Please solve it all over again and in a clear format because I posted before but they gave me wrong answers.

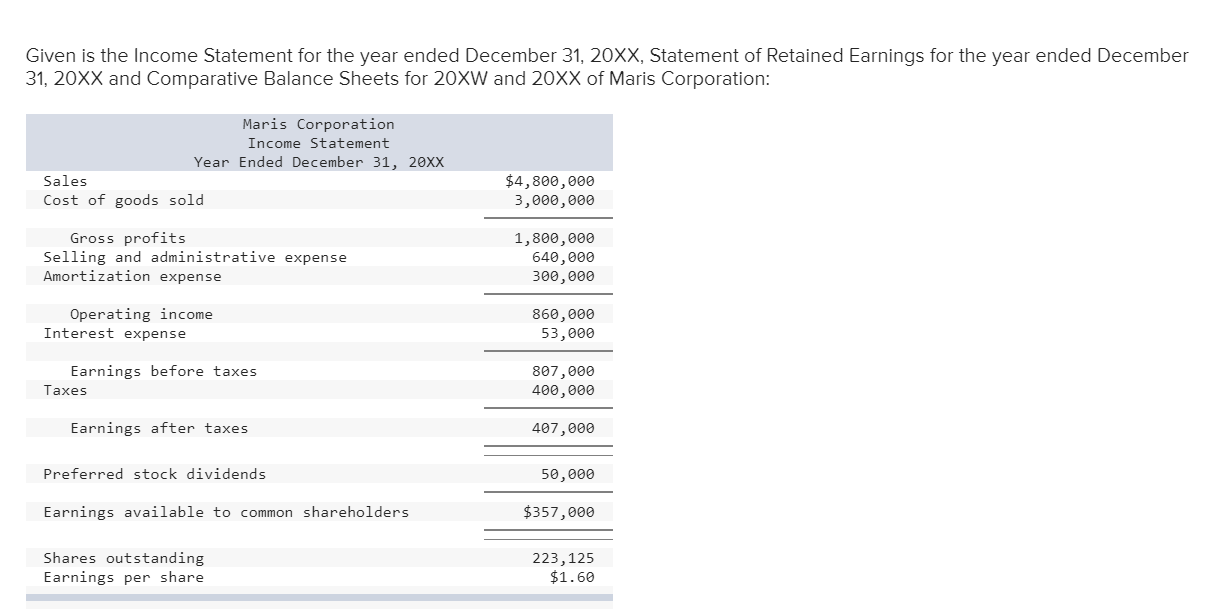

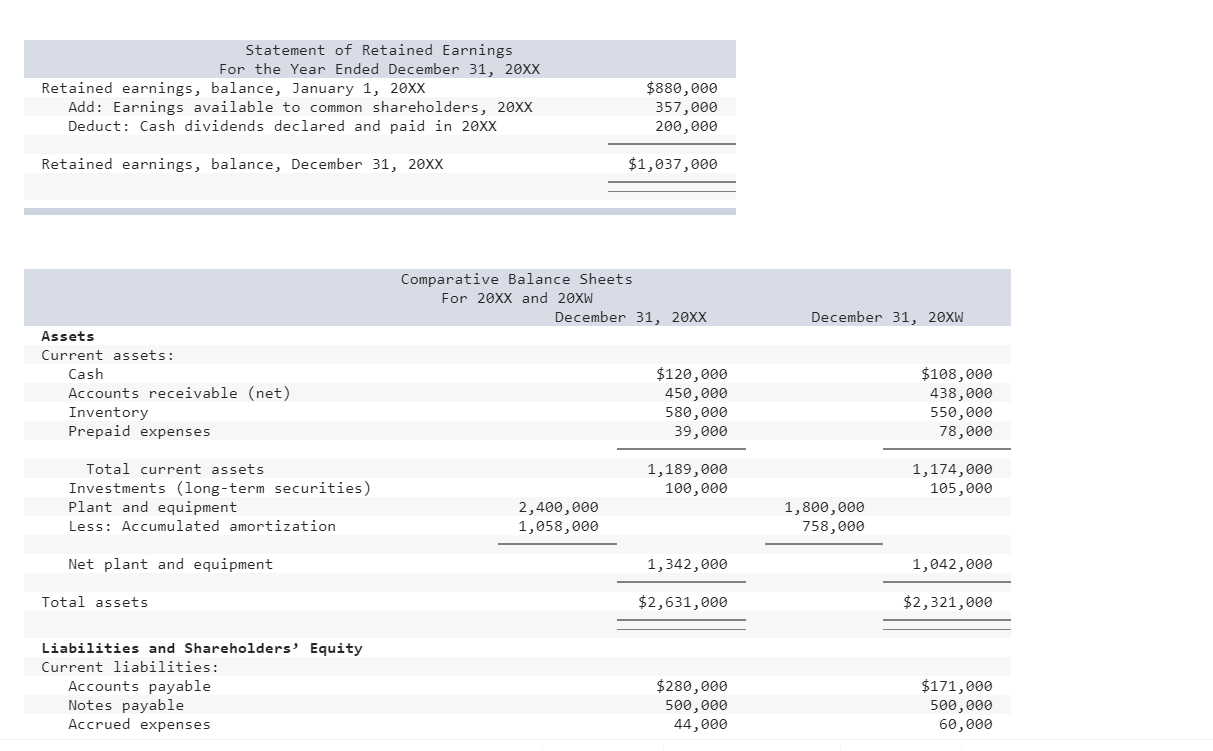

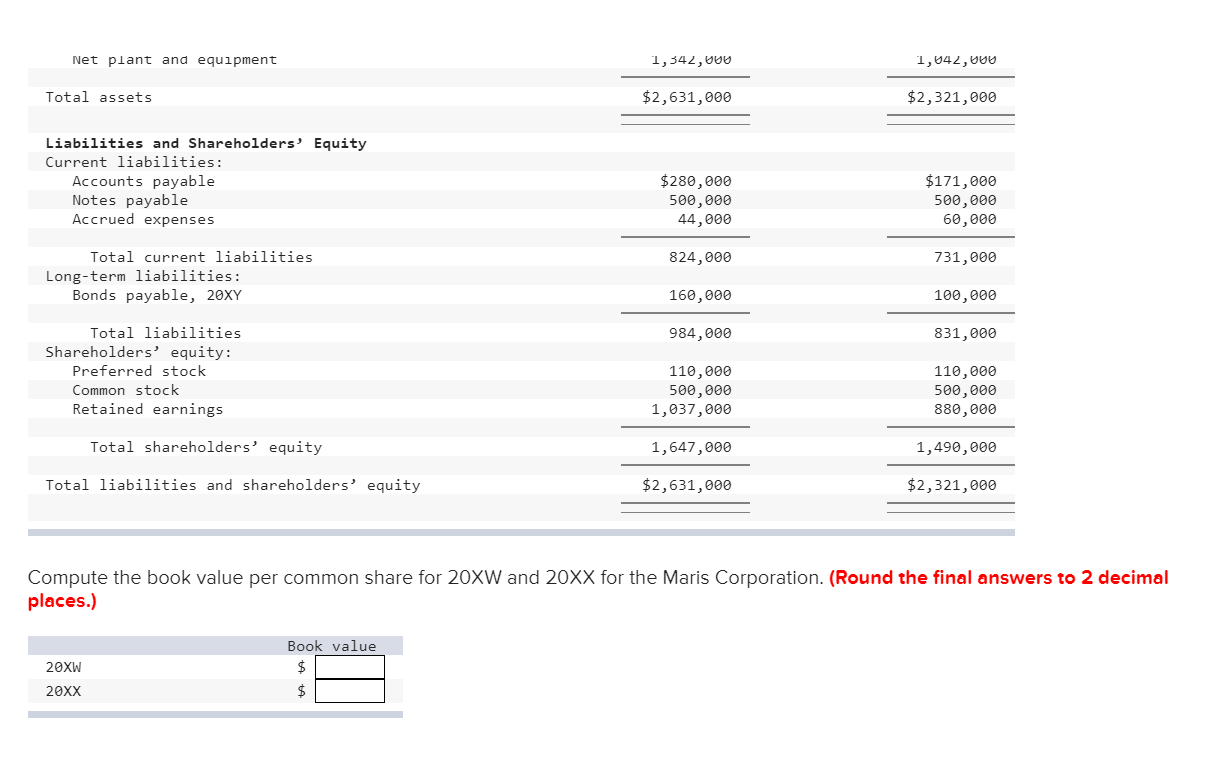

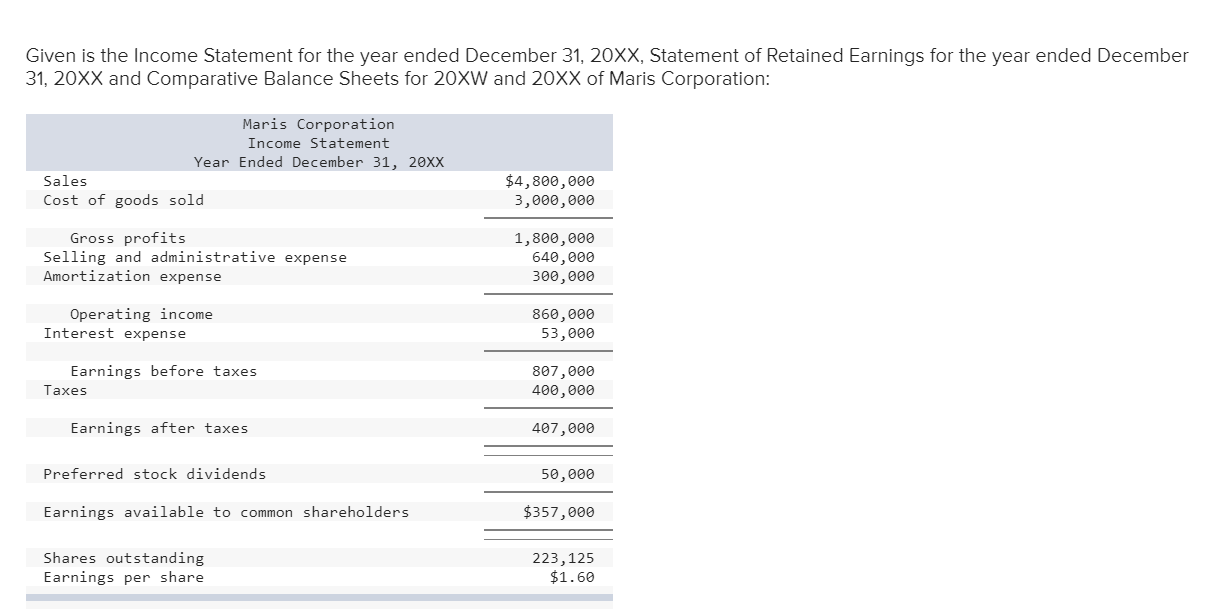

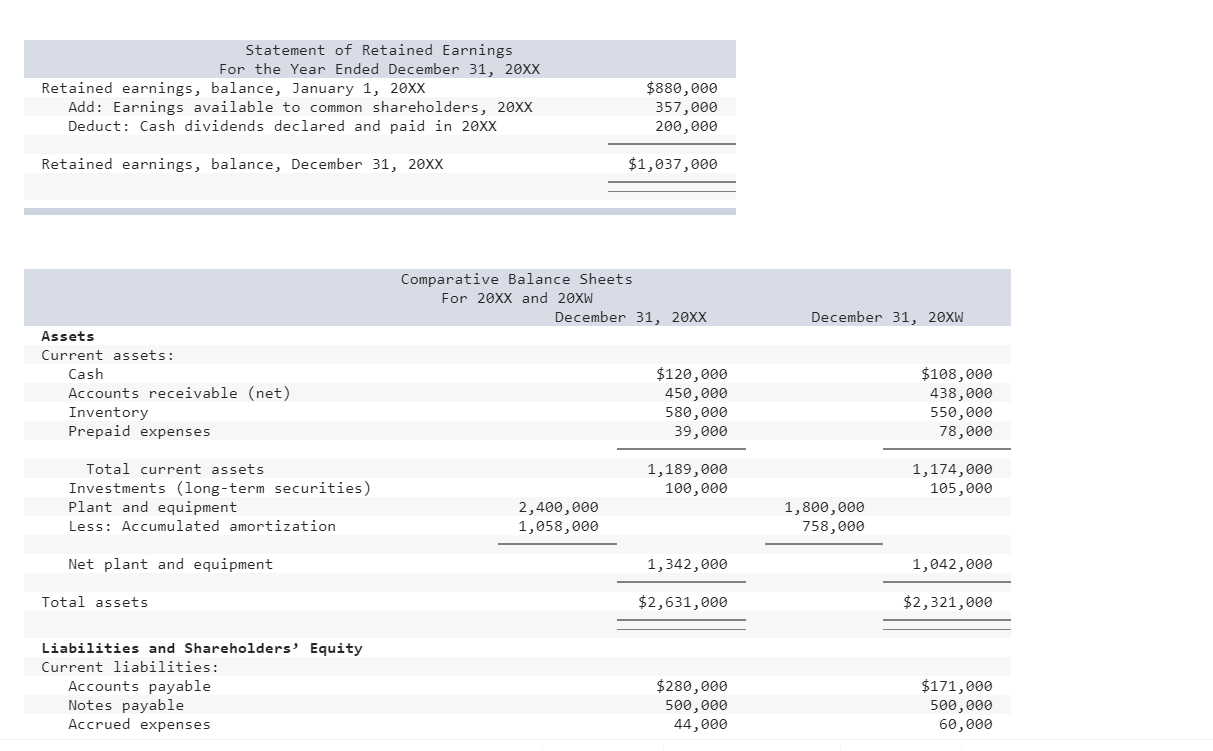

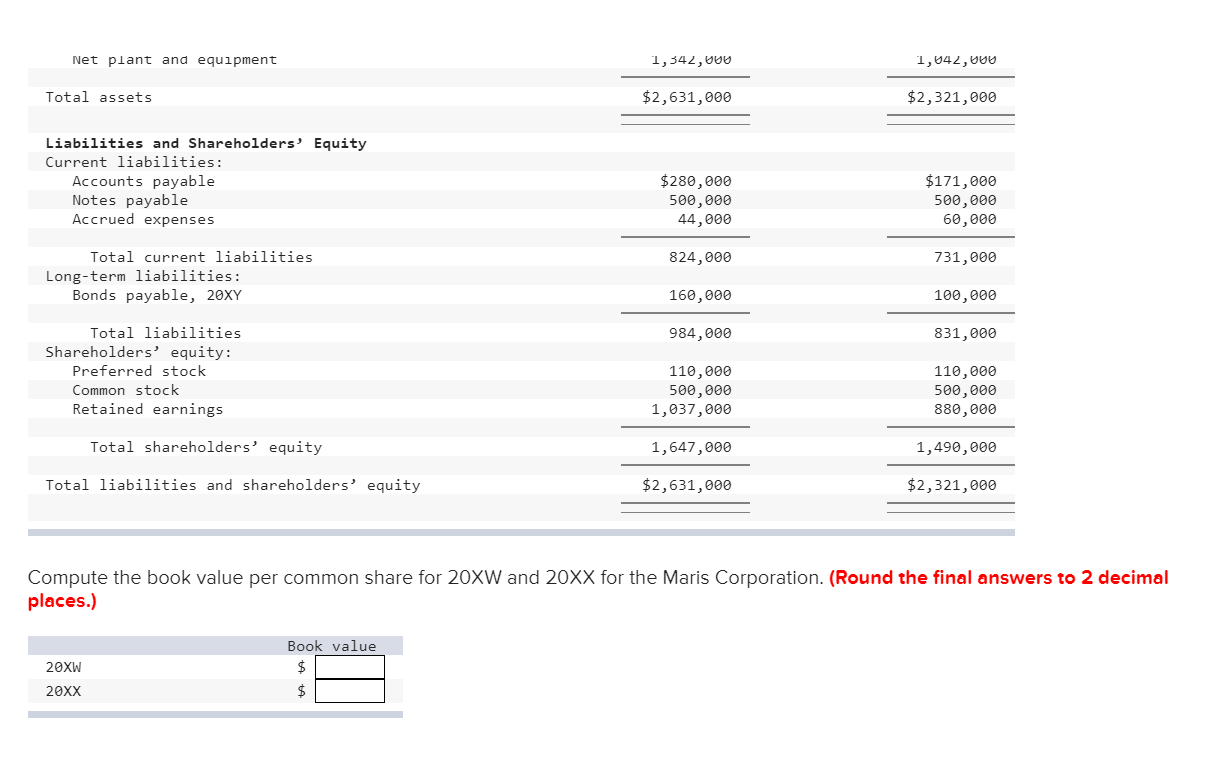

Given is the Income Statement for the year ended December 31, 20XX, Statement of Retained Earnings for the year ended December 31, 20XX and Comparative Balance Sheets for 20XW and 