Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE SOLVE IN EXCEL SPREADSHEEG. Managing a Portfolio. A local bank wants to build a bond portfolio from a set of five bonds with $

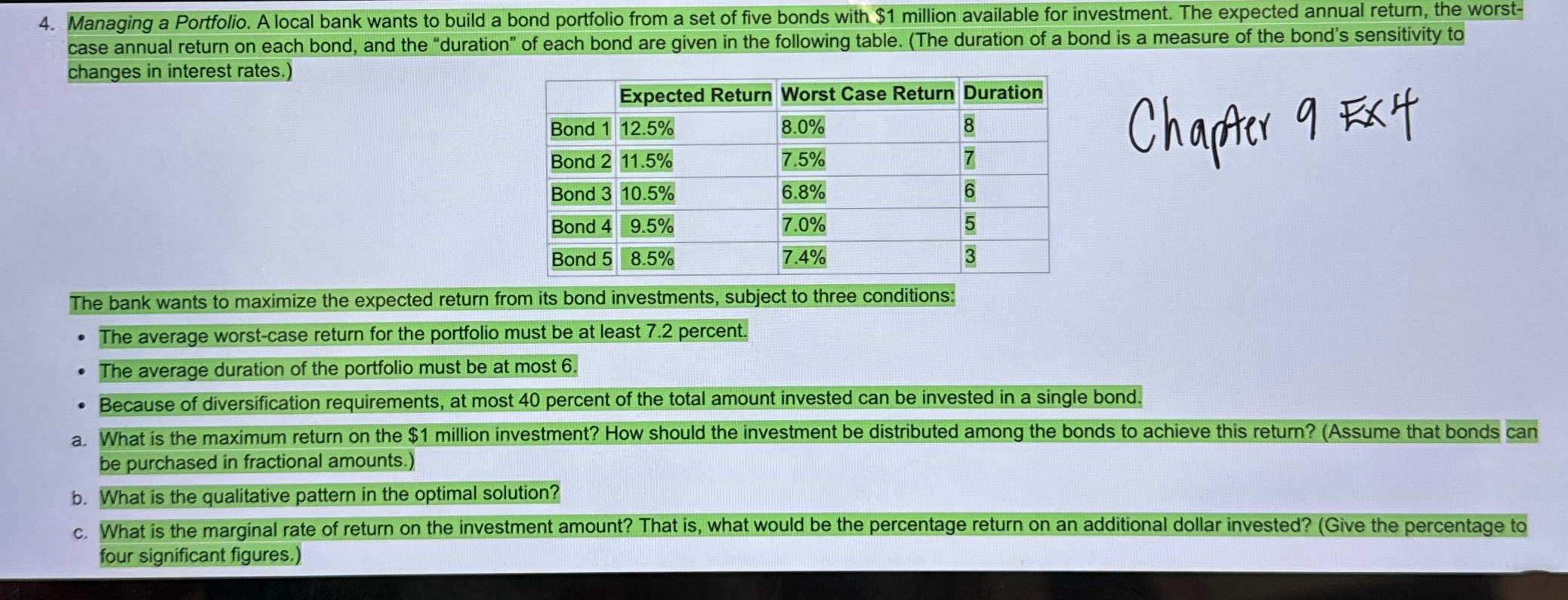

PLEASE SOLVE IN EXCEL SPREADSHEEG. Managing a Portfolio. A local bank wants to build a bond portfolio from a set of five bonds with $ million available for investment. The expected annual return, the worstcase annual return on each bond, and the "duration" of each bond are given in the following table. The duration of a bond is a measure of the bond's sensitivity to changes in interest rates.

tableExpected Return,Worst Case Return,DurationBond Bond Bond Bond Bond

Chapter ExY

The bank wants to maximize the expected return from its bond investments, subject to three conditions:

The average worstcase return for the portfolio must be at least percent.

The average duration of the portfolio must be at most

Because of diversification requirements, at most percent of the total amount invested can be invested in a single bond.

a What is the maximum return on the $ million investment? How should the investment be distributed among the bonds to achieve this return? Assume that bonds can be purchased in fractional amounts.

b What is the qualitative pattern in the optimal solution?

c What is the marginal rate of return on the investment amount? That is what would be the percentage return on an additional dollar invested? Give the percentage to four significant figures.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started