Question

please solve part (c) (green boxes are correct answers, red is incorrect) complete the journaling on May 31st and include all account titles. -------------------------------------------------------------------------------------------------------------------------------------- Kingbird

please solve part (c) (green boxes are correct answers, red is incorrect)

complete the journaling on May 31st and include all account titles.

--------------------------------------------------------------------------------------------------------------------------------------

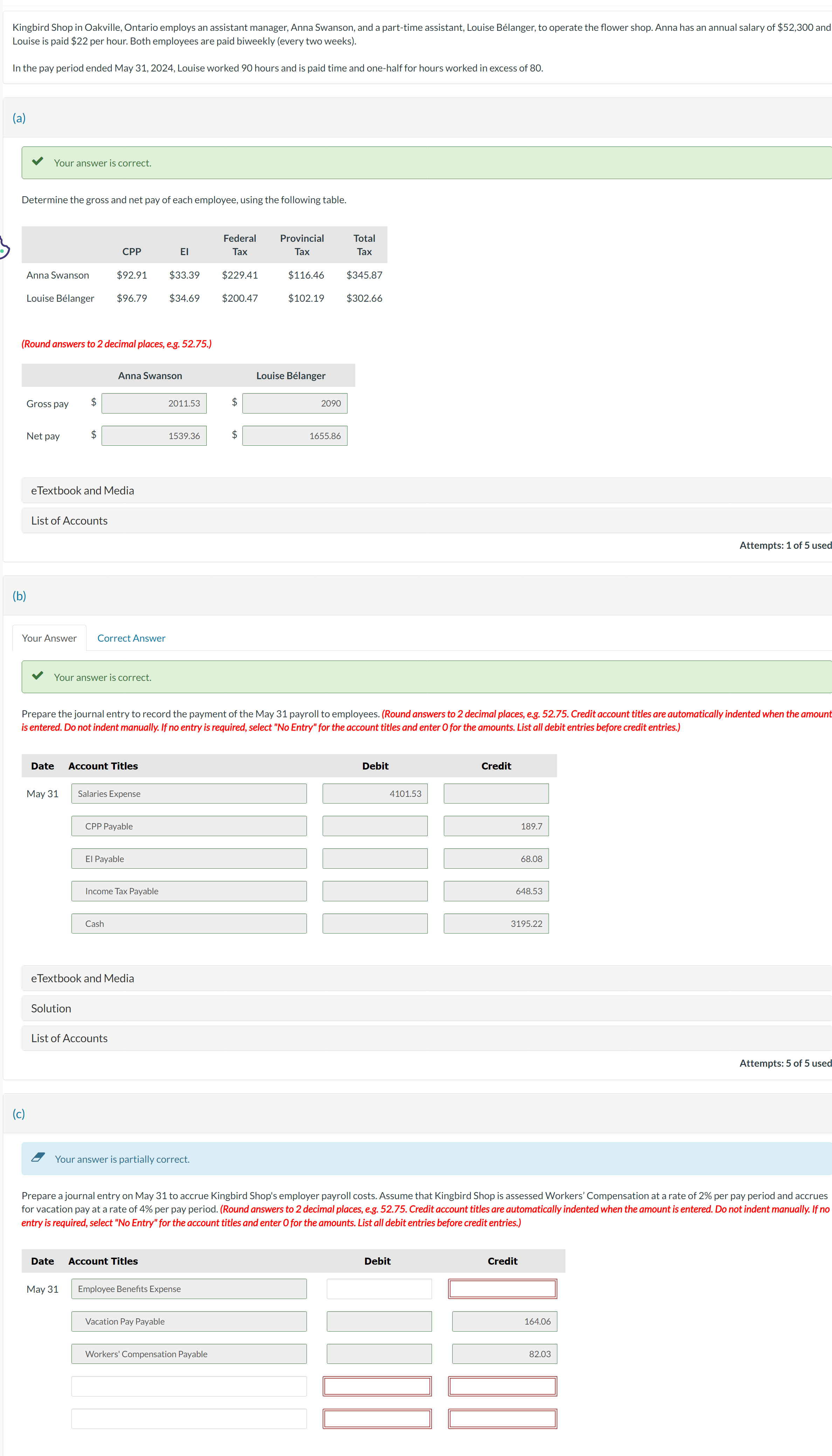

Kingbird Shop in Oakville, Ontario employs an assistant manager, Anna Swanson, and a part-time assistant, Louise Blanger, to operate the flower shop. Anna has an annual salary of $52,300 and Louise is paid $22 per hour. Both employees are paid biweekly (every two weeks). In the pay period ended May 31, 2024, Louise worked 90 hours and is paid time and one-half for hours worked in excess of 80.

Kingbird Shop in Oakville, Ontario employs an assistant manager, Anna Swanson, and a part-time assistant, Louise Blanger, to operate the flower shop. Anna has an annual salary of $52,300 and Louise is paid $22 per hour. Both employees are paid biweekly (every two weeks). In the pay period ended May 31, 2024, Louise worked 90 hours and is paid time and one-half for hours worked in excess of 80. Your answer is correct. Determine the gross and net pay of each employee, using the following table. (Round answers to 2 decimal places, e.g. 52.75.) eTextbook and Media List of Accounts Attempts: 1 of 5 used (b) Your answer is correct. Prepare the journal entry to record the payment of the May 31 payroll to employees. (Round answers to 2 decimal places, e.g. 52.75 . Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.) eTextbook and Media Solution List of Accounts Attempts: 5 of 5 used (c) Your answer is partially correct. Prepare a journal entry on May 31 to accrue Kingbird Shop's employer payroll costs. Assume that Kingbird Shop is assessed Workers' Compensation at a rate of 2% per pay period and accrues for vacation pay at a rate of 4% per pay period. (Round answers to 2 decimal places, e.g. 52.75 . Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.)

Kingbird Shop in Oakville, Ontario employs an assistant manager, Anna Swanson, and a part-time assistant, Louise Blanger, to operate the flower shop. Anna has an annual salary of $52,300 and Louise is paid $22 per hour. Both employees are paid biweekly (every two weeks). In the pay period ended May 31, 2024, Louise worked 90 hours and is paid time and one-half for hours worked in excess of 80. Your answer is correct. Determine the gross and net pay of each employee, using the following table. (Round answers to 2 decimal places, e.g. 52.75.) eTextbook and Media List of Accounts Attempts: 1 of 5 used (b) Your answer is correct. Prepare the journal entry to record the payment of the May 31 payroll to employees. (Round answers to 2 decimal places, e.g. 52.75 . Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.) eTextbook and Media Solution List of Accounts Attempts: 5 of 5 used (c) Your answer is partially correct. Prepare a journal entry on May 31 to accrue Kingbird Shop's employer payroll costs. Assume that Kingbird Shop is assessed Workers' Compensation at a rate of 2% per pay period and accrues for vacation pay at a rate of 4% per pay period. (Round answers to 2 decimal places, e.g. 52.75 . Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started