Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve it asap The latest report of condition and income and expense statement for Smiling Merchants National Bank are as shown in the following

please solve it asap

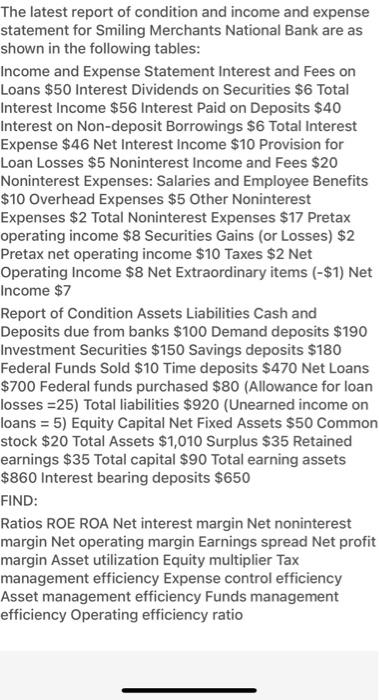

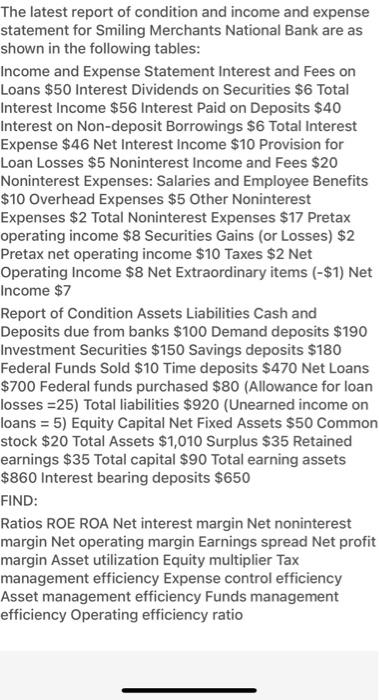

The latest report of condition and income and expense statement for Smiling Merchants National Bank are as shown in the following tables: Income and Expense Statement Interest and Fees on Loans $50 Interest Dividends on Securities $6 Total Interest Income $56 Interest Paid on Deposits $40 Interest on Non-deposit Borrowings $6 Total Interest Expense $46 Net Interest Income $10 Provision for Loan Losses $5 Noninterest Income and Fees $20 Noninterest Expenses: Salaries and Employee Benefits $10 Overhead Expenses $5 Other Noninterest Expenses $2 Total Noninterest Expenses $17 Pretax operating income $8 Securities Gains (or Losses) $2 Pretax net operating income $10 Taxes $2 Net Operating Income $8 Net Extraordinary items (-$1) Net Income $7 Report of Condition Assets Liabilities Cash and Deposits due from banks $100 Demand deposits $190 Investment Securities $150 Savings deposits $180 Federal Funds Sold $10 Time deposits $470 Net Loans $700 Federal funds purchased $80 (Allowance for loan losses =25) Total liabilities $920 (Unearned income on loans = 5) Equity Capital Net Fixed Assets $50 Common stock $20 Total Assets $1,010 Surplus $35 Retained earnings $35 Total capital $90 Total earning assets $860 Interest bearing deposits $650 FIND: Ratios ROE ROA Net interest margin Net noninterest margin Net operating margin Earnings spread Net profit margin Asset utilization Equity multiplier Tax management efficiency Expense control efficiency Asset management efficiency Funds management efficiency Operating efficiency ratio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started