Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve it in 20 mins I will thumb you up n Roster Question 25 D Myanmar's currency kyat per U.S. dollar 1,600 1,550 1,500

please solve it in 20 mins I will thumb you up

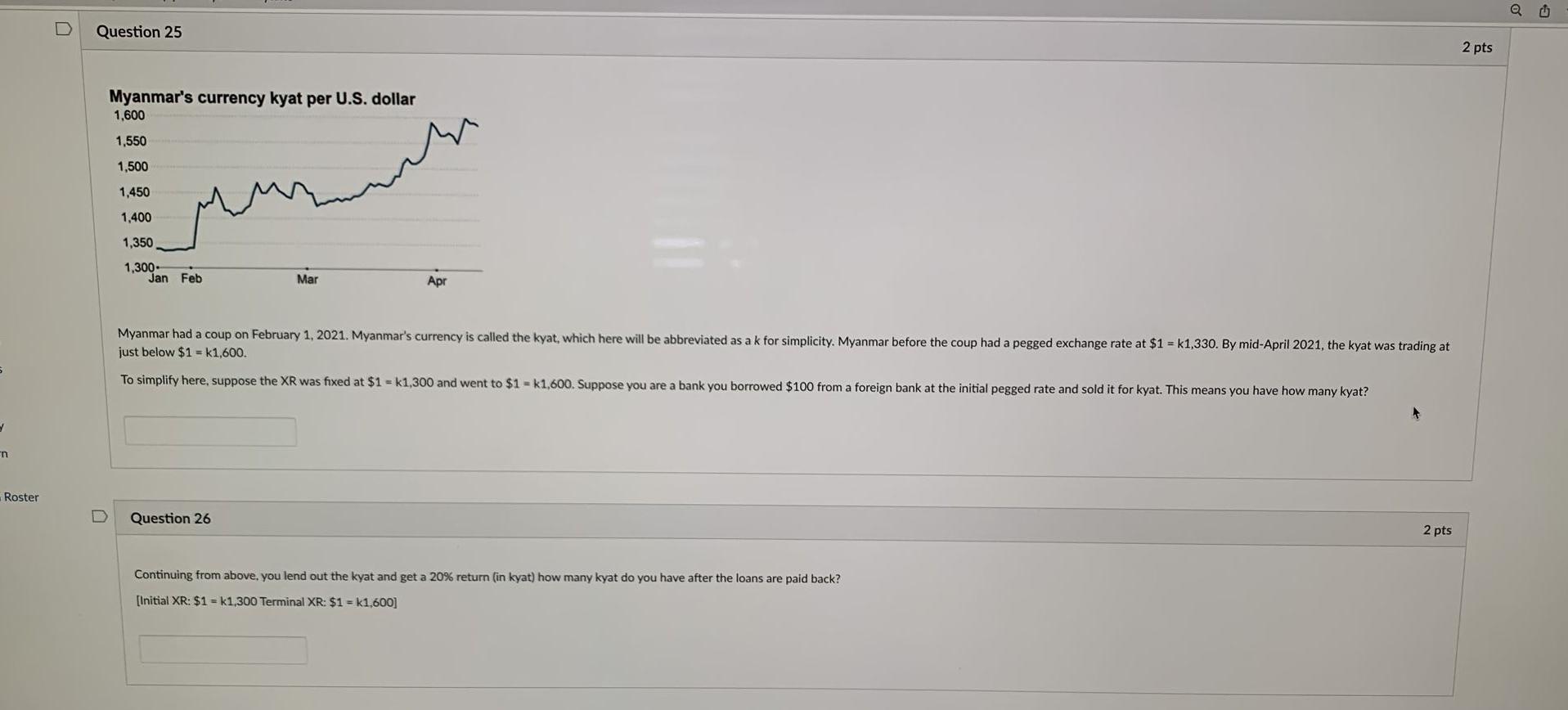

n Roster Question 25 D Myanmar's currency kyat per U.S. dollar 1,600 1,550 1,500 1,450 1,400 1,350 1,300- Jan Feb Mar Question 26 Apr Myanmar had a coup on February 1, 2021. Myanmar's currency is called the kyat, which here will be abbreviated as a k for simplicity. Myanmar before the coup had a pegged exchange rate at $1 = k1,330. By mid-April 2021, the kyat was trading at just below $1= k1,600. To simplify here, suppose the XR was fixed at $1 = k1,300 and went to $1 = k1,600. Suppose you are a bank you borrowed $100 from a foreign bank at the initial pegged rate and sold it for kyat. This means you have how many kyat? Continuing from above, you lend out the kyat and get a 20% return (in kyat) how many kyat do you have after the loans are paid back? [Initial XR: $1= k1,300 Terminal XR: $1= k1,600] 2 pts 2 pts n Roster Question 25 D Myanmar's currency kyat per U.S. dollar 1,600 1,550 1,500 1,450 1,400 1,350 1,300- Jan Feb Mar Question 26 Apr Myanmar had a coup on February 1, 2021. Myanmar's currency is called the kyat, which here will be abbreviated as a k for simplicity. Myanmar before the coup had a pegged exchange rate at $1 = k1,330. By mid-April 2021, the kyat was trading at just below $1= k1,600. To simplify here, suppose the XR was fixed at $1 = k1,300 and went to $1 = k1,600. Suppose you are a bank you borrowed $100 from a foreign bank at the initial pegged rate and sold it for kyat. This means you have how many kyat? Continuing from above, you lend out the kyat and get a 20% return (in kyat) how many kyat do you have after the loans are paid back? [Initial XR: $1= k1,300 Terminal XR: $1= k1,600] 2 pts 2 ptsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started