please solve :

- please use the same format when solving the problem.

- show on excel

- show work

- show formulas

-explain

Thank you!

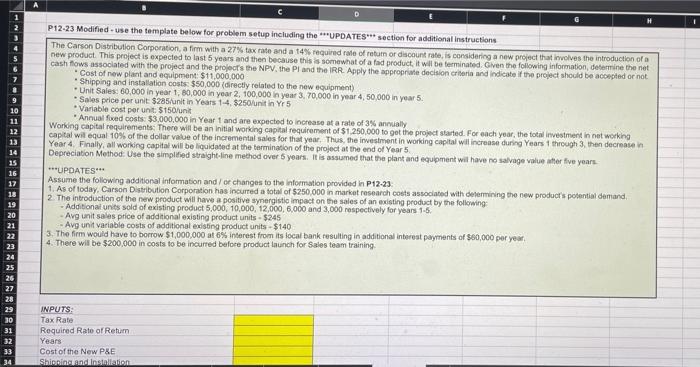

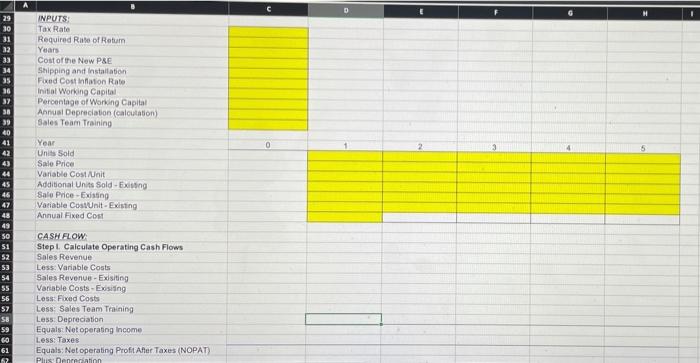

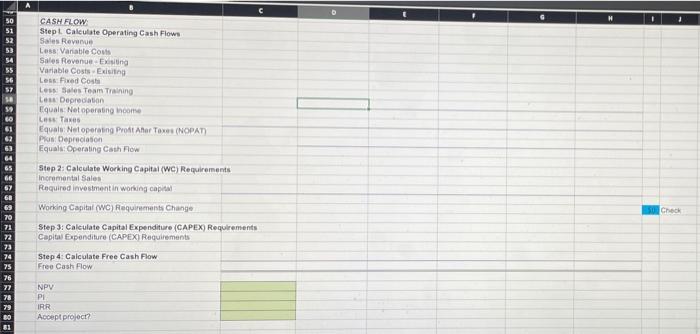

10 11 12 13 14 15 16 17 P12-23 Modified use the template below for problem setup including the **UPDATES"" section for additional instructions The Carson Distribution Corporation, a firm with a 27% tax rate and a 14% required rate of return or discount rate, is considering a new project that involves the introduction of a new product. This project is expected to last 5 years and then because this is somewhat of a fad product, it will be terminated. Given the following information, determine the net cash flows associated with the project and the project's the NPV the Pi and the IRR Apply the appropriate decision criteria and indicate the project should be accepted or not Cost of new plant and equipment: $11,000,000 Shipping and installation costs $50,000 (directly related to the new equipment) Unit Sales: 60,000 in year 1. 80,000 in year 2,100,000 in year 3.70,000 in year 4,50.000 in years Sales price per unit $285/unit in Years 1-4. $250/unit in Yes Variable cost per unit: $150/unit * Annual fixed costs: $3,000,000 in Year 1 and are expected to increase at a rate of 3% annually Working capital requirements: There will be an initial working capital requirement of $1.250.000 to get the project started. For each year, the total investment in not working capital wil equal 10% of the dollar value of the incremental sales for that year. Thus, the investment in working capital will increase during Years 1 through 3. then decrease in Year 4 Finally, all working capital will be liquidated at the termination of the project at the end of Year 5 Depreciation Method. Use the simplified straight line method over 5 years. It is assumed that the plant and equipment will have no salvage value iter five years ***UPDATES Assume the following additional information and/or changes to the Information provided in P12-23 1. As of today, Carson Distribution Corporation has incurred a total of $250,000 in market research costs associated with determining the new product's potential demand 2. The introduction of the new product will have a positive synergistic impact on the sales of an existing product by the following - Additional units sold of existing product 5,000, 10,000, 12,000,6,000 and 3,000 respectively for years 1-5 Avg unit sales price of additional existing product units - $245 Avg unit variable costs of additional existing product units - $140 3. The firm would have to borrow $1,000,000 at 6% interest from its local bank resulting in additional interest payments of $60,000 per year 4. There will be $200,000 in costs to be incurred before product launch for Sales team training URENNUNNM 19 20 21 22 23 24 25 26 27 28 29 10 31 32 33 INPUTS: Tax Rate Required Rate of Retum Years Cost of the New P&E Shinning and installation A N 29 10 BHAARAAS INPUTS Tax Rate Required Ruite of Retum Years Cost of the New PSE Shipping and installation Fixed Costinion Rate Initial Working Capital Percentage of Working Capital Annual Depreciation (calculation) Sales Team Training 0 2 4 31 12 33 34 35 30 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 GO 61 62 Year Units sold Sale Price Variable Cost/Unit Additional Units Sold - Existing Sale Price-Existing Variable CostUnit - Existing Annual Fixed Cost CASH FLOW Stepl. Calculate Operating Cash Flows Sales Revenue Less: Variable Costs Sales Revenue - Exisiting Variable Costs - Existing Less: Fixed Costs Less Sales Team Training Less: Depreciation Equals Net operating Income Less: Taxes Equals: Net operating Proft After Taxes (NOPAT) Plus Deneration 50 51 52 53 54 55 SG 57 CASH FLOW Step l. Calculate Operating Cash Flows Sales Revue Less Variable Cous Sales Revenue Existing Variable Costs Existing Les Fred Costa Less Sales Team Training Les Deprecation Equals Net operating income Les Taxes Equals Net operating Profit Aner Taxes (NOPAT) Pos Depreciation Equals: Operating Cash Flow Step 2: Calculate Working Capital (WC) Requirements Incremental Sales Required investment in working capital 64 50 Check Working Capital (WC) Requirements Change Step 3: Calculate Capital Expenditure (CAPEX) Requirements Capital Expenditure (CAPEX) Requirements PERKARERAS 68 69 70 71 72 73 74 75 76 22 78 Step 4: Calculate Free Cash Flow Free Cash Flow NPV PI IRR Accept project? 