Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please solve. Keep in mind last tutor who helped got part A wrong. Please help me get the rest correct. Using the CAPM,

Please solve. Keep in mind last tutor who helped got part A wrong. Please help me get the rest correct. Using the CAPM, what is company Bs WACC? Please finish rest of question so I may understand. Thank you.

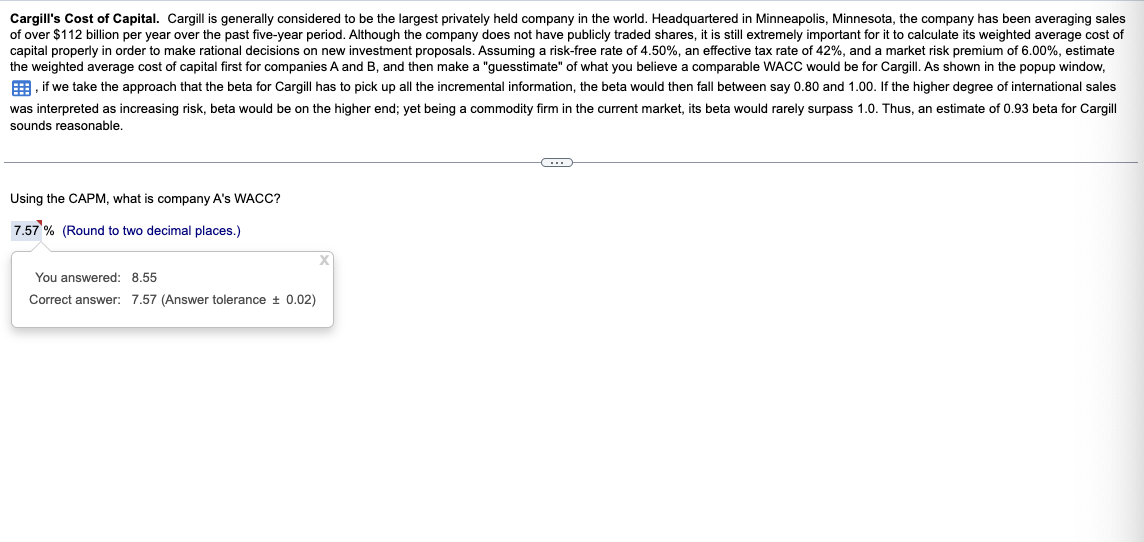

Cargill's Cost of Capital. Cargill is generally considered to be the largest privately held company in the world. Headquartered in Minneapolis, Minnesota, the company has been averaging sales

of over $ billion per year over the past fiveyear period. Although the company does not have publicly traded shares, it is still extremely important for it to calculate its weighted average cost of

capital properly in order to make rational decisions on new investment proposals. Assuming a riskfree rate of an effective tax rate of and a market risk premium of estimate

the weighted average cost of capital first for companies A and B and then make a "guesstimate" of what you believe a comparable WACC would be for Cargill. As shown in the popup window,

if we take the approach that the beta for Cargill has to pick up all the incremental information, the beta would then fall between say and If the higher degree of international sales

was interpreted as increasing risk, beta would be on the higher end; yet being a commodity firm in the current market, its beta would rarely surpass Thus, an estimate of beta for Cargill

sounds reasonable.

Using the CAPM, what is company As WACC?

Round to two decimal places.

You answered:

Correct answer: Answer tolerance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started