Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve questions 10 and 11 Jeff and Mary Douglas, a couple in their mid-30s, have two children - Paul age 6 and Marcy age

please solve questions 10 and 11

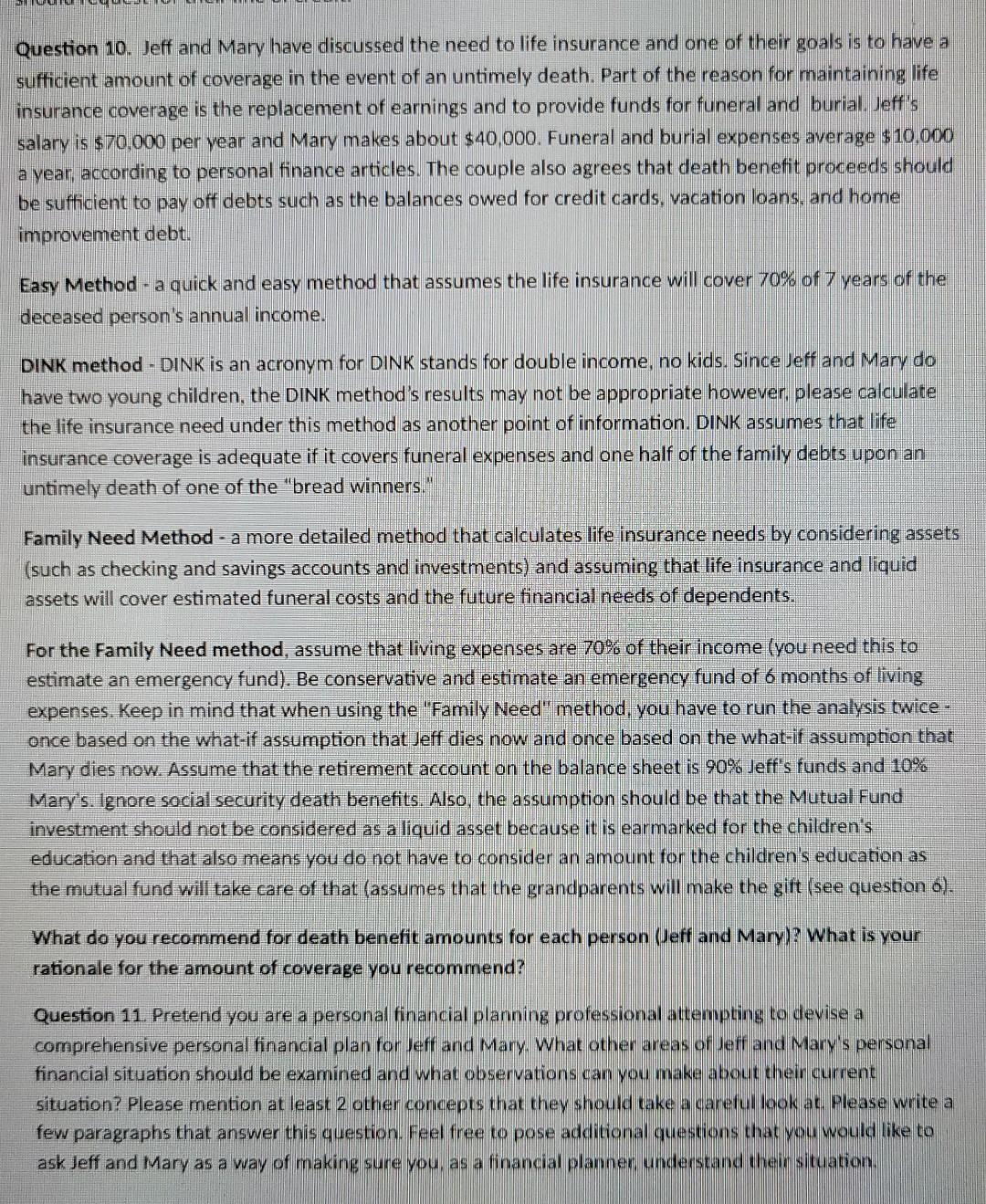

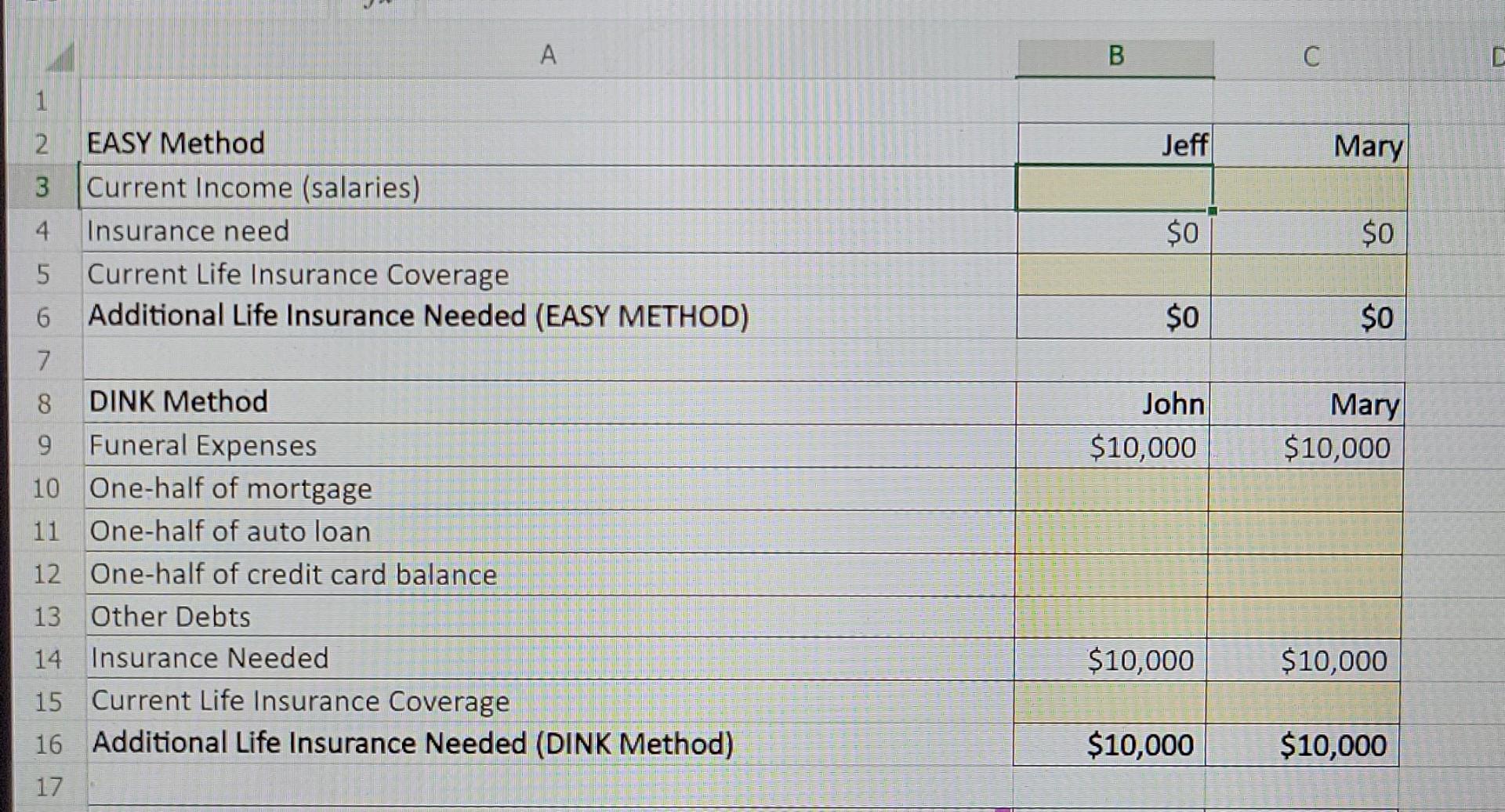

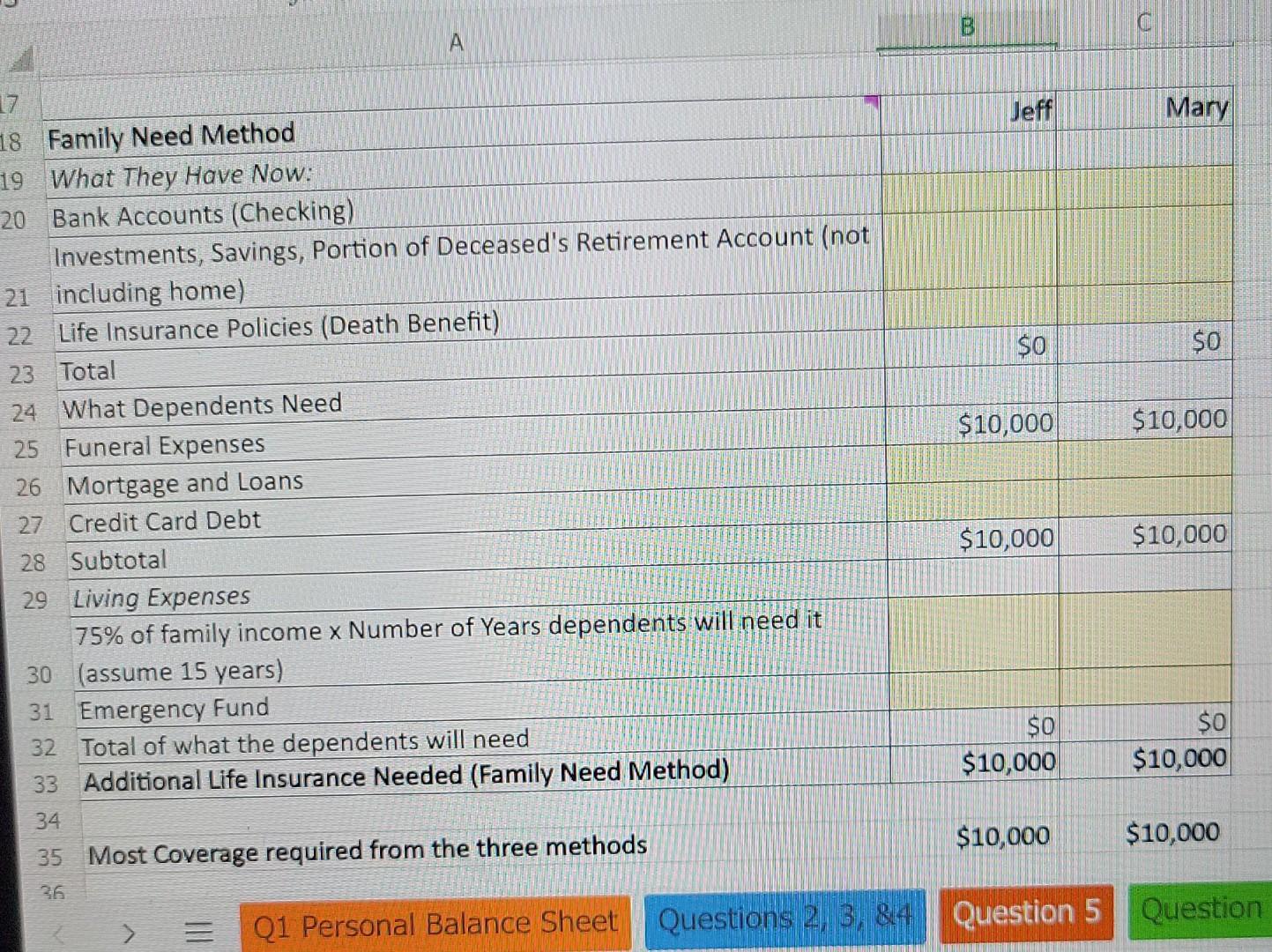

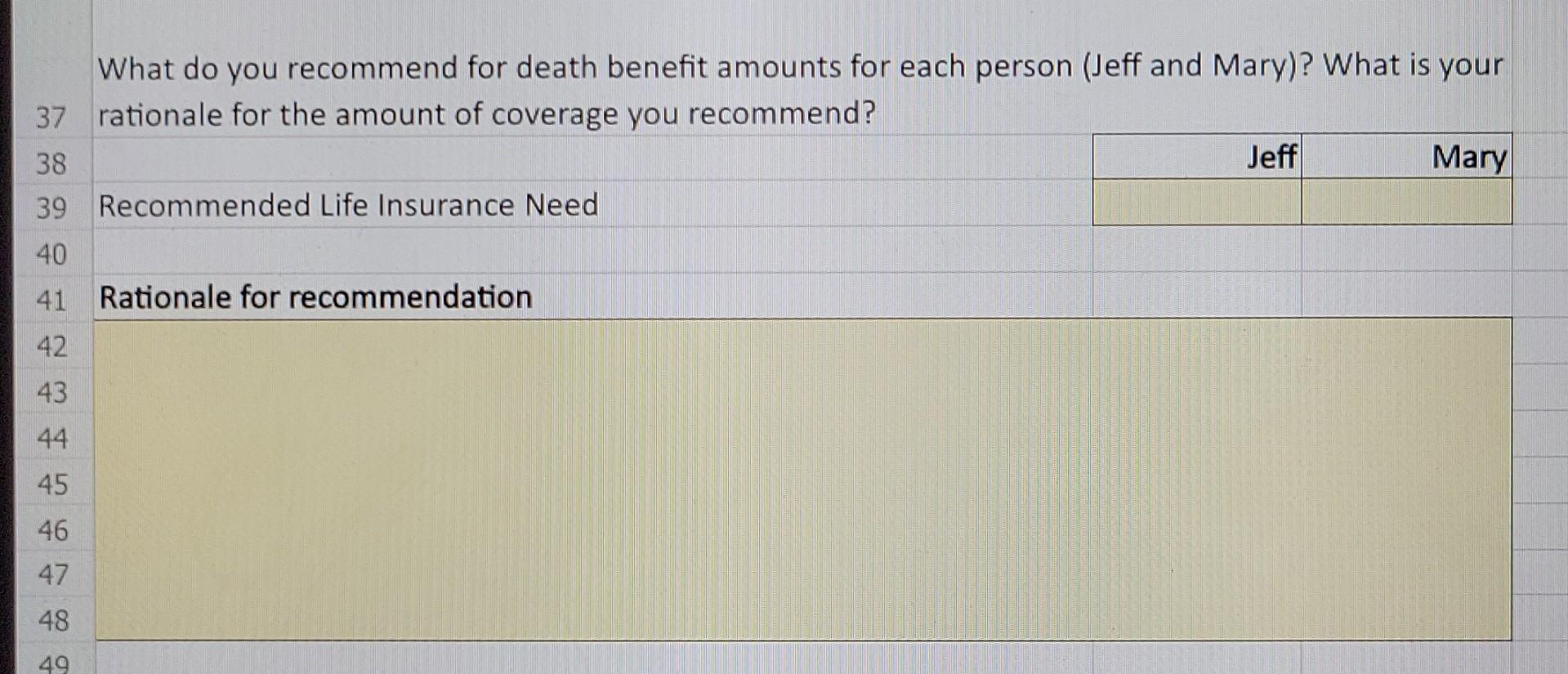

Jeff and Mary Douglas, a couple in their mid-30s, have two children - Paul age 6 and Marcy age 7. The Douglas' do not have substantial assets and have not yet reached their peak earning years, Jeff is a general manager of a jewelry manufacturer in Providence, RI while Mary teaches at the local elementary school in the town of Tiverton, RI. The family needs both incomes to meet their normal living expenses and to meet unforeseen emergency purchases. Their cash flow situation is tight, and they have had difficulty growing a "nest egg" through savings and investing. Jeff and Mary have discussed the needs of their two children who are typical, healthy and active kids, They have discussed trying to have Mary stay at home, be with the kids more and run the household but her income is very much needed, and she also wants a career and doesn't want to put her teaching job on hold to be a stay-at-home mother. Jeff also wants (and needs) to work and his job often requires long days - beyond the 9-5 grind. Now that both children are in school there is no day care need and Mary's job schedule matches nicely with the children's schedule, so she not only wants to continue to work but is thinking about completing a graduate degree. Currently, Mary can take most of the summer off from teaching (when the children are home on vacation) and so she enjoys a great deal of flexibility in the summer and spends quite a bit of time with the children in the summer. Jeff is the breadwinner of the family, but Mary's contribution is also very significant. Jeff earns about 65% of