Question

Please solve, need help! 1. CAPM: Assume the risk-free rate is 5% and the S&P 500 index return is 10%. AA stocks systematic risk is

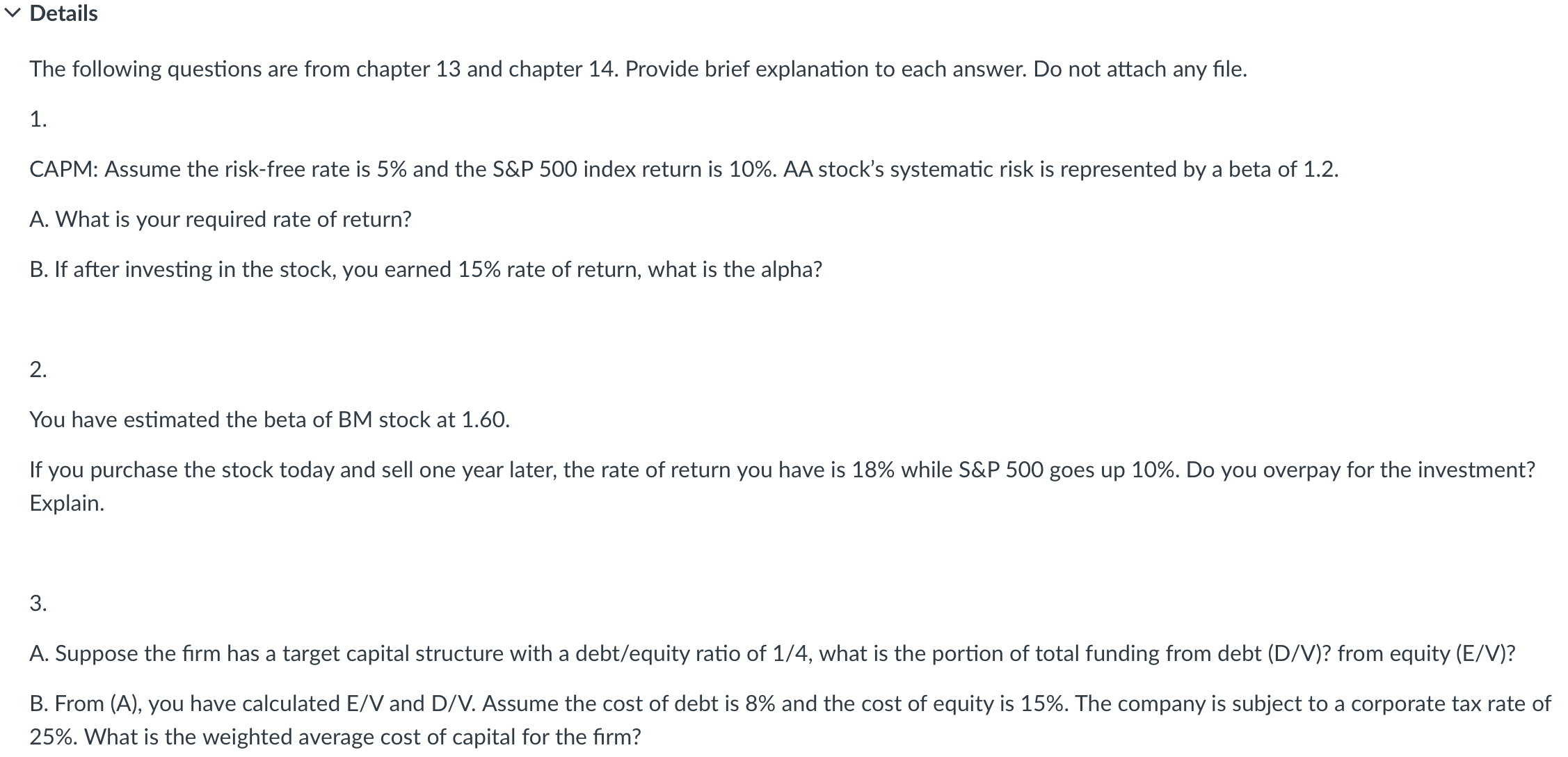

Please solve, need help! 1. CAPM: Assume the risk-free rate is 5% and the S&P 500 index return is 10%. AA stocks systematic risk is represented by a beta of 1.2. A. What is your required rate of return? B. If after investing in the stock, you earned 15% rate of return, what is the alpha? 2. You have estimated the beta of BM stock at 1.60. If you purchase the stock today and sell one year later, the rate of return you have is 18% while S&P 500 goes up 10%. Do you overpay for the investment? Explain. 3. A. Suppose the firm has a target capital structure with a debt/equity ratio of 1/4, what is the portion of total funding from debt (D/V)? from equity (E/V)? B. From (A), you have calculated E/V and D/V. Assume the cost of debt is 8% and the cost of equity is 15%. The company is subject to a corporate tax rate of 25%. What is the weighted average cost of capital for the firm?

Please solve, need help! 1. CAPM: Assume the risk-free rate is 5% and the S&P 500 index return is 10%. AA stocks systematic risk is represented by a beta of 1.2. A. What is your required rate of return? B. If after investing in the stock, you earned 15% rate of return, what is the alpha? 2. You have estimated the beta of BM stock at 1.60. If you purchase the stock today and sell one year later, the rate of return you have is 18% while S&P 500 goes up 10%. Do you overpay for the investment? Explain. 3. A. Suppose the firm has a target capital structure with a debt/equity ratio of 1/4, what is the portion of total funding from debt (D/V)? from equity (E/V)? B. From (A), you have calculated E/V and D/V. Assume the cost of debt is 8% and the cost of equity is 15%. The company is subject to a corporate tax rate of 25%. What is the weighted average cost of capital for the firm?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started