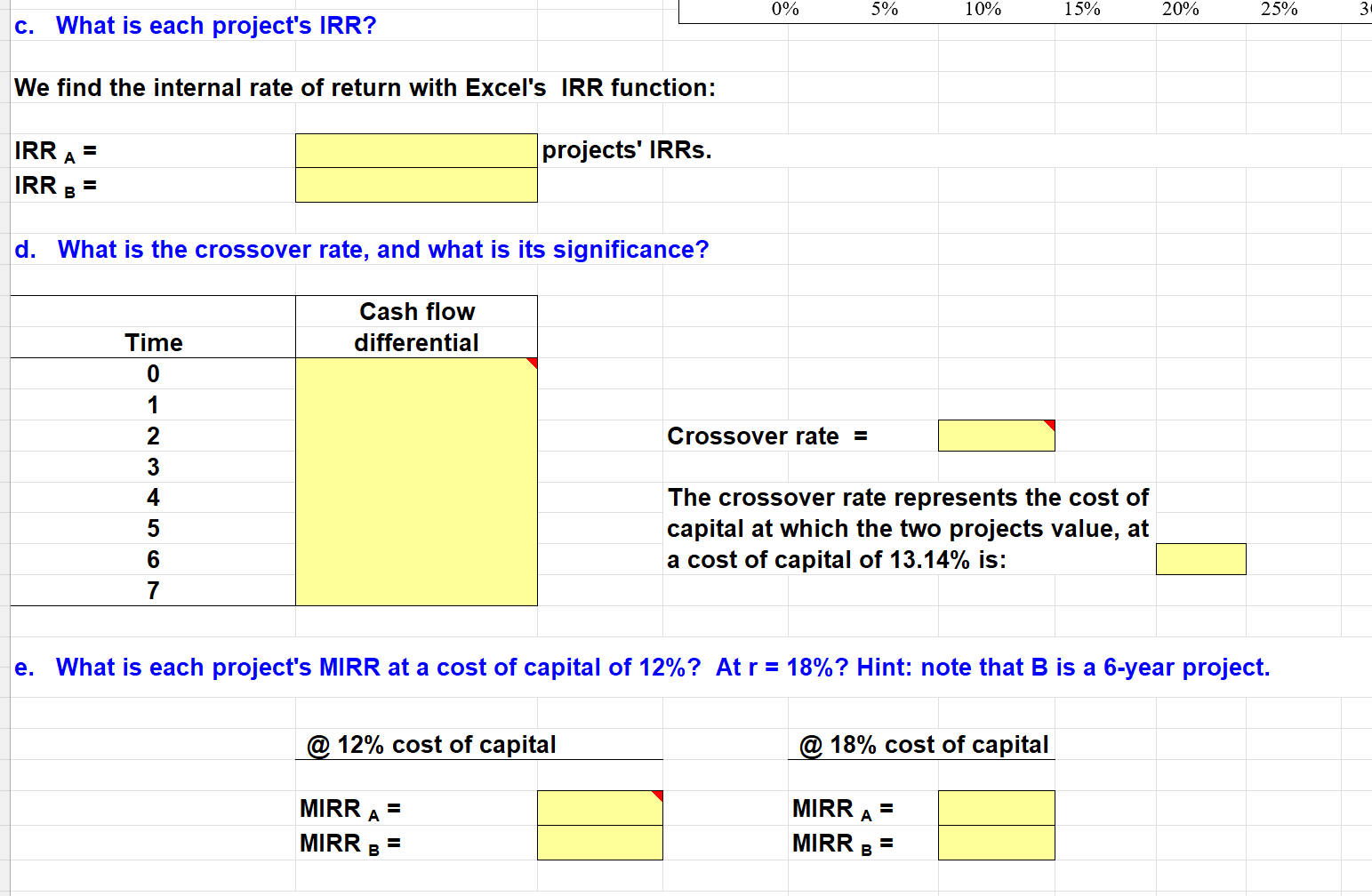

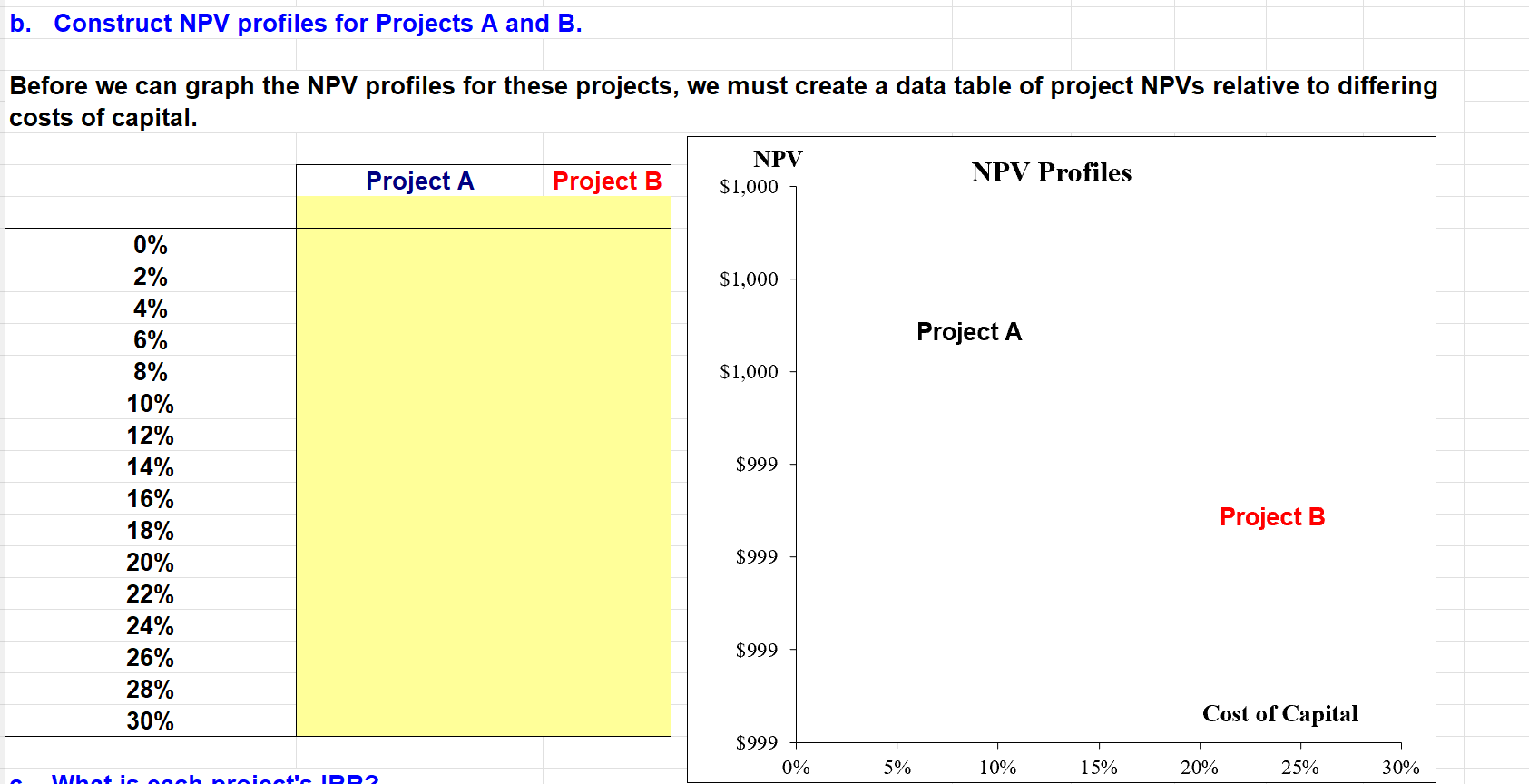

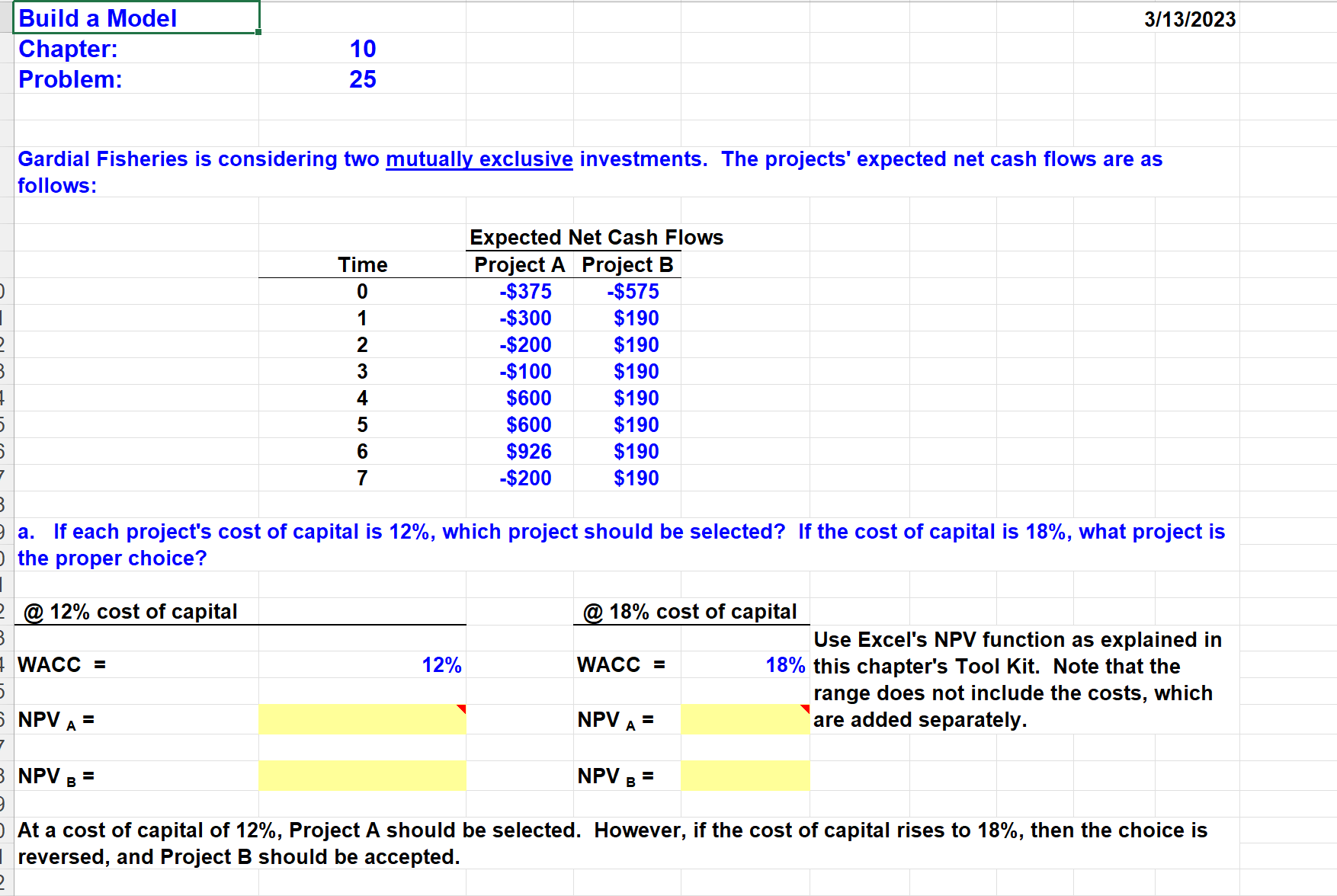

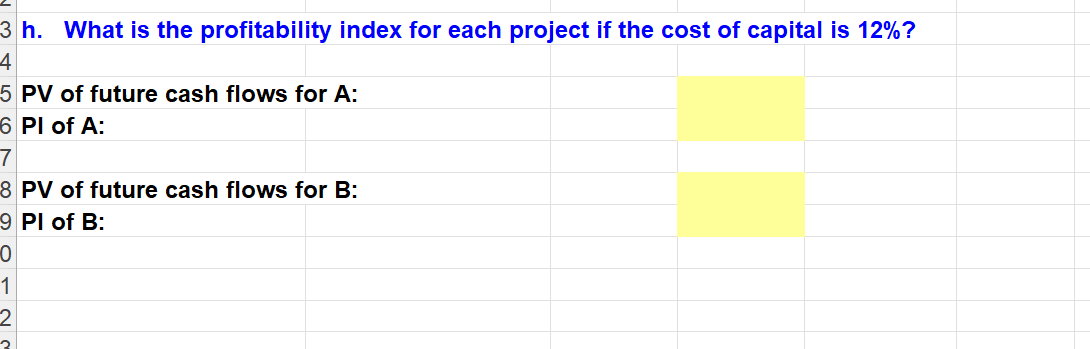

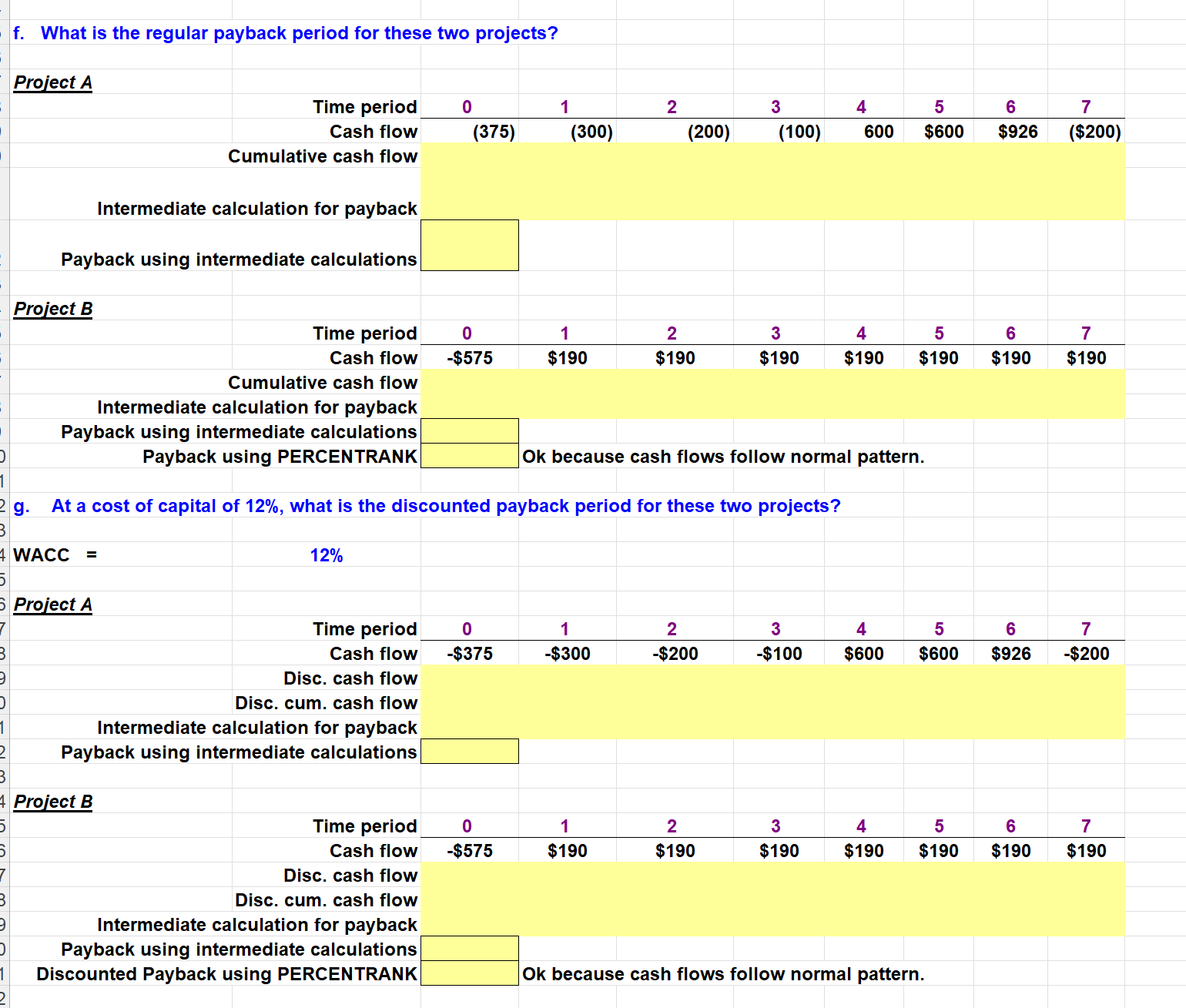

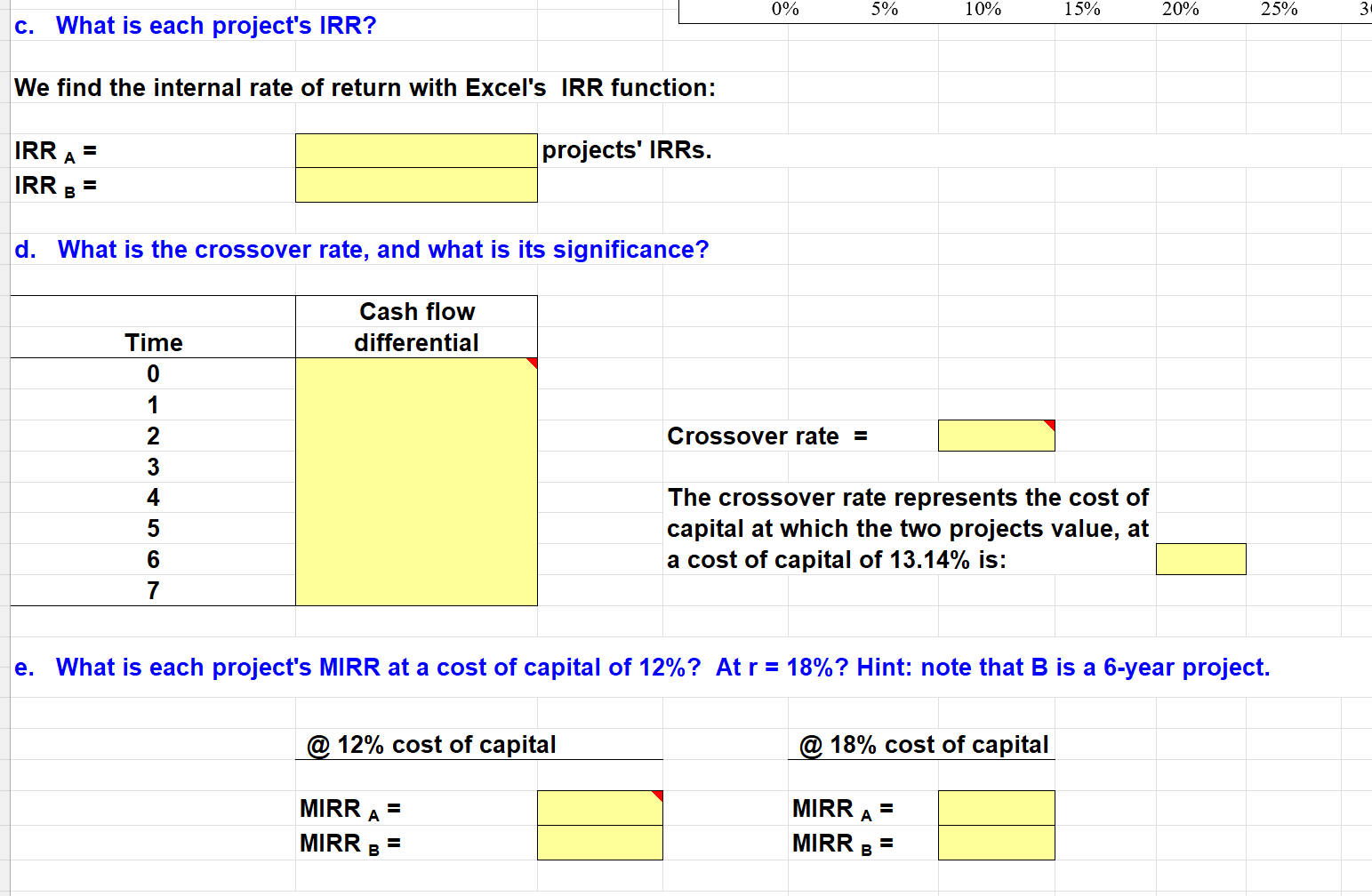

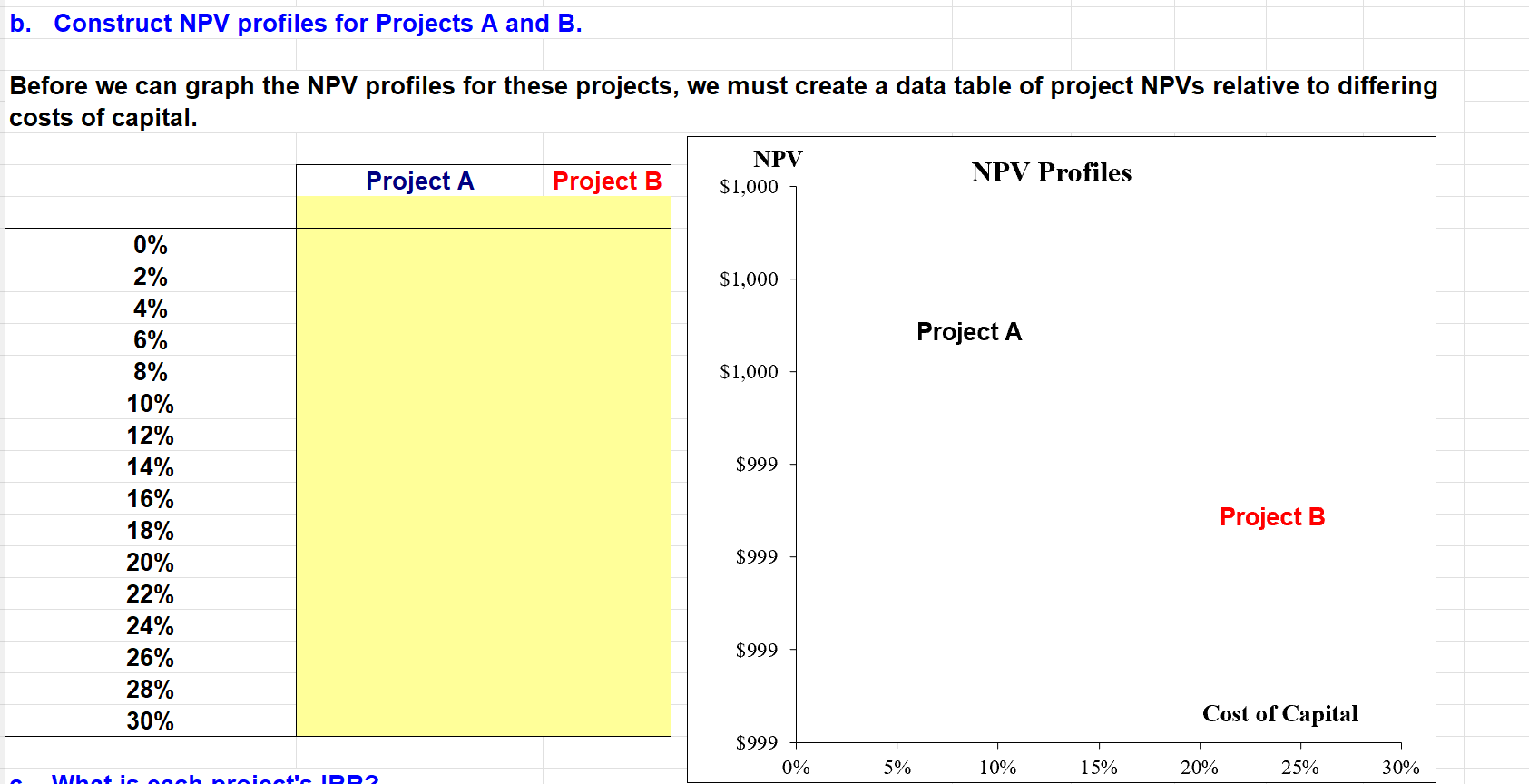

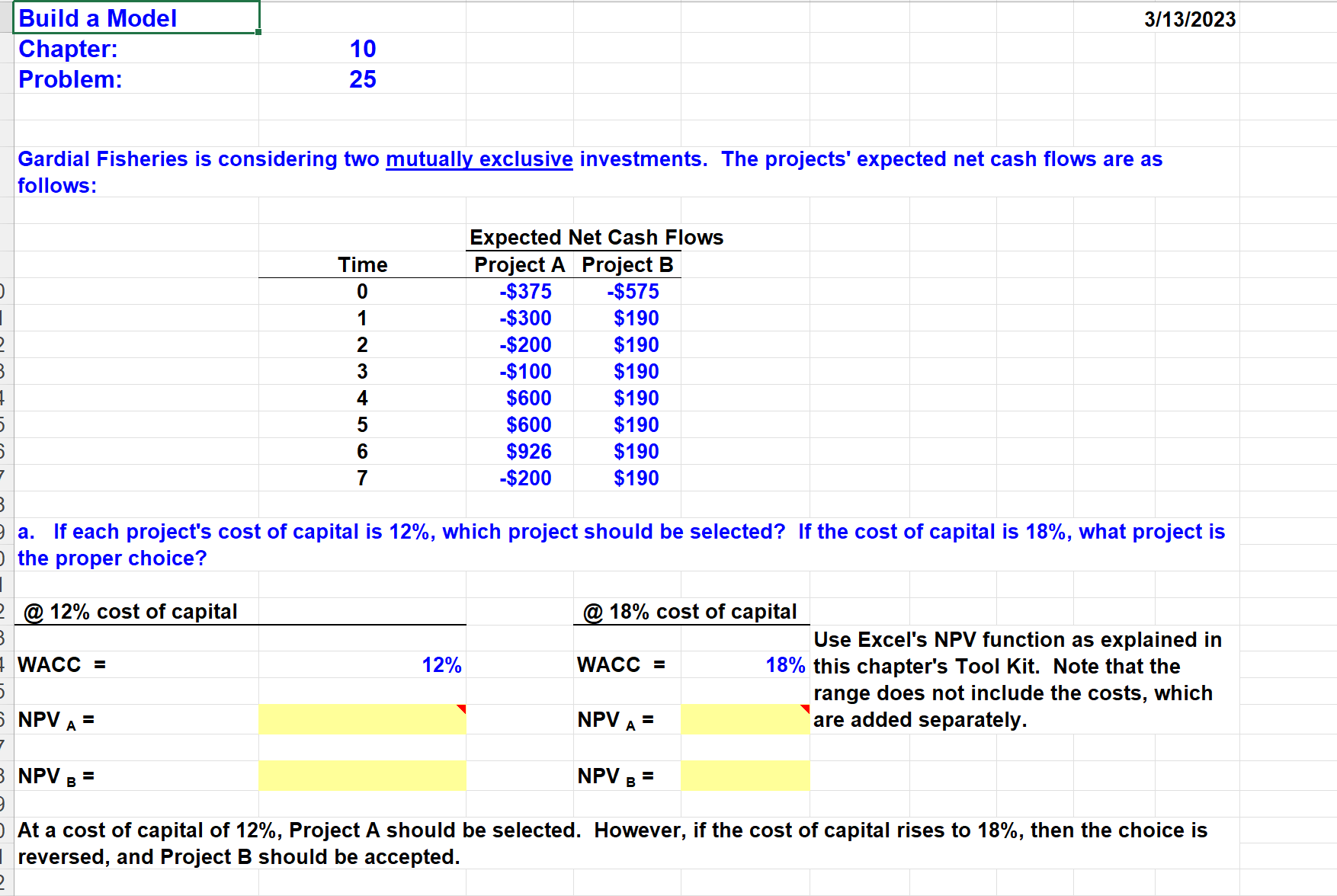

h. What is the profitability index for each project if the cost of capital is 12% ? PV of future cash flows for A : PI of A: 8 PV of future cash flows for B : PI of B: f. What is the regular payback period for these two projects? Project A Time period