Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please solve in details. Thank you! (FALL 2017 Midterm 02) L.L. Bean issued new bonds on March 1, 2015 to help it finance an expansion

Please solve in details. Thank you!

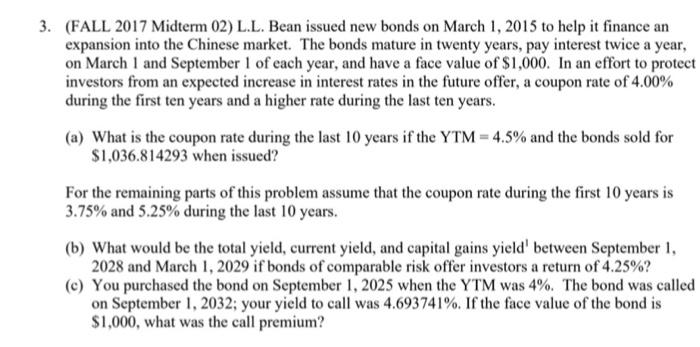

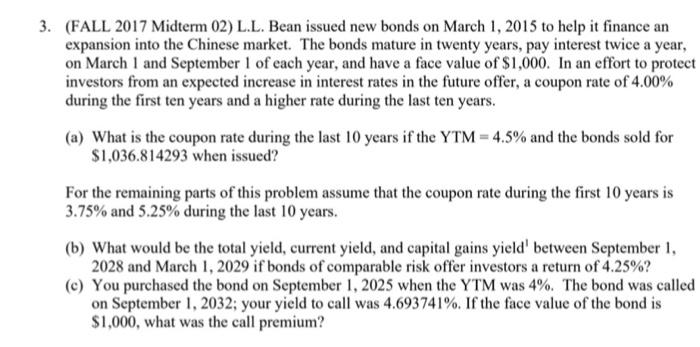

(FALL 2017 Midterm 02) L.L. Bean issued new bonds on March 1, 2015 to help it finance an expansion into the Chinese market. The bonds mature in twenty years, pay interest twice a year, on March 1 and September 1 of each year, and have a face value of $1,000. In an effort to protect investors from an expected increase in interest rates in the future offer, a coupon rate 4.00% during the first ten years and a higher rate during the last ten years. (a) What is the coupon rate during the last 10 years if the YTM =4.5% and the bonds sold for $1,036.814293 when issued? For the remaining parts of this problem assume that the coupon rate during the first 10 years is 3.75% and 5.25% during the last 10 years. (b) What would be the total yield, current yield, and capital gains yield between September 1 , 2028 and March 1, 2029 if bonds of comparable risk offer investors a return of 4.25% ? (c) You purchased the bond on September 1, 2025 when the YTM was 4\%. The bond was called on September 1, 2032; your yield to call was 4.693741%. If the face value of the bond is $1,000, what was the call premium? (FALL 2017 Midterm 02) L.L. Bean issued new bonds on March 1, 2015 to help it finance an expansion into the Chinese market. The bonds mature in twenty years, pay interest twice a year, on March 1 and September 1 of each year, and have a face value of $1,000. In an effort to protect investors from an expected increase in interest rates in the future offer, a coupon rate 4.00% during the first ten years and a higher rate during the last ten years. (a) What is the coupon rate during the last 10 years if the YTM =4.5% and the bonds sold for $1,036.814293 when issued? For the remaining parts of this problem assume that the coupon rate during the first 10 years is 3.75% and 5.25% during the last 10 years. (b) What would be the total yield, current yield, and capital gains yield between September 1 , 2028 and March 1, 2029 if bonds of comparable risk offer investors a return of 4.25% ? (c) You purchased the bond on September 1, 2025 when the YTM was 4\%. The bond was called on September 1, 2032; your yield to call was 4.693741%. If the face value of the bond is $1,000, what was the call premium

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started