Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please solve part A of the question, thank you. I will give you a food rate. *good Short Question (SQ.2) (15%) According to your statistical

Please solve part A of the question, thank you. I will give you a food rate.

*good

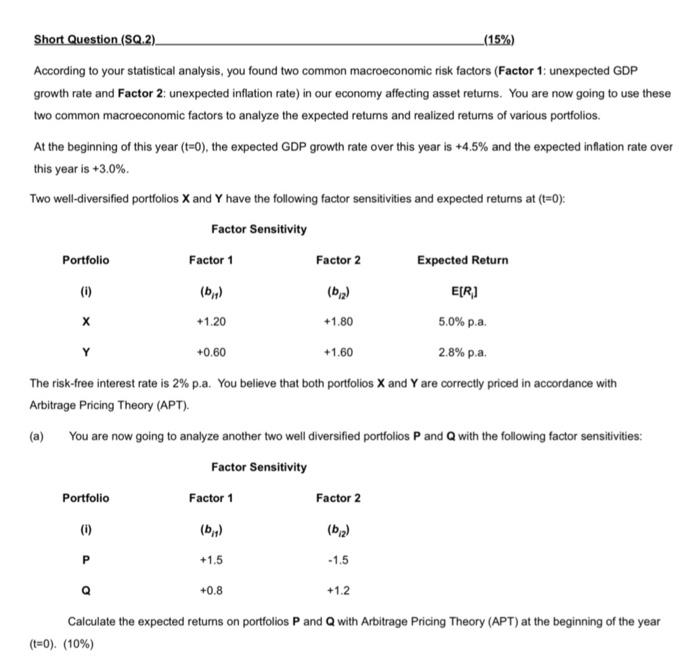

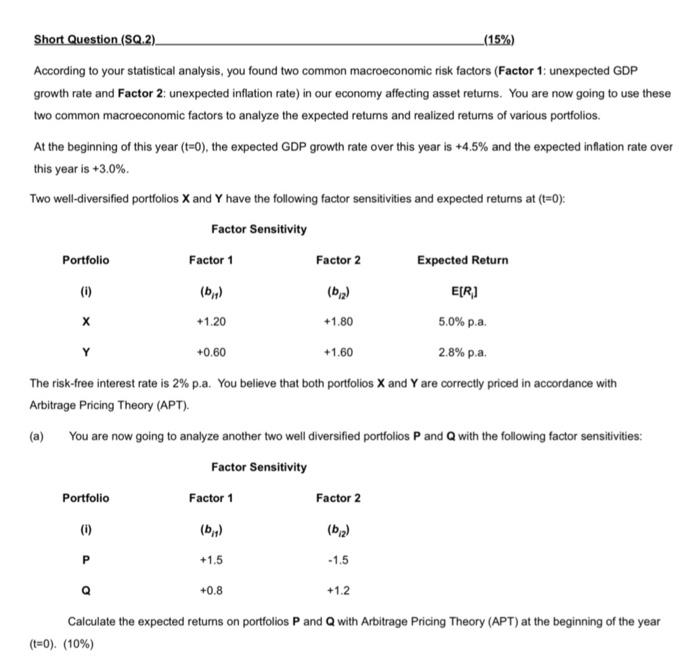

Short Question (SQ.2) (15%) According to your statistical analysis, you found two common macroeconomic risk factors (Factor 1: unexpected GDP growth rate and Factor 2: unexpected inflation rate) in our economy affecting asset returns. You are now going to use these two common macroeconomic factors to analyze the expected retums and realized returns of various portfolios. At the beginning of this year (t=0), the expected GDP growth rate over this year is +4.5% and the expected inflation rate over this year is +3.0%. Two well-diversified portfolios X and Y have the following factor sensitivities and expected returns at (t=0); Factor Sensitivity Factor 1 Factor 2 Expected Return Portfolio (1) (61) (bz) EIRI +1.20 +1.80 5.0% p.a +0.60 +1.60 2.8% p.a. The risk-free interest rate is 2% p.a. You believe that both portfolios X and Y are correctly priced in accordance with Arbitrage Pricing Theory (APT). (a) You are now going to analyze another two well diversified portfolios P and Q with the following factor sensitivities: Factor Sensitivity Portfolio Factor 1 Factor 2 (1) (0:1) (ba) P +1.5 -1.5 +0.8 +1.2 Calculate the expected returns on portfolios P and Q with Arbitrage Pricing Theory (APT) at the beginning of the year (t=0). (10%) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started