Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please solve it urgently for me Final Assessment QUESTION 1) (30 pts) Using the below financial statements and additional information given for Company XYZ, a)

Please solve it urgently for me

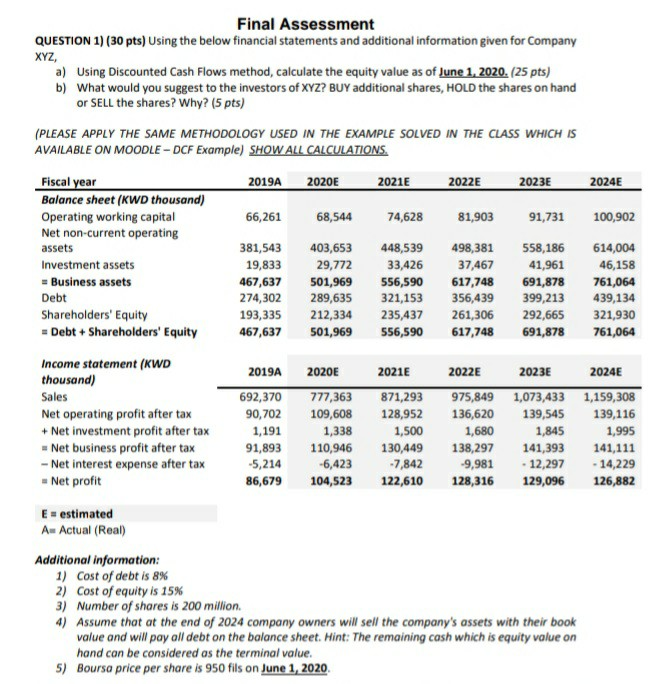

Final Assessment QUESTION 1) (30 pts) Using the below financial statements and additional information given for Company XYZ, a) Using Discounted Cash Flows method, calculate the equity value as of June 1, 2020. (25 pts) b) What would you suggest to the investors of XYZ? BUY additional shares, HOLD the shares on hand or SELL the shares? Why? (5 pts) (PLEASE APPLY THE SAME METHODOLOGY USED IN THE EXAMPLE SOLVED IN THE CLASS WHICH IS AVAILABLE ON MOODLE - DCF Example) SHOW ALL CALCULATIONS 2019A 2020E 2021E 2022E 2023E 2024E 66,261 68,544 74,628 81,903 91,731 100,902 Fiscal year Balance sheet (KWD thousand) Operating working capital Net non-current operating assets Investment assets = Business assets Debt Shareholders' Equity Debt + Shareholders' Equity 381,543 19,833 467,637 274,302 193,335 467,637 403,653 29,772 501,969 289,635 212,334 501,969 448,539 33,426 556,590 321,153 235,437 556,590 498,381 37,467 617,748 356,439 261,306 617,748 558,186 41,961 691,878 399,213 292,665 691,878 614,004 46,158 761,064 439,134 321,930 761,064 Income statement (KWD thousand) Sales Net operating profit after tax + Net investment profit after tax = Net business profit after tax - Net interest expense after tax - Net profit 2019A 692,370 90,702 1,191 91,893 -5,214 86,679 2020E 777,363 109,608 1,338 110,946 -6,423 104,523 2021E 871,293 128,952 1,500 130,449 -7,842 122,610 2022E 2023E 2024E 975,849 1,073,433 1,159,308 136,620 139,545 139,116 1,680 1,845 1,995 138,297 141,393 141,111 -9,981 - 12,297 - 14,229 128,316 129,096 126,882 Eestimated A Actual (Real) Additional information: 1) Cost of debt is 8% 2) Cost of equity is 15% 3) Number of shares is 200 million. 4) Assume that at the end of 2024 company owners will sell the company's assets with their book value and will pay all debt on the balance sheet. Hint: The remaining cash which is equity value on hand can be considered as the terminal value. 5) Boursa price per share is 950 fils on June 1, 2020Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started