Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve it fast i am third time posting but not getting answer according to requirement please please i will fail if i not complete

please solve it fast i am third time posting but not getting answer according to requirement please please i will fail if i not complete this please help me

there is some parts expert completed but it is not whole question answer A to D part are done you remaining part complete it i need more then 1000 words for this . this expert part that done

please remaining part you answer me

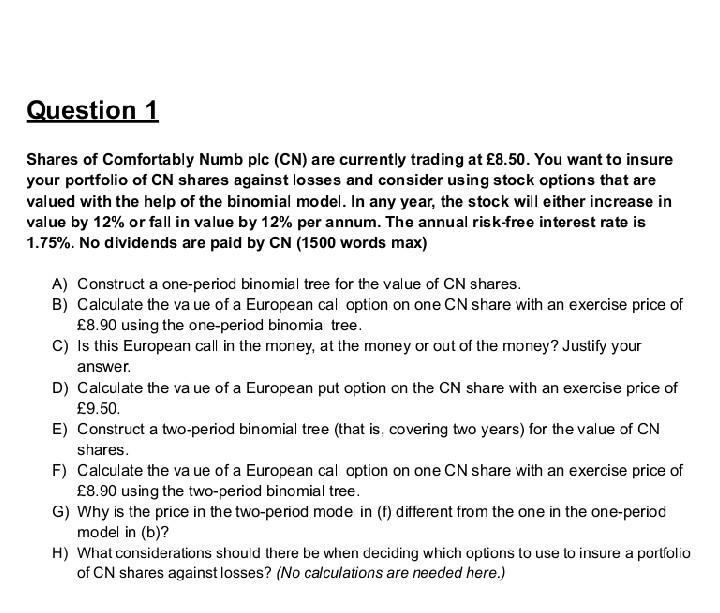

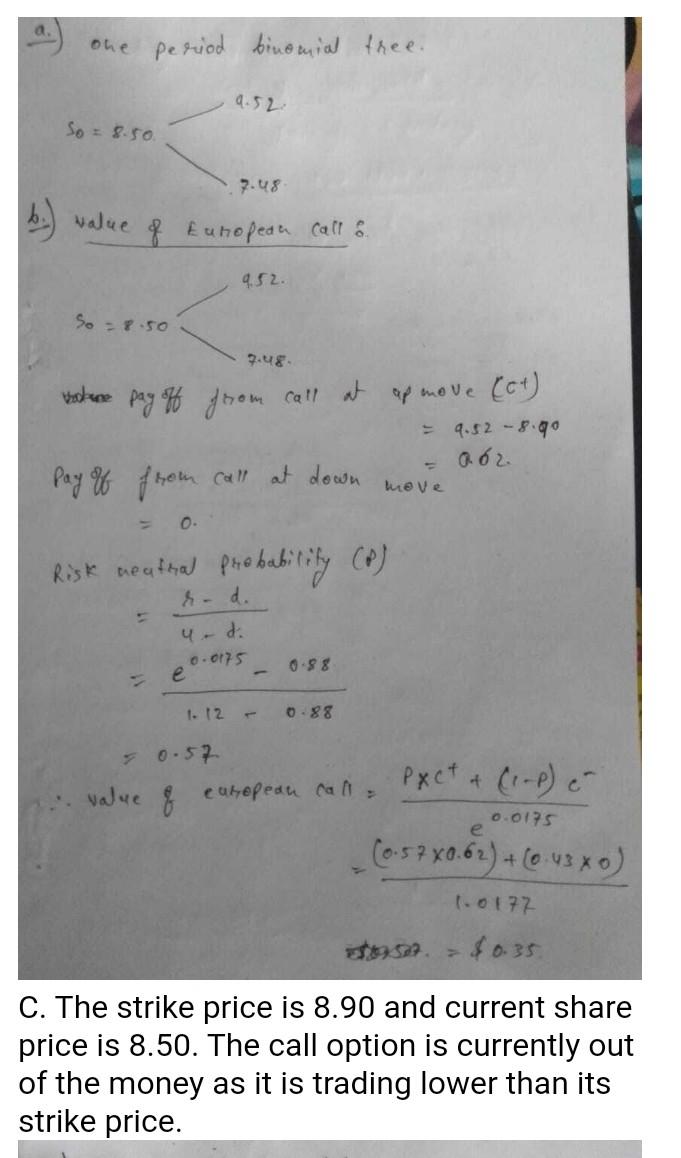

one period binemial free. 9.52 So 8.50 7.48 b.) value of European call & 4.52 so -8.50 9.48 . bokune pay off from Call at apmove (et) 4.52 -8.90 a oz. Pay off from call at down move 0. Risk neathal Probability (P) rd. 4. di 0.0175 e 0.88 1.12 0.88 0.57 Pact + (1-P) e value 8 eukepedu ca 0.0175 (0.57 80.62) + (0.430) 1.0177 09329. $ 0.35 C. The strike price is 8.90 and current share price is 8.50. The call option is currently out of the money as it is trading lower than its strike priceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started