the total household income with Mary earning the remainder. By completing a graduate degree, Mary could increase her salary by at least 20% but she would need to commit to a continuing education program at either Providence College or University of Rhode Island. Although their net worth is not substantial, they have big dreams and aspirations. Their personal financial objectives relate to goals for a high standard of living. They want to help their children go to good colleges, a goal that they share with their own parents (the grandparents who want to help fund that dream). Jeff and Mary want to accumulate significant assets that allow for a comfortable retirement. Both are in excellent health and have family histories of long-life expectancies. Their retirements (at age 65 or so) could be a period of 20 or more years. Current Financial Information They own their home which they purchased two years ago for $285 000. Their town (Rumford, Rhode Island) tax office has assessed the home value at $200,000. Recently Mary hired a ceruined real estate appraiser to prepare a home appraisal and his appraised value was $300.000 (the real estate appraiser based her opinion of value on recent sales of comparable homes in similar neighborhoods and considered current construction costs and land value.) While surting the web Mar nouced that their home is listed on Zillow.com with a Zestimate" of $350.000. Zestimates are powered by an algorithm. Mary knows that the variables of the valuation system, including analysis of home exterior and interior and traditional real estate lacts and figures images, can be inaccurate and may be updateve however Mary logs into Zillow often to see how the system is valuing one of the rammes and most important asset. The mortgage on the home has a balance of $140.000. A review of the Douglas' financial information, bank statements, and other documents shows the following as of Dec. 31. 2021: . 