Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve for total risk, systematic risk and non-systematic risk using regressions and explain all the steps of calculation in detail. please solve for total

please solve for total risk, systematic risk and non-systematic risk using regressions and explain all the steps of calculation in detail.

please solve for total risk, systematic risk and non-systematic risk using regressions and explain all the steps of calculation in detail.

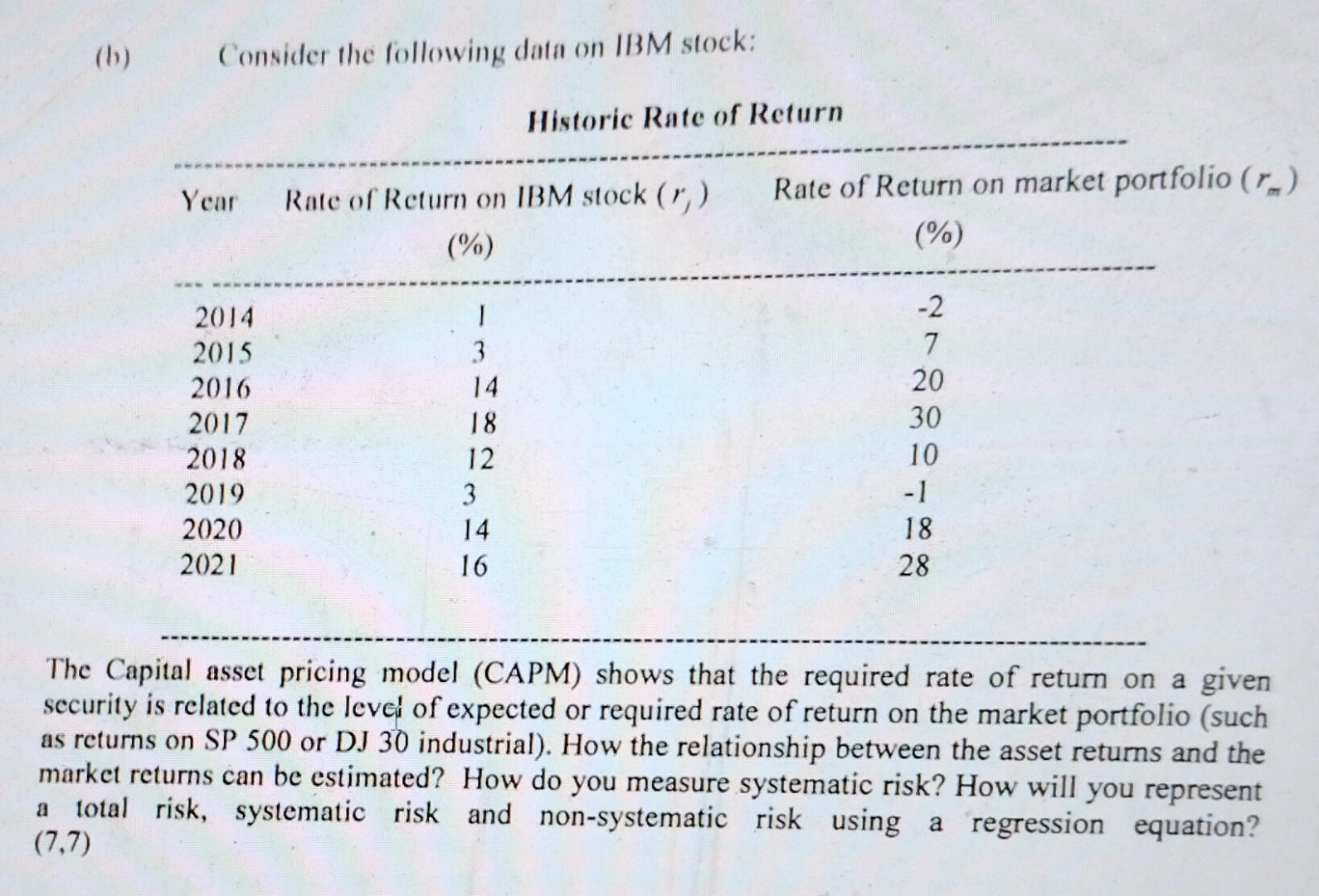

(b) Consider the following data on IBM stock: Historic Rate of Return The Capital asset pricing model (CAPM) shows that the required rate of return on a given security is related to the level of expected or required rate of return on the market portfolio (such as returns on SP 500 or DJ 30 industrial). How the relationship between the asset returns and the market returns can be estimated? How do you measure systematic risk? How will you represent a total risk, systematic risk and non-systematic risk using a regression equation? (7,7)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started