Answered step by step

Verified Expert Solution

Question

1 Approved Answer

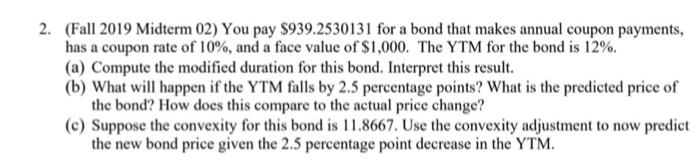

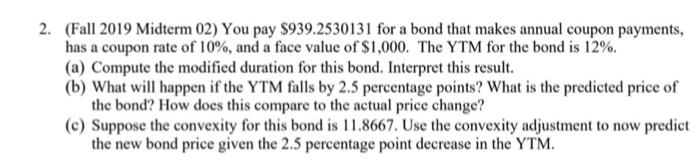

Please solve in details. Thank you! 2. (Fall 2019 Midterm 02) You pay $939.2530131 for a bond that makes annual coupon payments, has a coupon

Please solve in details. Thank you!

2. (Fall 2019 Midterm 02) You pay $939.2530131 for a bond that makes annual coupon payments, has a coupon rate of 10%, and a face value of $1,000. The YTM for the bond is 12%. (a) Compute the modified duration for this bond. Interpret this result. (b) What will happen if the YTM falls by 2.5 percentage points? What is the predicted price of the bond? How does this compare to the actual price change? (c) Suppose the convexity for this bond is 11.8667. Use the convexity adjustment to now predict the new bond price given the 2.5 percentage point decrease in the YTM

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started