2015 Camry worth about $11,000 (Kelly Blue Book), with a bank loan balance of $3.000 2014 Volvo S60 purchased six months ago for $14,500 is worth about $15.000 (Kelly Blue Book), with a bank loan balance of $10,000 . An insurance policy on Jeff's life with a face value of $100,000 with a cash surrender value of $2,500 and no policy loan balance. Mary is the beneficiary listed on Jeff's policy. An insurance policy on Mary's life with a face value of $10,000 and no cash surrender value. Jeff is the beneficiary listed on Mary's policy. Credit card balances that total $3 500. A savings account with a $1,000 balance. Two mutual funds earmarked for the children's college education. The account for Paul has a balance of $10,000 and Marcy's has $11,000 as a current balance. The fund has averaged an 8% annual rate of return over its life. 100 shares of Apple Inc. (NASDAQ: stock symbol = AAPL), formerly Apple Computer, Inc. You need to value this stock and all the stocks they own based on the Dec. 31, 2021 price per share. You will need to find that on the Internet. The cost basis is $120 per share. 200 shares of AT&T. The cost basis is $41 a share. 50 shares of Microsoft. The cost basis is $158 per share. $ 75 shares of Alphabet Inc. The cost basis is $1.600 per share. A checking account with a balance of $3.000. Jeff estimates that their furniture, fixtures etc, in the home are worth about $7.000. Jeff and Mary have retirement accounts that have a current market value of approximately $200.000 Mary still has an education loan with an outstanding balance of $15.000. It still has seven years left on it. A vacation loan of $750 due in 6 months and a home improvement loan of $2.000 due in 2 years (unsecured - not a home equity loan.) Jeff wants to finish the basement and he has discussed this at length with Mary. He is getting estimates from contractors based on ideas that both he and Mary have to create a play area for the children