Cash flow (375) 1 (300) 2 Cumulative cash flow (200) 3 (100) 4 7 600 $600 \begin{tabular}{c|c} 6 & 7 \\ \hline$926 & ($200) \end{tabular} Intermediate calculation for payback Payback using intermediate calculations ProjectB Time period Cash flow 1 Cumulative cash flow Intermediate calculation for payback Payback using intermediate calculations Payback using PERCENTRANK Ok because cash flows follow normal pattern. g. At a cost of capital of 12%, what is the discounted payback period for these two projects? Disc. cash flow Disc. cum. cash flow Intermediate calculation for payback Payback using intermediate calculations Discounted Payback using PERCENTRANK Ok because cash flows follow normal pattern. c. What is each project's IRR? 0% 5% 10% 15% 20% 25% 3 We find the internal rate of return with Excel's IRR function: IRRA= projects' IRRs. IRRB= d. What is the crossover rate, and what is its significance? \begin{tabular}{|c|c|} \hline & Cashflowdifferential \\ \hline 0 & \\ 1 & \\ 2 & \\ 3 & \\ 4 & \\ 5 & \\ 6 & \\ 7 & \\ \hline \end{tabular} Crossover rate = The crossover rate represents the cost of capital at which the two projects value, at a cost of capital of 13.14% is: e. What is each project's MIRR at a cost of capital of 12% ? At r=18% ? Hint: note that B is a 6 -year project. @12% cost of capital @ 18% cost of capital MIRRA= MIRRA= MIRRB= MIRRB= b. Construct NPV profiles for Projects A and B. a. If each project's cost of capital is 12%, which project should be selected? If the cost of capital is 18%, what project is the proper choice? At a cost of capital of 12%, Project A should be selected. However, if the cost of capital rises to 18%, then the choice is reversed, and Project B should be accepted. h. What is the