Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve it You are bearish on Bark River Machine and Tool Company. You give your broker $7,500 to establish your margin account. You sell

please solve it

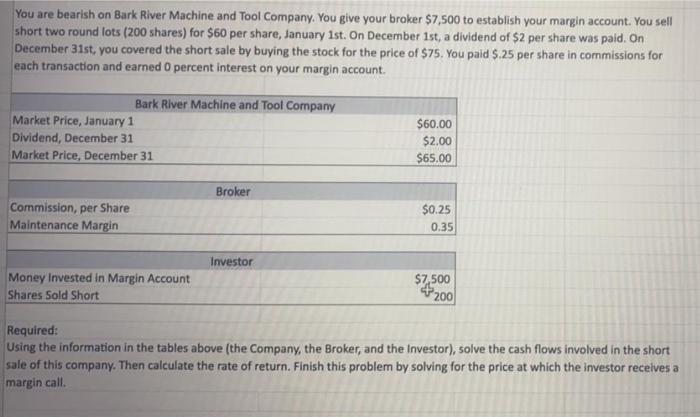

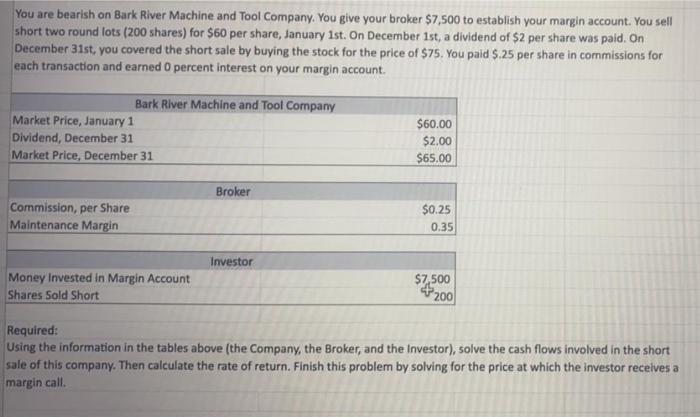

You are bearish on Bark River Machine and Tool Company. You give your broker $7,500 to establish your margin account. You sell short two round lots (200 shares) for $60 per share, January 1st. On December 1st, a dividend of $2 per share was paid. On December 31st, you covered the short sale by buying the stock for the price of $75. You paid $.25 per share in commissions for each transaction and earned 0 percent interest on your margin account. Bark River Machine and Tool Company Market Price, January 1 Dividend, December 31 $60.00 $2.00 $65.00 Market Price, December 31 Broker Commission, per Share $0.25 Maintenance Margin 0.35 Investor Money Invested in Margin Account $7,500 200 Shares Sold Short Required: Using the information in the tables above (the Company, the Broker, and the Investor), solve the cash flows involved in the short sale of this company. Then calculate the rate of return. Finish this problem by solving for the price at which the investor receives a margin call

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started