Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve however you can QUESTION Premium chemicals plc were considering the installation of a new processing plant. The two plants under consideration were: Plant

please solve however you can

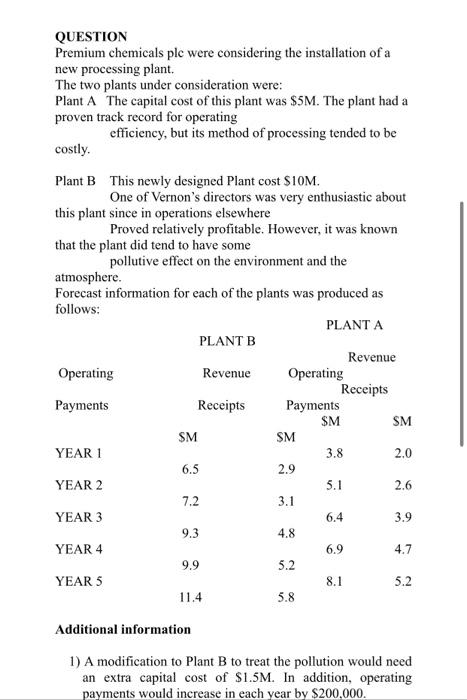

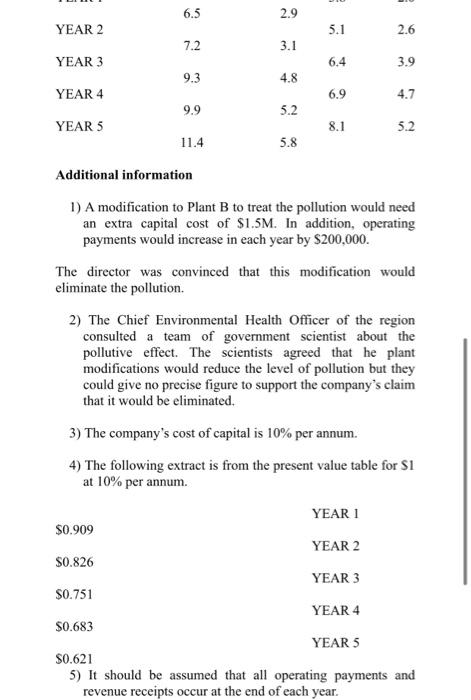

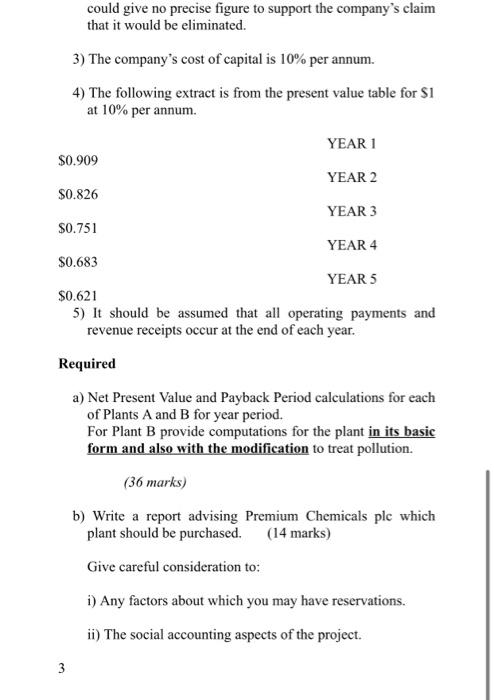

QUESTION Premium chemicals plc were considering the installation of a new processing plant. The two plants under consideration were: Plant A The capital cost of this plant was $5M. The plant had a proven track record for operating efficiency, but its method of processing tended to be costly. Plant B This newly designed Plant cost $10M. One of Vernon's directors was very enthusiastic about this plant since in operations elsewhere Proved relatively profitable. However, it was known that the plant did tend to have some pollutive effect on the environment and the atmosphere. Forecast information for each of the plants was produced as follows: Additional information 1) A modification to Plant B to treat the pollution would need an extra capital cost of $1.5M. In addition, operating payments would increase in each year by $200.000. Additional information 1) A modification to Plant B to treat the pollution would need an extra capital cost of $1.5M. In addition, operating payments would increase in each year by $200,000. The director was convinced that this modification would eliminate the pollution. 2) The Chief Environmental Health Officer of the region consulted a team of government scientist about the pollutive effect. The scientists agreed that he plant modifications would reduce the level of pollution but they could give no precise figure to support the company's claim that it would be eliminated. 3) The company's cost of capital is 10% per annum. 4) The following extract is from the present value table for $1 at 10% per annum. 5) It should be assumed that all operating payments and revenue receipts occur at the end of each year. could give no precise figure to support the company's claim that it would be eliminated. 3) The company's cost of capital is 10% per annum. 4) The following extract is from the present value table for $1 at 10% per annum. $.01 5) It should be assumed that all operating payments and revenue receipts occur at the end of each year. Required a) Net Present Value and Payback Period calculations for each of Plants A and B for year period. For Plant B provide computations for the plant in its basic form and also with the modification to treat pollution. (36 marks) b) Write a report advising Premium Chemicals ple which plant should be purchased. (14 marks) Give careful consideration to: i) Any factors about which you may have reservations. ii) The social accounting aspects of the project. 3 Premium chemicals plc were considering the installation of a new processing plant. The two plants under consideration were: Plant A The capital cost of this plant was $5M. The plant had a proven track record for operating efficiency, but its method of processing tended to be costly. Plant B This newly designed Plant cost $10M. One of Vernon's directors was very enthusiastic about this plant since in operations elsewhere Proved relatively profitable. However, it was known that the plant did tend to have some pollutive effect on the environment and the atmosphere. Forecast information for each of the plants was produced as follows: Additional information 1) A modification to Plant B to treat the pollution would need an extra capital cost of $1.5M. In addition, operating payments would increase in each year by $200,000. Additional information 1) A modification to Plant B to treat the pollution would need an extra capital cost of $1.5M. In addition, operating payments would increase in each year by $200,000. The director was convinced that this modification would eliminate the pollution. 2) The Chief Environmental Health Officer of the region consulted a team of government scientist about the pollutive effect. The scientists agreed that he plant modifications would reduce the level of pollution but they could give no precise figure to support the company's claim that it would be eliminated. 3) The company's cost of capital is 10% per annum. 4) The following extract is from the present value table for $1 at 10% per annum. 5) It should be assumed that all operating payments and revenue receipts occur at the end of each year. could give no precise figure to support the company's claim that it would be eliminated. 3) The company's cost of capital is 10% per annum. 4) The following extract is from the present value table for $1 at 10% per annum. 5) It should be assumed that all operating payments and revenue receipts occur at the end of each year. Required a) Net Present Value and Payback Period calculations for each of Plants A and B for year period. For Plant B provide computations for the plant in its basic form and also with the modification to treat pollution. ( 36 marks) b) Write a report advising Premium Chemicals plc which plant should be purchased. (14 marks) Give careful consideration to: i) Any factors about which you may have reservations. ii) The social accounting aspects of the project

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started