Please solve it ASAP with all requirements

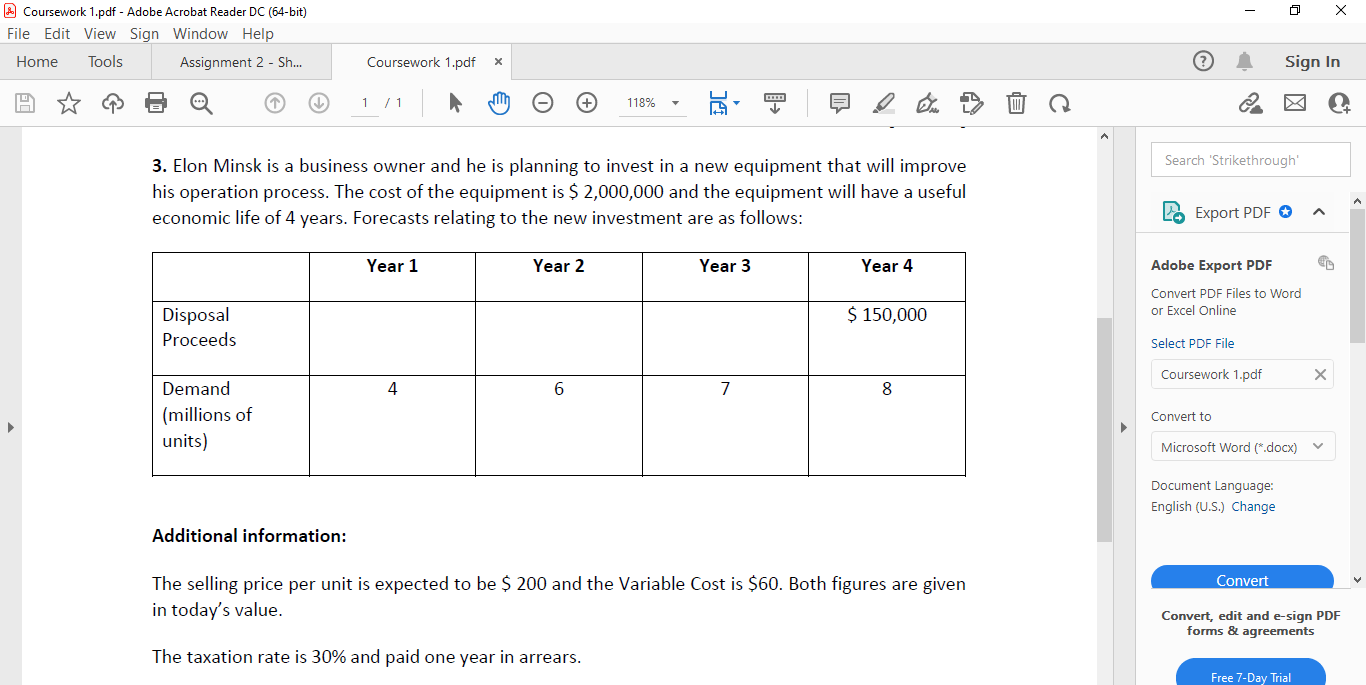

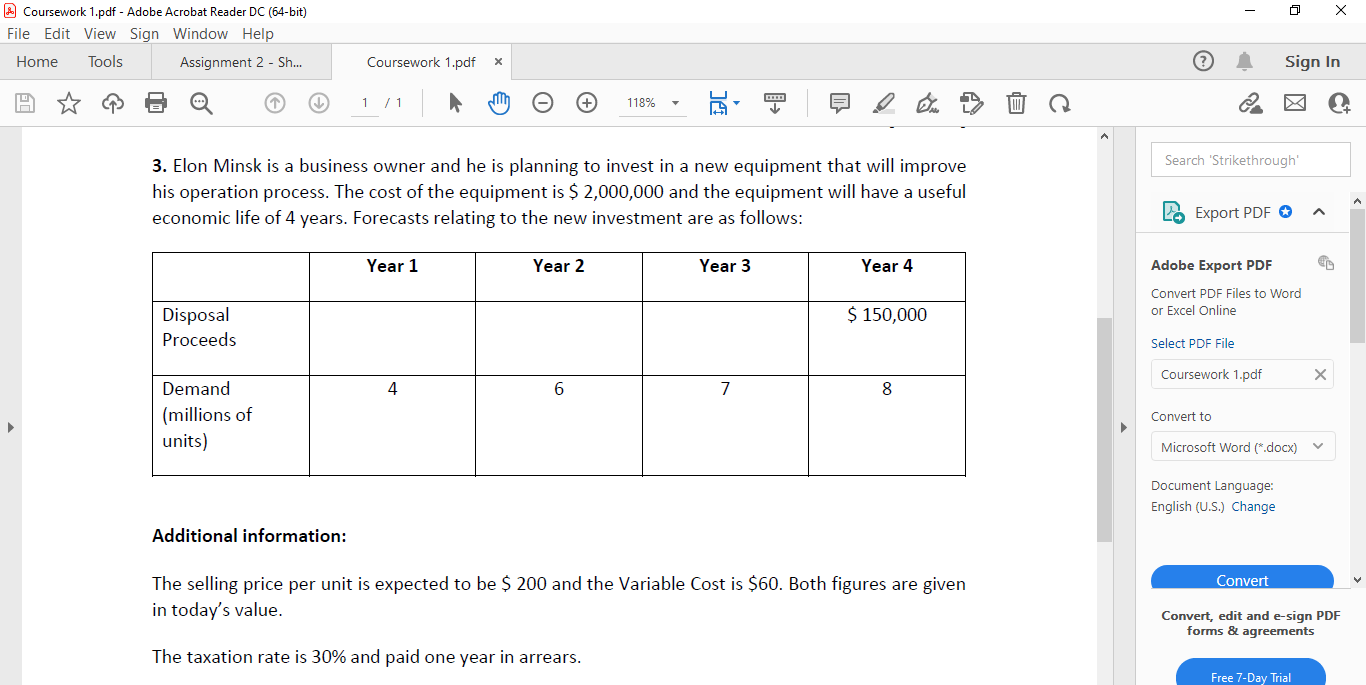

3. Elon Minsk is a business owner and he is planning to invest in a new equipment that will improve his operation process. The cost of the equipment is $2,000,000 and the equipment will have a useful economic life of 4 years. Forecasts relating to the new investment are as follows: Search 'Strikethrough' (- Export PDF Document Language: English (U.S.) Change Additional information: The selling price per unit is expected to be $200 and the Variable Cost is $60. Both figures are given in today's value. Convert, edit and e-sign PDF forms \& agreements The taxation rate is 30% and paid one year in arrears. Additional information: The selling price per unit is expected to be $200 and the Variable Cost is $60. Both figures are given in today's value. The taxation rate is 30% and paid one year in arrears. Working Capital will be required equal to 10% of Annual Sales. This will need to be in place at the start of each year. Tax-Allowable Depreciation is available at 25% reducing balance. The company has a rate of return of 10% (Discount Factor). Document Language: Selling price is expected to inflate at 4% and variable cost at 5% per annum. Determine the Net Present Value of the Project. Convert, edit and e-sign PDF forms & agreements 3. Elon Minsk is a business owner and he is planning to invest in a new equipment that will improve his operation process. The cost of the equipment is $2,000,000 and the equipment will have a useful economic life of 4 years. Forecasts relating to the new investment are as follows: Search 'Strikethrough' (- Export PDF Document Language: English (U.S.) Change Additional information: The selling price per unit is expected to be $200 and the Variable Cost is $60. Both figures are given in today's value. Convert, edit and e-sign PDF forms \& agreements The taxation rate is 30% and paid one year in arrears. Additional information: The selling price per unit is expected to be $200 and the Variable Cost is $60. Both figures are given in today's value. The taxation rate is 30% and paid one year in arrears. Working Capital will be required equal to 10% of Annual Sales. This will need to be in place at the start of each year. Tax-Allowable Depreciation is available at 25% reducing balance. The company has a rate of return of 10% (Discount Factor). Document Language: Selling price is expected to inflate at 4% and variable cost at 5% per annum. Determine the Net Present Value of the Project. Convert, edit and e-sign PDF forms & agreements