Answered step by step

Verified Expert Solution

Question

1 Approved Answer

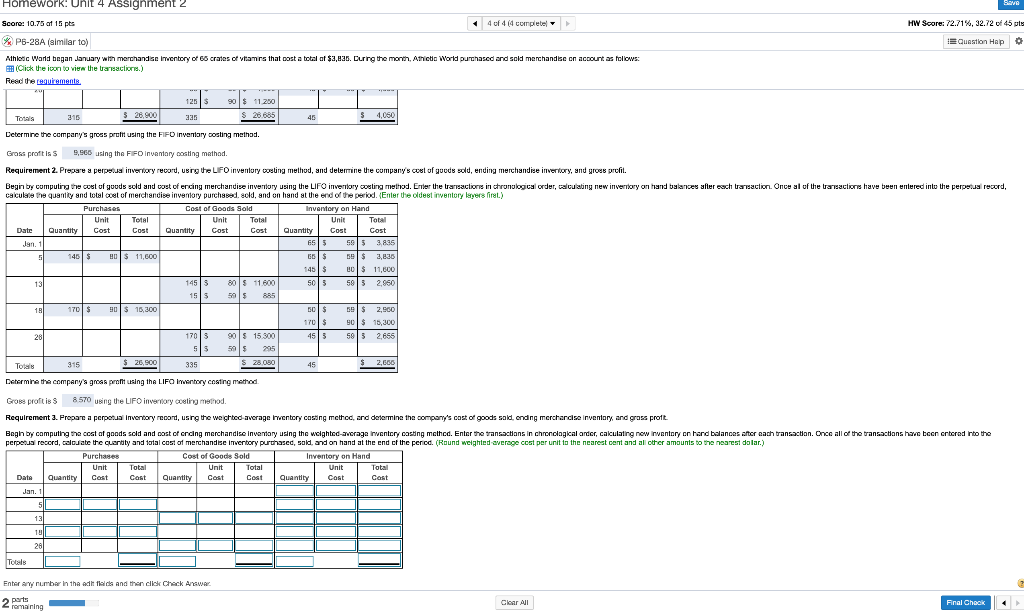

please solve it all Requirement 3. Prepare a perpetual inventory record, using the weighted average inventory costing method, and determine the company's cost of goods

