Answered step by step

Verified Expert Solution

Question

1 Approved Answer

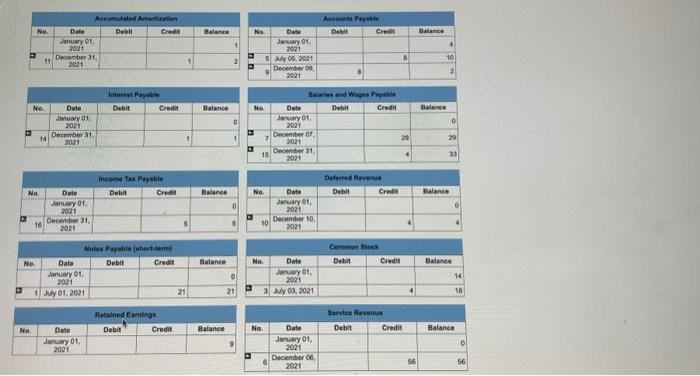

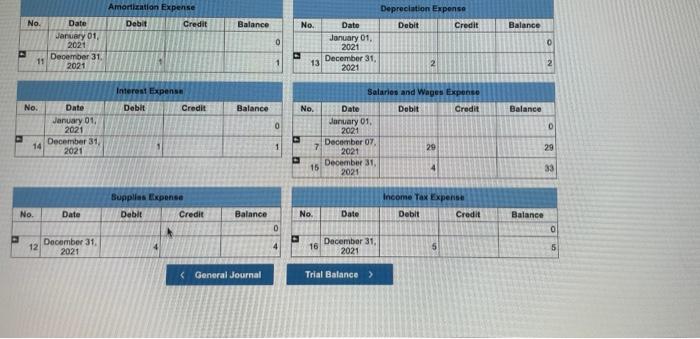

PLEASE SOLVE FOR THE POST-CLOSING GENERAL LEDGER ! THANK YOU! Data for adfusting journal entries on December 3t: k. Amortization for 2021, $1. 1. Supplies

PLEASE SOLVE FOR THE POST-CLOSING GENERAL LEDGER ! THANK YOU!

