Please solve it ASAP with all requirements

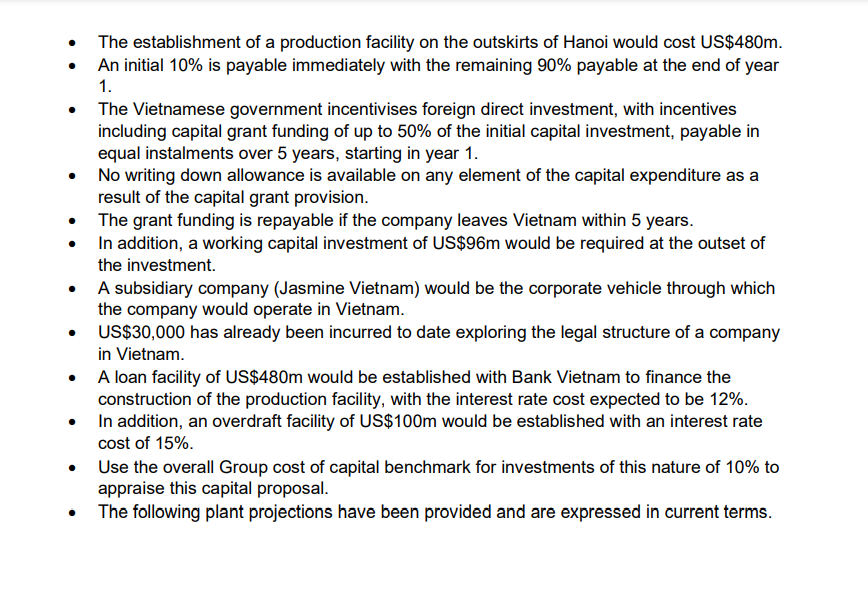

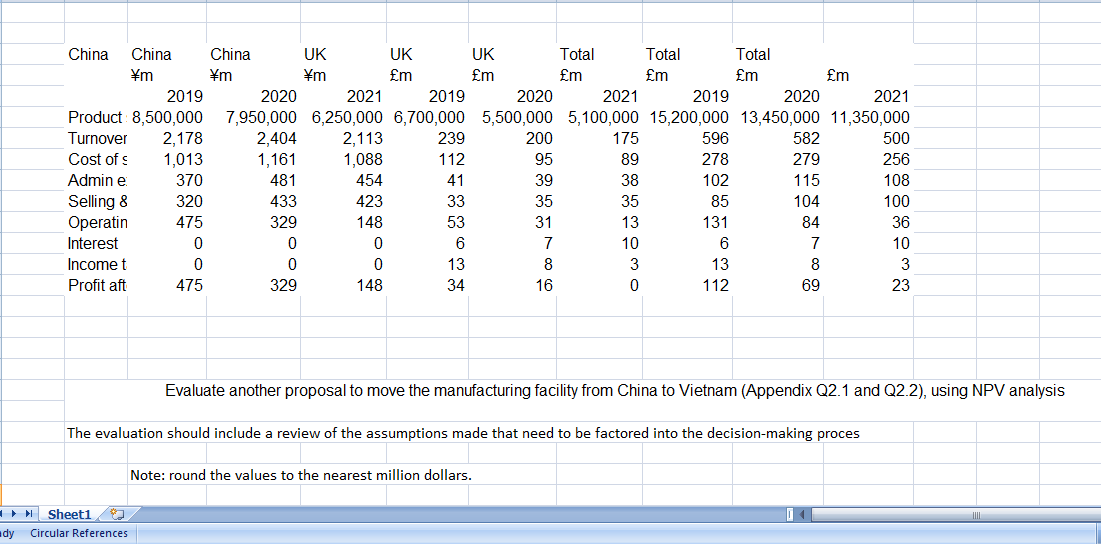

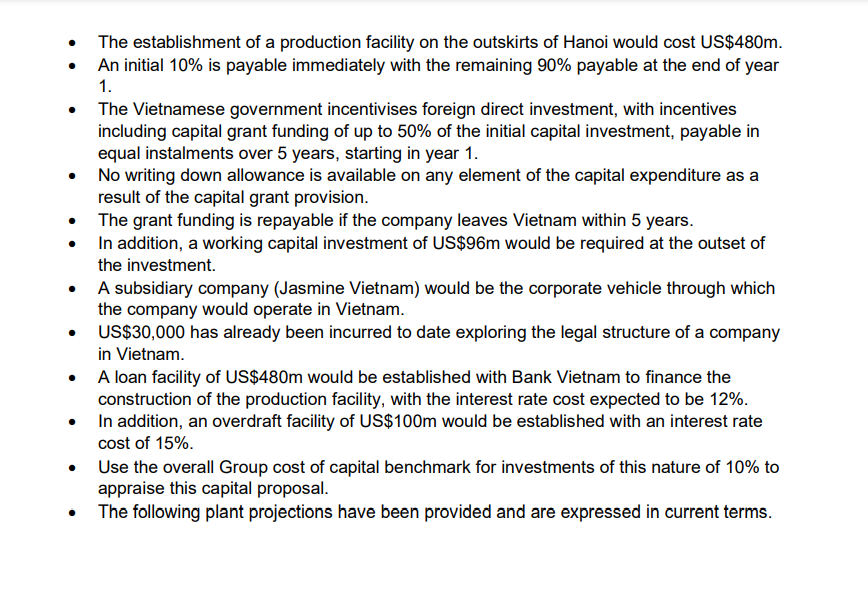

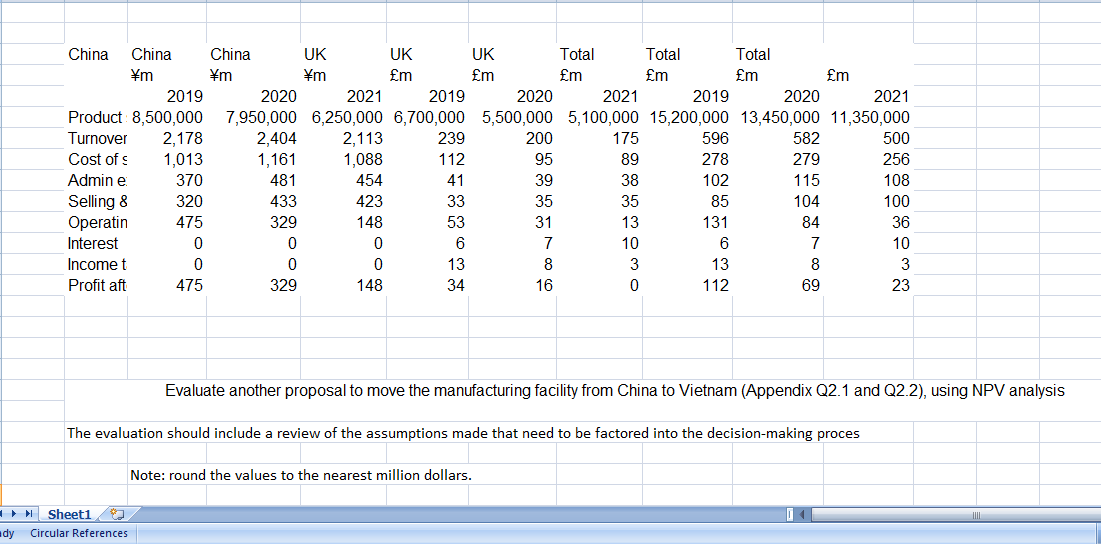

The establishment of a production facility on the outskirts of Hanoi would cost US$480m. An initial 10% is payable immediately with the remaining 90% payable at the end of year 1. The Vietnamese government incentivises foreign direct investment, with incentives including capital grant funding of up to 50% of the initial capital investment, payable in equal instalments over 5 years, starting in year 1. No writing down allowance is available on any element of the capital expenditure as a result of the capital grant provision. The grant funding is repayable if the company leaves Vietnam within 5 years. In addition, a working capital investment of US$96m would be required at the outset of the investment A subsidiary company (Jasmine Vietnam) would be the corporate vehicle through which the company would operate in Vietnam. US$30,000 has already been incurred to date exploring the legal structure of a company in Vietnam. A loan facility of US$480m would be established with Bank Vietnam to finance the construction of the