20XX of Maris Corporation: Maris Corporation Income Statement Year Ended December 31, 20XX Sales Cost of goods sold $4,800,000 3,000,000 Gross profits Selling and administrative expense Amortization expense 1,800,000 640,000 300,000 Operating income Interest expense 860,000 53,000 Earnings before taxes Taxes 807,000 400,000 Earnings after taxes 407,000 Preferred stock dividends 50,000 Earnings available to common shareholders $357,000 Shares outstanding Earnings per share 223,125 $1.60 Statement of Retained Earnings For the Year Ended December 31, 20XX Retained earnings, balance, January 1, 20XX Add: Earnings available to common shareholders, 20XX Deduct: Cash dividends declared and paid in 20XX $880,000 357,000 200,000 Retained earnings, balance, December 31, 20XX $1,037,000 Comparative Balance Sheets For 20XX and 20XW December 31, 20xx December 31, 20XW Assets Current assets: Cash Accounts receivable (net) Inventory Prepaid expenses $120,000 450,000 580,000 39,000 $108,000 438,000 550,000 78,000 1,189,000 100,000 1,174,000 105,000 Total current assets Investments (long-term securities) Plant and equipment Less: Accumulated amortization 2,400,000 1,058,000 1,800,000 758,000 Net plant and equipment 1,342,000 1,042,000 Total assets $2,631,000 $2,321,000 Liabilities and Shareholders' Equity Current liabilities: Accounts payable Notes payable Accrued expenses $280,000 500,000 44,000 $171,000 500,000 60,000 Net plant and equipment 1,342,000 1,042,000 Total assets $2,631,000 $2,321,000 Liabilities and Shareholders' Equity Current liabilities: Accounts payable Notes payable Accrued expenses $280,000 500,000 44,000 $171,000 500,000 60,000 824,000 731,000 Total current liabilities Long-term liabilities: Bonds payable, 20xY 160,000 100,000 984,000 831,000 Total liabilities Shareholders' equity: Preferred stock Common stock Retained earnings 110,000 500,000 1,037,000 110,000 500,000 880,000 Total shareholders' equity 1,647,000 1,490,000 Total liabilities and shareholders' equity $2,631,000 $2,321,000 Compute the book value per common share for 20XW and 20XX for the Maris Corporation. (Round the final answers to 2 decimal places.) Book value 20XW 20xx