10 11 12 13 14 15 16 17 P12-23 Modified use the template below for problem setup including the **UPDATES"" section for additional instructions The Carson Distribution Corporation, a firm with a 27% tax rate and a 14% required rate of return or discount rate, is considering a new project that involves the introduction of a new product. This project is expected to last 5 years and then because this is somewhat of a fad product, it will be terminated. Given the following information, determine the net cash flows associated with the project and the project's the NPV the Pi and the IRR Apply the appropriate decision criteria and indicate the project should be accepted or not Cost of new plant and equipment: $11,000,000 Shipping and installation costs $50,000 (directly related to the new equipment) Unit Sales: 60,000 in year 1. 80,000 in year 2,100,000 in year 3.70,000 in year 4,50.000 in years Sales price per unit $285/unit in Years 1-4. $250/unit in Yes Variable cost per unit: $150/unit * Annual fixed costs: $3,000,000 in Year 1 and are expected to increase at a rate of 3% annually Working capital requirements: There will be an initial working capital requirement of $1.250.000 to get the project started. For each year, the total investment in not working capital wil equal 10% of the dollar value of the incremental sales for that year. Thus, the investment in working capital will increase during Years 1 through 3. then decrease in Year 4 Finally, all working capital will be liquidated at the termination of the project at the end of Year 5 Depreciation Method. Use the simplified straight line method over 5 years. It is assumed that the plant and equipment will have no salvage value iter five years ***UPDATES Assume the following additional information and/or changes to the Information provided in P12-23 1. As of today, Carson Distribution Corporation has incurred a total of $250,000 in market research costs associated with determining the new product's potential demand 2. The introduction of the new product will have a positive synergistic impact on the sales of an existing product by the following - Additional units sold of existing product 5,000, 10,000, 12,000,6,000 and 3,000 respectively for years 1-5 Avg unit sales price of additional existing product units - $245 Avg unit variable costs of additional existing product units - $140 3. The firm would have to borrow $1,000,000 at 6% interest from its local bank resulting in additional interest payments of $60,000 per year 4. There will be $200,000 in costs to be incurred before product launch for Sales team training URENNUNNM 19 20 21 22 23 24 25 26 27 28 29 10 31 32 33 INPUTS: Tax Rate Required Rate of Retum Years Cost of the New P&E Shinning and installation A N 29 10 BHAARAAS INPUTS Tax Rate Required Ruite of Retum Years Cost of the New PSE Shipping and installation Fixed Costinion Rate Initial Working Capital Percentage of Working Capital Annual Depreciation (calculation) Sales Team Training 0 2 4 31 12 33 34 35 30 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 GO 61 62 Year Units sold Sale Price Variable Cost/Unit Additional Units Sold - Existing Sale Price-Existing Variable CostUnit - Existing Annual Fixed Cost CASH FLOW Stepl. Calculate Operating Cash Flows Sales Revenue Less: Variable Costs Sales Revenue - Exisiting Variable Costs - Existing Less: Fixed Costs Less Sales Team Training Less: Depreciation Equals Net operating Income Less: Taxes Equals: Net operating Proft After Taxes (NOPAT) Plus Deneration 50 51 52 53 54 55 SG 57 CASH FLOW Step l. Calculate Operating Cash Flows Sales Revue Less Variable Cous Sales Revenue Existing Variable Costs Existing Les Fred Costa Less Sales Team Training Les Deprecation Equals Net operating income Les Taxes Equals Net operating Profit Aner Taxes (NOPAT) Pos Depreciation Equals: Operating Cash Flow Step 2: Calculate Working Capital (WC) Requirements Incremental Sales Required investment in working capital 64 50 Check Working Capital (WC) Requirements Change Step 3: Calculate Capital Expenditure (CAPEX) Requirements Capital Expenditure (CAPEX) Requirements PERKARERAS 68 69 70 71 72 73 74 75 76 22 78 Step 4: Calculate Free Cash Flow Free Cash Flow NPV PI IRR Accept project