please solve it all

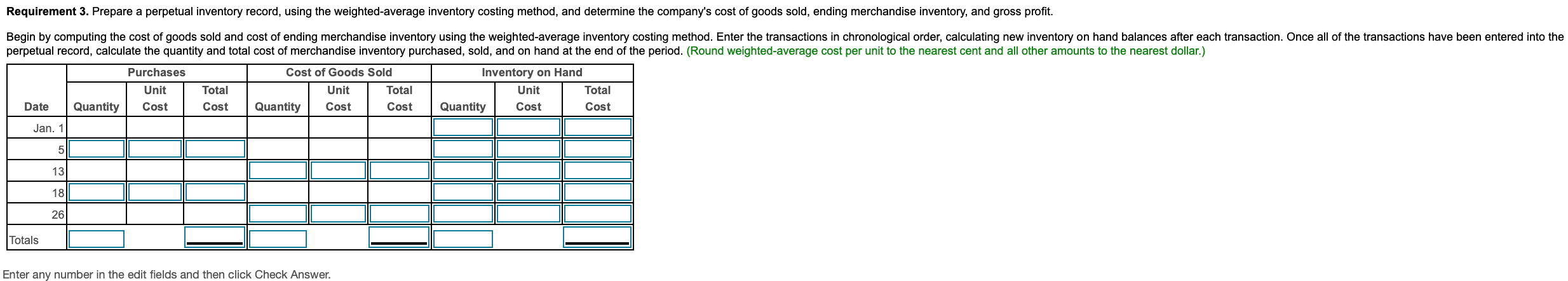

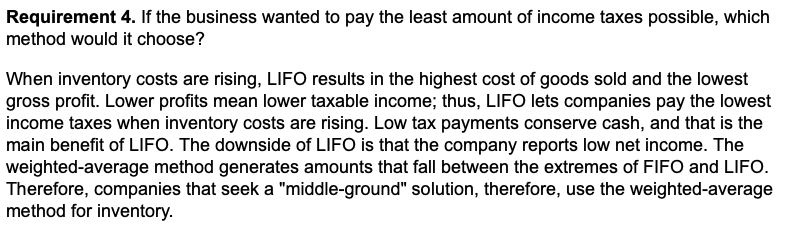

Requirement 3. Prepare a perpetual inventory record, using the weighted average inventory costing method, and determine the company's cost of goods sold, ending merchandise inventory, and gross profit. Begin by computing the cost of goods sold and cost of ending merchandise inventory using the weighted average inventory costing method. Enter the transactions in chronological order, calculating new inventory on hand balances after each transaction. Once all of the transactions have been entered into the perpetual record, calculate the quantity and total cost of merchandise inventory purchased, sold, and on hand at the end of the period. (Round weighted average cost per unit to the nearest cent and all other amounts to the nearest dollar.) Purchases Cost of Goods Sold Inventory on Hand Unit Total Unit Total Unit Total Date Quantity Cost Cost Quantity Cost Cost | Quantity Cost Cost Jan. 1 Totals Enter any number in the edit fields and then click Check Answer. An inventory costing method approximates the flow of inventory in the business and is used to determine the amount of cost of goods sold and ending merchandise inventory. This is done by using one of four inventory costing methods: 1. Specific Identification 2. First-in, First-out (FIFO) 3. Last-in, First-out (LIFO) 4. Weighted-Average In this problem, we will focus on the last three of the inventory costing methods: FIFO, LIFO, and weighted average. Requirement 4. If the business wanted to pay the least amount of income taxes possible, which method would it choose? When inventory costs are rising, LIFO results in the highest cost of goods sold and the lowest gross profit. Lower profits mean lower taxable income; thus, LIFO lets companies pay the lowest income taxes when inventory costs are rising. Low tax payments conserve cash, and that is the main benefit of LIFO. The downside of LIFO is that the company reports low net income. The weighted average method generates amounts that fall between the extremes of FIFO and LIFO. Therefore, companies that seek a "middle-ground" solution, therefore, use the weighted average method for inventory. Homework! Unit 4 Assignment 2 Save Score: 10.75 of 15 pts 4 of 4d complete HW Score: 72.71%, 32.72 of 45 pts Question HAPO P6-28A (similar to) Athletic Wand began January with marchandise inventory of 66 crates of vitamrs that cost a total of $3,830. During the month, Athic Click the icon to view the transactions.) Read the remonts World purchased and sold merchandise on account as follows: 120 S 90 / 1200 Totals 215 S 26,800 2 35 S 28.685 45 3 4.060 Determine the company's gross profit using the FIFO inventary costing method. Gross proftis S 9,966 using the FIFO inventary costing method. Requirement 2. Prepare a perpetual inventory record, using the LIFO inventory costing method, and determine the company's cost of goods sold, ending merchandise inventory, and gross profil Begin by computing the cost of goods sold and cost ofercing merchandise inventory using the LIFO inventory coeling method. Errer the transactions in chronological order, calculating new invertory on hand balances after each transaction. Once al of the transactions have been entered into the perpetual record, calculate the quantity and total cost of merchandise inventory purchased. sold, and on hand at the end of the period. Enter the oldest inventory layers firal.) Purchases Unit Cost of Goods Sold Unit Total Quantity Cost Cost Date Quantity Cost Cost Jan 11 Inventory on Hand Unit Total Quantity Cost Cost 655 595 3,835 65 $ $ 3,836 145 $ 10 $ 11,600 505 593 2.950 145 S HOS 11,600 145 S 80S 11.600 1513 39s 170S 0S 15,300 BO $ $ 2,900 170$ 5 S 35 90 $ 15.300 S 295 S 28.080 Totals 315 $ 26,900 3 45 $ 2,666 Determine the company's gross profit using the LIFO Inventory costing method Gross proftis 8570 using the LIFO inventory coeling method. Requirement 3. Prepare a perpetual Inventory record, using the weighted average inwertery cosing method, end determine the company's cost of goods sold, ondng merchandise inventory and gross profit ent and all cher almocontacte Bogh by computing the cost of goods sold and cost of orcing merchandise Inventory using the weighted average Inventory casting method. Enter the transactions in chronological ander, calculating now inventory on hand balances after each transaction. Once all of the transactions have been crtered into the perpetual record, calculate the quantity and total cost of merchandise inventory purchased, sold, and on hand at the end of the period. (Round weighted average cost per unit to the nearest cent and all other amounts to the nearest dolar.) Purchases Cost of Goods Sold Inventory on Hand Unit Total Unit Total Unit Data quantity Cost Cast Quantity Cost Cost quantity Cast Tools Enter any number in the edit fields and then click Check AnGWA 2 ports 2 Clear