production facility, with the interest rate cost expected to be 12%. In addition, an overdraft facility of US$100m would be established with an interest rate cost of 15%. Use the overall Group cost of capital benchmark for investments of this nature of 10% to appraise this capital proposal. The following plant projections have been provided and are expressed in current terms. 2021 China China China UK UK UK Total Total Total \m m \m m m fm m fm Em 2019 2020 2021 2019 2020 2021 2019 2020 Product 8,500,000 7,950,000 6,250,000 6,700,000 5,500,000 5,100,000 15,200,000 13,450,000 11,350,000 Turnover 2,178 2,404 2,113 239 200 175 596 582 500 Cost of 1,013 1.161 1,088 112 95 89 278 279 256 Admin e 370 481 454 41 39 38 102 115 108 Selling 8 320 433 423 33 35 35 85 104 100 Operatin 475 329 148 53 31 13 131 84 36 Interest 0 0 0 6 7 10 6 7 10 Incomet 0 0 0 13 8 3 13 8 3 Profit aft 475 329 148 34 16 0 112 69 23 Evaluate another proposal to move the manufacturing facility from China to Vietnam (Appendix Q2.1 and Q2.2), using NPV analysis The evaluation should include a review of the assumptions made that need to be factored into the decision-making proces Note: round the values to the nearest million dollars. 1 Sheet1 dy Circular References