Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve it fast i have one hour remaining please with all working ew Help 1. View The following summarized statements of profit or loss

please solve it fast i have one hour remaining please with all working

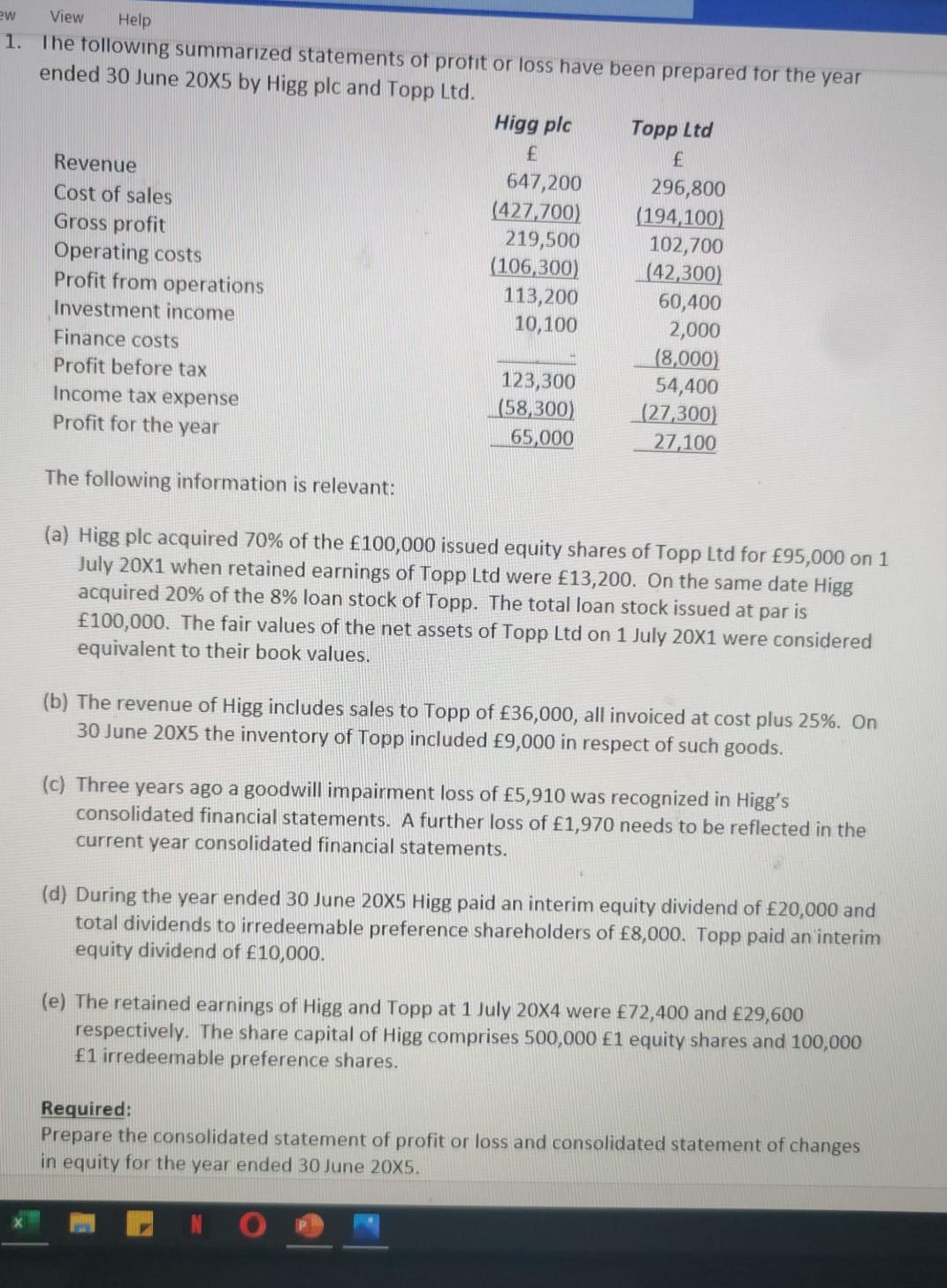

ew Help 1. View The following summarized statements of profit or loss have been prepared for the year ended 30 June 20x5 by Higg plc and Topp Ltd. Higg plc Topp Ltd f f Revenue 647,200 296,800 Cost of sales (427,700) (194,100) Gross profit 219,500 102,700 Operating costs (106,300) (42,300) Profit from operations 113,200 60,400 Investment income 10,100 2,000 Finance costs (8,000) Profit before tax 123,300 54,400 Income tax expense (58,300) (27,300) Profit for the year 65,000 27,100 The following information is relevant: (a) Higg plc acquired 70% of the 100,000 issued equity shares of Topp Ltd for 95,000 on 1 July 20X1 when retained earnings of Topp Ltd were 13,200. On the same date Higg acquired 20% of the 8% loan stock of Topp. The total loan stock issued at par is 100,000. The fair values of the net assets of Topp Ltd on 1 July 20X1 were considered equivalent to their book values. (b) The revenue of Higg includes sales to Topp of 36,000, all invoiced at cost plus 25%. On 30 June 20x5 the inventory of Topp included 9,000 in respect of such goods. (c) Three years ago a goodwill impairment loss of 5,910 was recognized in Higg's consolidated financial statements. A further loss of 1,970 needs to be reflected in the current year consolidated financial statements. (d) During the year ended 30 June 20X5 Higg paid an interim equity dividend of 20,000 and total dividends to irredeemable preference shareholders of 8,000. Topp paid an interim equity dividend of 10,000. (e) The retained earnings of Higg and Topp at 1 July 20X4 were 72,400 and 29,600 respectively. The share capital of Higg comprises 500,000 1 equity shares and 100,000 1 irredeemable preference shares. Required: Prepare the consolidated statement of profit or loss and consolidated statement of changes in equity for the year ended 30 June 2005

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started