Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please solve if you are 100 % sure. Don't copy answers from chegg that are already solved. Thank you! Required Information Problem 25-50 (LO 25-3)

Please solve if you are 100 % sure. Don't copy answers from chegg that are already solved. Thank you!

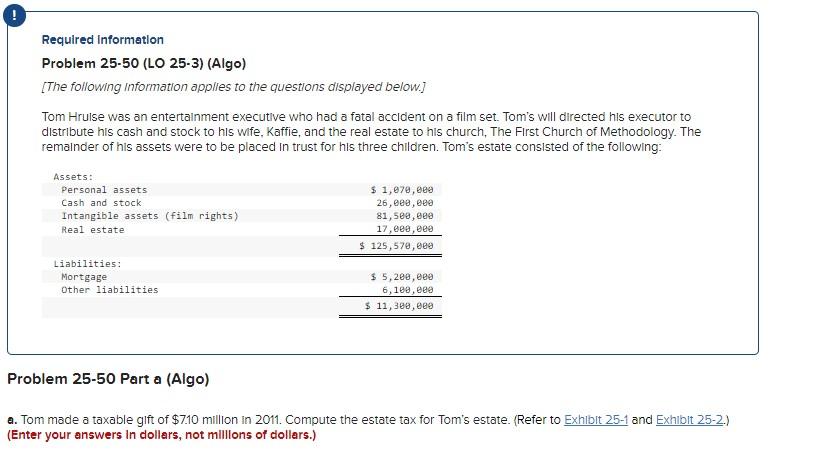

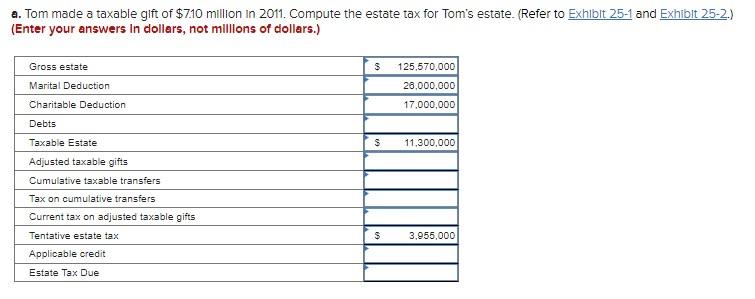

Required Information Problem 25-50 (LO 25-3) (Algo) [The following information applies to the questions displayed below.) Tom Hruise was an entertainment executive who had a fatal accident on a film set. Tom's will directed his executor to distribute his cash and stock to his wife, Kaffie, and the real estate to his church, The First Church of Methodology. The remainder of his assets were to be placed in trust for his three children. Tom's estate consisted of the following: Assets: Personal assets Cash and stock Intangible assets (film rights) Real estate $ 1,079,80 26, eee, eee 81,588, eee 17, eee, eee $ 125,570,000 Liabilities: Mortgage Other liabilities $ 5,200,eee 6,100,000 $ 11,380,000 Problem 25-50 Part a (Algo) a. Tom made a taxable gift of $710 million in 2011. Compute the estate tax for Tom's estate. (Refer to Exhibit 25-1 and Exhibit 25-2.) (Enter your answers in dollars, not millions of dollars.) a. Tom made a taxable gift of $710 million in 2011. Compute the estate tax for Tom's estate. (Refer to Exhibit 25-1 and Exhibit 25-2.) (Enter your answers in dollars, not millions of dollars.) $ 125,570,000 28,000,000 17,000,000 S 11,300,000 Gross estate Marital Deduction Charitable Deduction Debts Taxable Estate Adjusted taxable gifts Cumulative taxable transfers Tax on cumulative transfers Current tax on adjusted taxable gifts Tentative estate tax Applicable credit $ 3.955,000 Estate Tax DueStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started