profitability index for each project if the cost of capital is 12% ? PV of future cash flows for A : PI of A: 8 PV of future cash flows for B : PI of B: f. What is the regular payback period for these two projects? Project A Time period Cash flow (375) 1 (300) 2 Cumulative cash flow (200) 3 (100) 4 7 600 $600 \begin{tabular}{c|c} 6 & 7 \\ \hline$926 & ($200) \end{tabular} Intermediate calculation for payback Payback using intermediate calculations ProjectB Time period Cash flow 1 Cumulative cash flow Intermediate calculation for payback Payback using intermediate calculations Payback using PERCENTRANK Ok because cash flows follow normal pattern. g. At a cost of capital of 12%, what is the discounted payback period for these two projects? Disc. cash flow Disc. cum. cash flow Intermediate calculation for payback Payback using intermediate calculations Discounted Payback using PERCENTRANK Ok because cash flows follow normal pattern. c. What is each project's IRR? 0% 5% 10% 15% 20% 25% 3 We find the internal rate of return with Excel's IRR function: IRRA= projects' IRRs. IRRB= d. What is the crossover rate, and what is its significance? \begin{tabular}{|c|c|} \hline & Cashflowdifferential \\ \hline 0 & \\ 1 & \\ 2 & \\ 3 & \\ 4 & \\ 5 & \\ 6 & \\ 7 & \\ \hline \end{tabular} Crossover rate = The crossover rate represents the cost of capital at which the two projects value, at a cost of capital of 13.14% is: e. What is each project's MIRR at a cost of capital of 12% ? At r=18% ? Hint: note that B is a 6 -year project. @12% cost of capital @ 18% cost of capital MIRRA= MIRRA= MIRRB= MIRRB= b. Construct NPV profiles for Projects A and B. a. If each project's cost of capital is 12%, which project should be selected? If the cost of capital is 18%, what project is the proper choice? At a cost of capital of 12%, Project A should be selected. However, if the cost of capital rises to 18%, then the choice is reversed, and Project B should be accepted

Please solve for the answer in the highlighted yellow cells. Very important to make sure each cell shows how the solution was gotten by referencing the cell used in the calculation. Thanks

Please solve for the answer in the highlighted yellow cells. Very important to make sure each cell shows how the solution was gotten by referencing the cell used in the calculation. Thanks