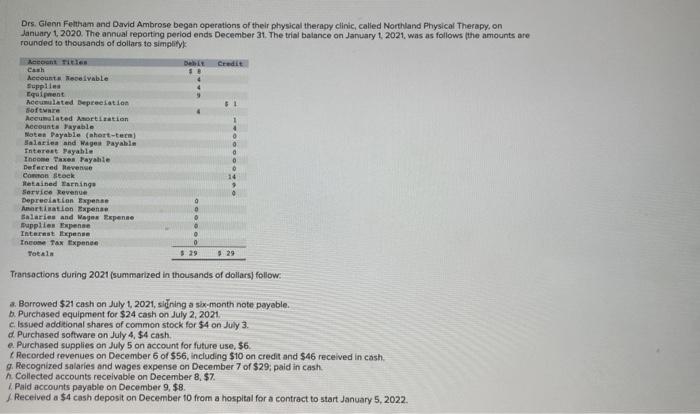

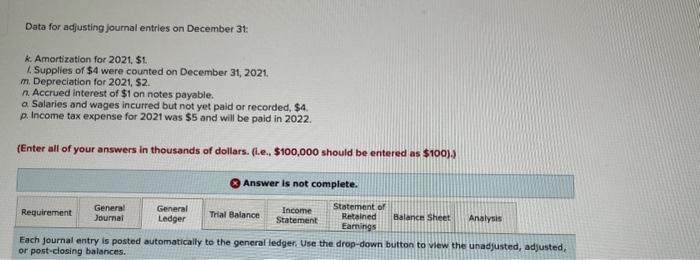

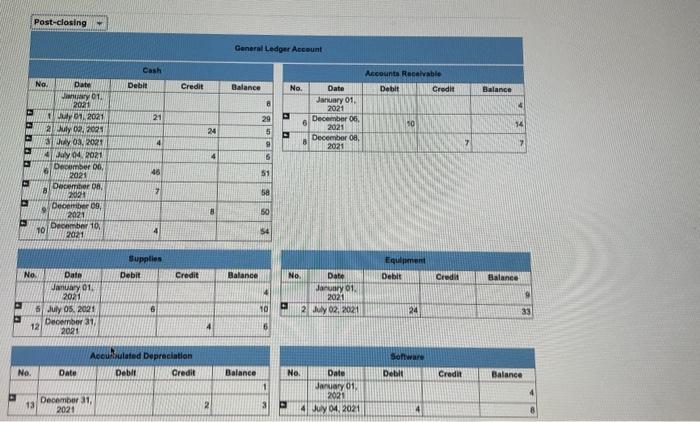

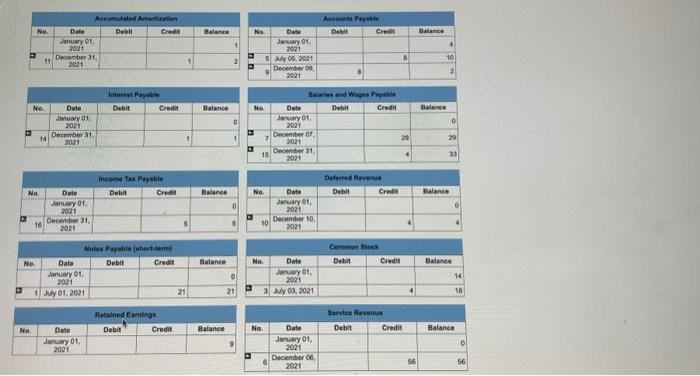

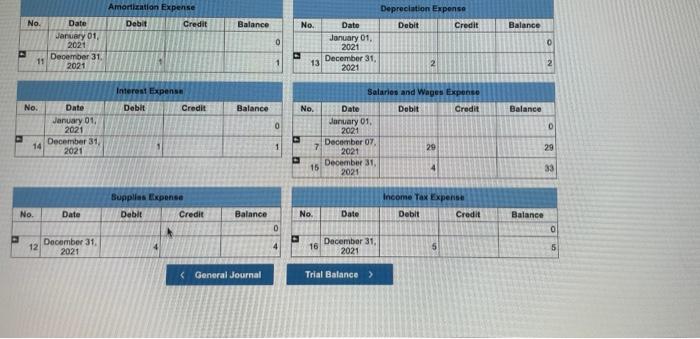

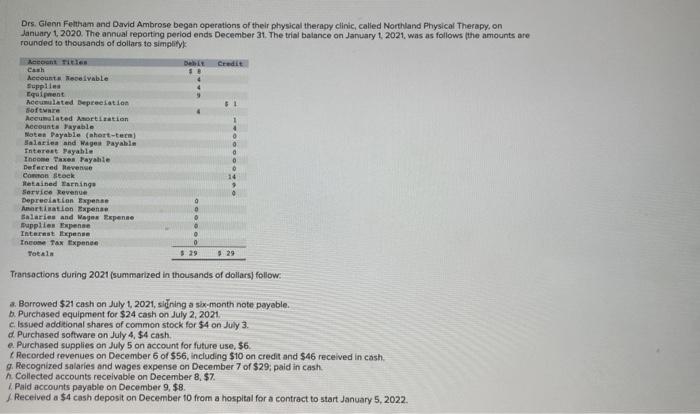

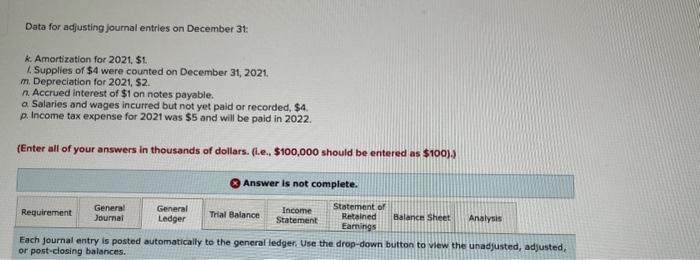

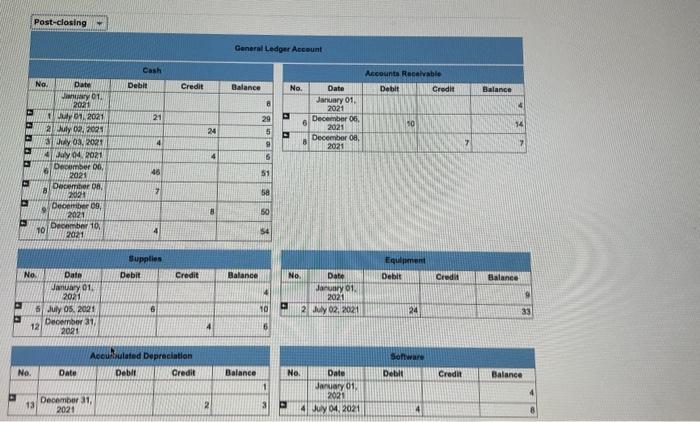

Data for adfusting journal entries on December 3t: k. Amortization for 2021, \$1. 1. Supplies of $4 were counted on December 31, 2021. m. Depreciation for 2021,$2. n. Accrued interest of $1 on notes payable. a Salaries and wages incurred but not yet paid or recorded, $4. p. Income tax expense for 2021 was $5 and will be paid in 2022 . (Enter all of your answers in thousands of dollars. (i.e., $100,000 should be entered as $100) ) Answer is not complete. Each journal entry is posted automatically to the general ledger. Use the drop-down button to view the unadjusted, adjusted, or post-closing balances. General Ledger Account Amortization Expense Depreciation Expense \begin{tabular}{|c|c|c|c|c|} \hline No. & Date & Dobit & Credit & Balance \\ \hline & Jonuary01,2021 & & 0 \\ \hline 13 & December31,2021 & 2 & 2 \\ \hline \end{tabular} Bupplas Expense Income Tax Expense \begin{tabular}{|c|c||c|c|r|} \hline No. & Date & Debit & Credit & Balance \\ \hline & & & & 0 \\ \hline 16 & December31,2021 & & 5 & 5 \\ \hline \end{tabular} General Journal Trial Balance ? Drs. Glenn Fettram and David Ambrose began operations of their physical therapy clinic, called Northland Physical Therapy, on Janiary 1,2020 . The annual reporting period ends December 31. The trial batance on January 1,2021 , was as follows (the amounts are rounded to thousands of dollars to simplityk Transactions during 2021 (summarized in thousands of dollars) follow: a. Borrowed $21 cash on July 1,2021 , sining a sbx-month note payable. b. Purchased equipment for $24 cash on July 2,2021 . c. Issued additional shares of common stock for $4 on July 3 . d. Purchased software on July 4,54 cash. e. Purchased supplies on July 5 on account for future use, $6. Recorded revenues on December 6 of $56, including $10 on credit and $46 received in cash. g. Recognized salaries and wages expense on December 7 of \$29; paid in cash. h. Collected accounts receivable on December 8,$7. 1. Paid accounts payable on December 9,$8. I Received a $4 cash deposit on December to from a hospital for a contract to start January 5,2022

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started