Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve it in Matlab if u cant solve it in matlab please solve it handwritten Problem 3 Suppose you work at a company who

please solve it in Matlab

if u cant solve it in matlab please solve it handwritten

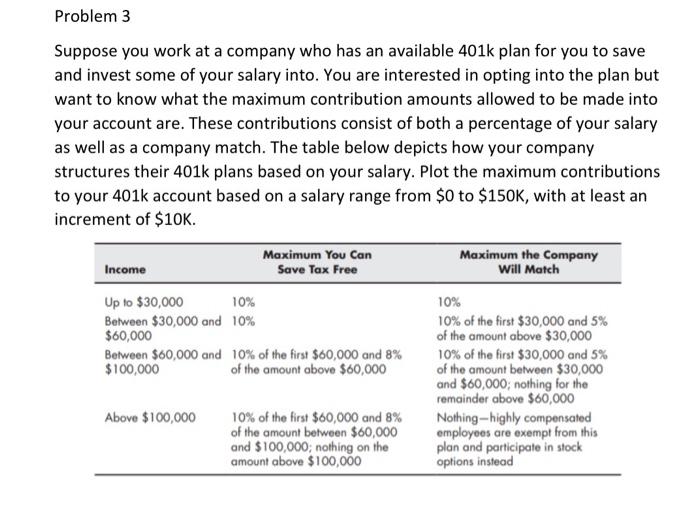

Problem 3 Suppose you work at a company who has an available 401k plan for you to save and invest some of your salary into. You are interested in opting into the plan but want to know what the maximum contribution amounts allowed to be made into your account are. These contributions consist of both a percentage of your salary as well as a company match. The table below depicts how your company structures their 401k plans based on your salary. Plot the maximum contributions to your 401k account based on a salary range from $0 to $150K, with at least an increment of $10K. Maximum You Can Maximum the Company Income Save Tax Free Will Match Up to $30,000 10% 10% Between $30,000 and 10% 10% of the first $30,000 and 5% $60,000 of the amount above $30,000 Between $60,000 and 10% of the first $60,000 and 8% 10% of the first $30,000 and 5% $100,000 of the amount above $60,000 of the amount between $30,000 and $60,000, nothing for the remainder above $60,000 Above $100,000 10% of the first $60,000 and 8% Nothing-highly compensated of the amount between $60,000 employees are exempt from this and $100,000, nothing on the plan and participate in stock amount above $100,000 options instead Problem 3 Suppose you work at a company who has an available 401k plan for you to save and invest some of your salary into. You are interested in opting into the plan but want to know what the maximum contribution amounts allowed to be made into your account are. These contributions consist of both a percentage of your salary as well as a company match. The table below depicts how your company structures their 401k plans based on your salary. Plot the maximum contributions to your 401k account based on a salary range from $0 to $150K, with at least an increment of $10K. Maximum You Can Maximum the Company Income Save Tax Free Will Match Up to $30,000 10% 10% Between $30,000 and 10% 10% of the first $30,000 and 5% $60,000 of the amount above $30,000 Between $60,000 and 10% of the first $60,000 and 8% 10% of the first $30,000 and 5% $100,000 of the amount above $60,000 of the amount between $30,000 and $60,000, nothing for the remainder above $60,000 Above $100,000 10% of the first $60,000 and 8% Nothing-highly compensated of the amount between $60,000 employees are exempt from this and $100,000, nothing on the plan and participate in stock amount above $100,000 options instead Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started