Answered step by step

Verified Expert Solution

Question

1 Approved Answer

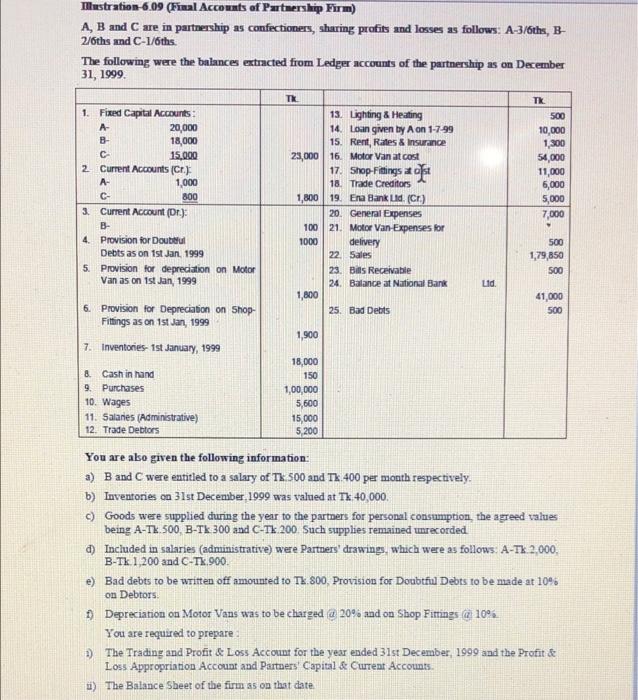

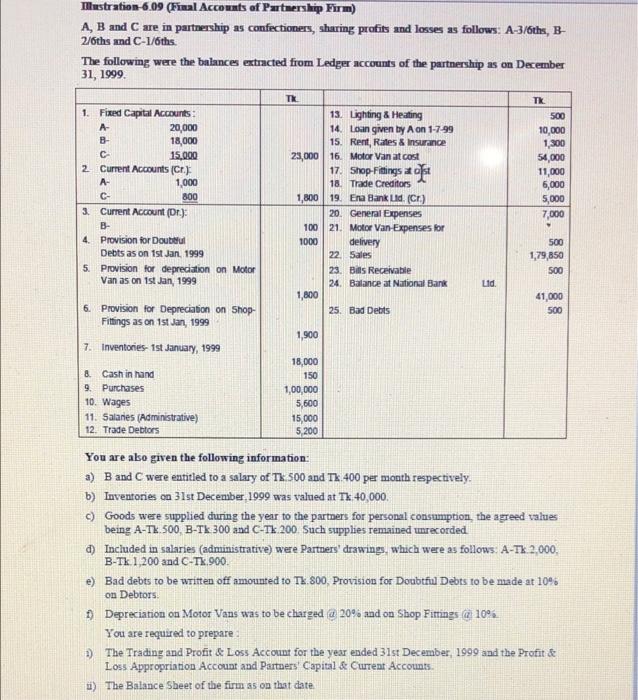

Please solve it asap Mustration-6-09 (Final Accounts of Putnership Firm) A, B and C are in partnership as confectioners, sharing profits and losses as follows:

Please solve it asap

Mustration-6-09 (Final Accounts of Putnership Firm) A, B and C are in partnership as confectioners, sharing profits and losses as follows: A-3/6ths, B- 2/6ths and C-1/6ths The following were the balances extracted from Ledger accounts of the partnership as on December 31, 1999 1. Fixed Capital Accounts: A- 20,000 B- 18,000 C 15.000 2 Current Accounts (Cr. A- 1,000 C- 800 3 Current Account (Dr.) B- 4. Provision for Doubtful Debts as on 1st Jan. 1999 5. Provision for depreciation on Motor Van as on 1st Jan, 1999 TK 13. Lighting & Heating 14. Loan given by A on 1-7-99 15. Rent, Rates & Insurance 23,000 16. Motor Van at cost 17. Shop Fitings of 18. Trade Creditors 1,300 19. Era Bank Lid. (C) 20. General Expenses 100 21. Motor Van-Expenses for 1000 delivery 22. Sales 23. Bills Receivable 24. Balance at National Bank 1,800 25. Bad Debts TK 500 10,000 1,300 54,000 11,000 6,000 5,000 7,000 500 1,79,850 500 Lid. 41,000 500 1,900 6. Provision for Depreciation on Shop Fittings as on 1st Jan, 1999 7. Inventories 1st January, 1999 & Cash in hand 9. Purchases 10. Wages 11. Salaries (Administrative) 12. Trade Debtors 18,000 150 1,00,000 5,600 15,000 5,200 You are ako given the following information: a) B and C were entitled to a salary of TX 500 and TX 400 per month respectively. b) Inventories on 31st December 1999 was valued at Tk 40,000. ) Goods were supplied during the year to the partners for personal consumption the agreed values being A-TW.500 B-Tk 300 and C-Tk 200 Such supplies remained unrecorded a) Included in salaries (administrative) were Partners' drawings, which were as follows. A-TK. 2,000. B-Tk 1,200 and C-Tk.900. e) Bad debts to be written off amounted to TX. 800. Provision for Doubtful Debts to be made at 10% on Debtors Depreciation on Motor Vans was to be charged @ 20's and on Shop Fittings @ 10 You are required to prepare :) The Trading and Profit & Loss Account for the year ended 31st December 1999 and the Profit & Loss Appropriation Account and Partners' Capital & Current Accounts. 1) The Balance Sheet of the firm as on that date

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started