and a TV/den for the family. Jeff and Mary love to play ping pong and pool and would love to introduce the children to both "sports." He believes that the project will cost about $30,000 and he is interested in tapping into the home equity. Jeff is also an avid baseball fan and is looking at buying a membership to a local baseball/softball facility for both Paul and Marcy. He figures that since he doesn't have any expensive hobbies, it would be fun to get Paul started as a baseball player and Marcy as a softball player. The membership costs and related costs are as follows: $1,500 per year (covers both kids), equipment $500 per year, and team registration and travel costs will be about another $1,000 to $2,000 a year depending on how serious the kids become. Mary is not sure that this is a priority at this point and wants to explore this possibility in more detailGeneral instructions Question 10. Jeff and Mary have discussed the need to life insurance and one of their goals is to have a sufficient amount of coverage in the event of an untimely death. Part of the reason for maintaining life insurance coverage is the replacement of earnings and to provide funds for funeral and burial. Jeff's salary is $70,000 per year and Mary makes about $40,000. Funeral and burial expenses average $10.000 a year, according to personal finance articles. The couple also agrees that death benefit proceeds should be sufficient to pay off debts such as the balances owed for credit cards, vacation loans, and home improvement debt. Easy Method - a quick and easy method that assumes the life insurance will cover 70% of 7 years of the deceased person's annual income. DINK method - DINK is an acronym for DINK stands for double income, no kids. Since Jeff and Mary do have two young children, the DINK method's results may not be appropriate however, please calculate the life insurance need under this method as another point of information. DINK