Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve InstaHam is a service that provides you with an endless feed of free bacon, but generates revenue by selling your private data to

please solve

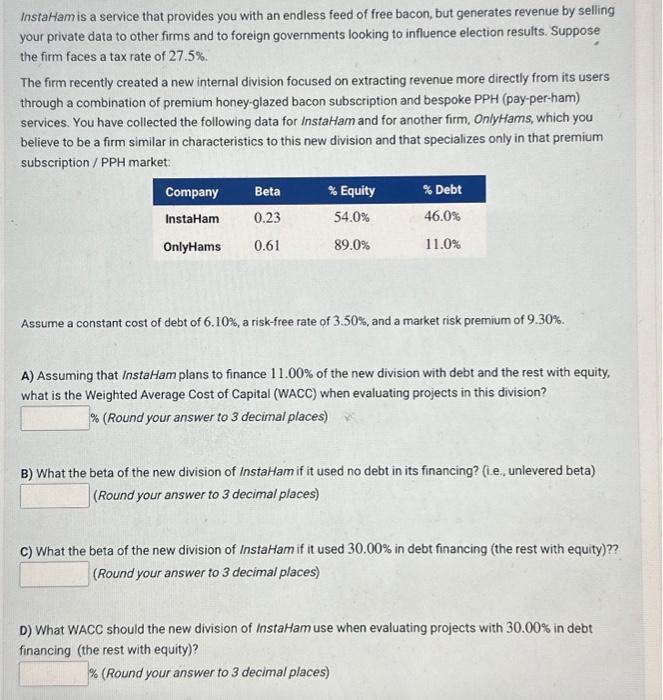

InstaHam is a service that provides you with an endless feed of free bacon, but generates revenue by selling your private data to other firms and to foreign governments looking to influence election results. Suppose the firm faces a tax rate of 27.5%. The firm recently created a new internal division focused on extracting revenue more directly from its users through a combination of premium honey-glazed bacon subscription and bespoke PPH (pay-per-ham) services. You have collected the following data for InstaHam and for another firm, OnlyHams, which you believe to be a firm similar in characteristics to this new division and that specializes only in that premium subscription / PPH market: Assume a constant cost of debt of 6.10%, a risk-free rate of 3.50%, and a market risk premium of 9.30%. A) Assuming that InstaHam plans to finance 11.00% of the new division with debt and the rest with equity, what is the Weighted Average Cost of Capital (WACC) when evaluating projects in this division? % (Round your answer to 3 decimal places) B) What the beta of the new division of InstaHam if it used no debt in its financing? (i.e., unlevered beta) (Round your answer to 3 decimal places) C) What the beta of the new division of InstaHam if it used 30.00% in debt financing (the rest with equity)?? (Round your answer to 3 decimal places) D) What WACC should the new division of InstaHam use when evaluating projects with 30.00% in debt financing (the rest with equity)? \% (Round your answer to 3 decimal places)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started