All aning Final Check Requirement 3. Prepare a perpetual inventory record, using the weighted average inventory costing method, and determine the company's cost of goods sold, ending merchandise inventory, and gross profit. Begin by computing the cost of goods sold and cost of ending merchandise inventory using the weighted average inventory costing method. Enter the transactions in chronological order, calculating new inventory on hand balances after each transaction. Once all of the transactions have been entered into the perpetual record, calculate the quantity and total cost of merchandise inventory purchased, sold, and on hand at the end of the period. (Round weighted average cost per unit to the nearest cent and all other amounts to the nearest dollar.) Purchases Cost of Goods Sold Inventory on Hand Unit Total Unit Total Unit Total Date Quantity Cost Cost Quantity Cost Cost | Quantity Cost Cost Jan. 1 Totals Enter any number in the edit fields and then click Check Answer. An inventory costing method approximates the flow of inventory in the business and is used to determine the amount of cost of goods sold and ending merchandise inventory. This is done by using one of four inventory costing methods: 1. Specific Identification 2. First-in, First-out (FIFO) 3. Last-in, First-out (LIFO) 4. Weighted-Average In this problem, we will focus on the last three of the inventory costing methods: FIFO, LIFO, and weighted average. Requirement 4. If the business wanted to pay the least amount of income taxes possible, which method would it choose? When inventory costs are rising, LIFO results in the highest cost of goods sold and the lowest gross profit. Lower profits mean lower taxable income; thus, LIFO lets companies pay the lowest income taxes when inventory costs are rising. Low tax payments conserve cash, and that is the main benefit of LIFO. The downside of LIFO is that the company reports low net income. The weighted average method generates amounts that fall between the extremes of FIFO and LIFO. Therefore, companies that seek a "middle-ground" solution, therefore, use the weighted average method for inventory. Homework! Unit 4 Assignment 2 Save Score: 10.75 of 15 pts 4 of 4d complete HW Score: 72.71%, 32.72 of 45 pts Question HAPO P6-28A (similar to) Athletic Wand began January with marchandise inventory of 66 crates of vitamrs that cost a total of $3,830. During the month, Athic Click the icon to view the transactions.) Read the remonts World purchased and sold merchandise on account as follows: 120 S 90 / 1200 Totals 215 S 26,800 2 35 S 28.685 45 3 4.060 Determine the company's gross profit using the FIFO inventary costing method. Gross proftis S 9,966 using the FIFO inventary costing method. Requirement 2. Prepare a perpetual inventory record, using the LIFO inventory costing method, and determine the company's cost of goods sold, ending merchandise inventory, and gross profil Begin by computing the cost of goods sold and cost ofercing merchandise inventory using the LIFO inventory coeling method. Errer the transactions in chronological order, calculating new invertory on hand balances after each transaction. Once al of the transactions have been entered into the perpetual record, calculate the quantity and total cost of merchandise inventory purchased. sold, and on hand at the end of the period. Enter the oldest inventory layers firal.) Purchases Unit Cost of Goods Sold Unit Total Quantity Cost Cost Date Quantity Cost Cost Jan 11 Inventory on Hand Unit Total Quantity Cost Cost 655 595 3,835 65 $ $ 3,836 145 $ 10 $ 11,600 505 593 2.950 145 S HOS 11,600 145 S 80S 11.600 1513 39s 170S 0S 15,300 BO $ $ 2,900 170$ 5 S 35 90 $ 15.300 S 295 S 28.080 Totals 315 $ 26,900 3 45 $ 2,666 Determine the company's gross profit using the LIFO Inventory costing method Gross proftis 8570 using the LIFO inventory coeling method. Requirement 3. Prepare a perpetual Inventory record, using the weighted average inwertery cosing method, end determine the company's cost of goods sold, ondng merchandise inventory and gross profit ent and all cher almocontacte Bogh by computing the cost of goods sold and cost of orcing merchandise Inventory using the weighted average Inventory casting method. Enter the transactions in chronological ander, calculating now inventory on hand balances after each transaction. Once all of the transactions have been crtered into the perpetual record, calculate the quantity and total cost of merchandise inventory purchased, sold, and on hand at the end of the period. (Round weighted average cost per unit to the nearest cent and all other amounts to the nearest dolar.) Purchases Cost of Goods Sold Inventory on Hand Unit Total Unit Total Unit Data quantity Cost Cast Quantity Cost Cost quantity Cast Tools Enter any number in the edit fields and then click Check AnGWA 2 ports 2 Clear All aning Final CheckStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started