Answered step by step

Verified Expert Solution

Question

1 Approved Answer

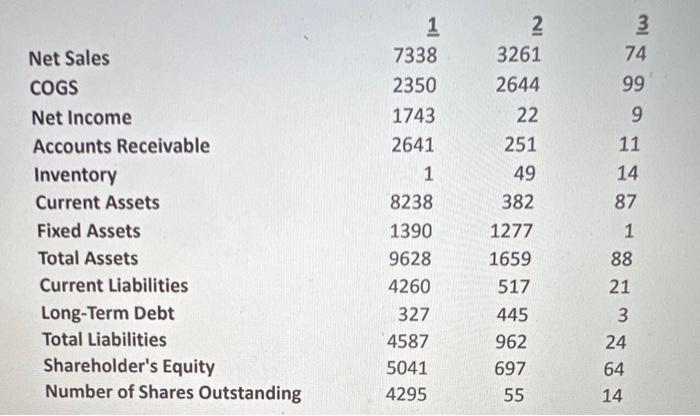

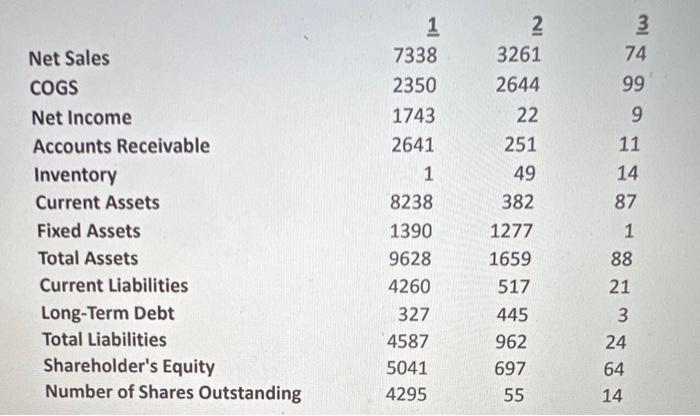

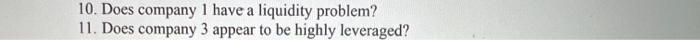

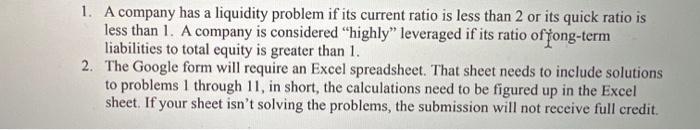

please solve on excel!! NetSalesCOGSNetIncomeAccountsReceivableInventoryCurrentAssetsFixedAssetsTotalAssetsCurrentLiabilitiesLong-TermDebtTotalLiabilitiesShareholdersEquityNumberofSharesOutstanding173382350174326411823813909628426032745875041429523261264422251493821277165951744596269755374999111487188213246414 10. Does company 1 have a liquidity problem? 11. Does company 3 appear to be highly leveraged? 1. A company

please solve on excel!!

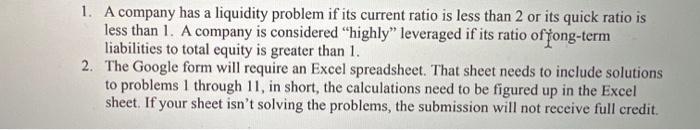

NetSalesCOGSNetIncomeAccountsReceivableInventoryCurrentAssetsFixedAssetsTotalAssetsCurrentLiabilitiesLong-TermDebtTotalLiabilitiesShareholdersEquityNumberofSharesOutstanding173382350174326411823813909628426032745875041429523261264422251493821277165951744596269755374999111487188213246414 10. Does company 1 have a liquidity problem? 11. Does company 3 appear to be highly leveraged? 1. A company has a liquidity problem if its current ratio is less than 2 or its quick ratio is less than 1. A company is considered "highly" leveraged if its ratio of ong-term liabilities to total equity is greater than 1 . 2. The Google form will require an Excel spreadsheet. That sheet needs to include solutions to problems 1 through 11 , in short, the calculations need to be figured up in the Excel sheet. If your sheet isn't solving the problems, the submission will not receive full credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started