assumes that life insurance coverage is adequate if it covers funeral expenses and one half of the family debts upon an untimely death of one of the "bread winners." Family Need Method - a more detailed method that calculates life insurance needs by considering assets (such as checking and savings accounts and investments) and assuming that life insurance and liquid assets will cover estimated funeral costs and the future financial needs of dependents. For the Family Need method, assume that living expenses are 70% of their income (you need this to estimate an emergency fund). Be conservative and estimate an emergency fund of 6 months of living expenses. Keep in mind that when using the "Family Need" method, you have to run the analysis twice - once based on the what-if assumption that Jeff dies now and once based on the what-if assumption that Mary dies now. Assume that the retirement account on the balance sheet is 90% Jeff's funds and 10% Mary's. Ignore social security death benefits. Also, the assumption should be that the Mutual Fund investment should not be considered as a liquid asset because it is earmarked for the children's education and that also means you do not have to consider an amount for the children's education as the mutual fund will take care of that (assumes that the grandparents will make the gift (see question 6). What do you recommend for death benefit amounts for each person (Jeff and Mary)? What is your rationale for the amount of coverage you recommend? Question 11. Pretend you are a personal financial planning professional attempting to devise a comprehensive personal financial plan for Jeff and Mary. What other areas of Jeff and Mary's personal financial situation should be examined and what observations can you make about their current situation? Please mention at least 2 other concepts that they should take a careful look at. Please write a few paragraphs that answer this question. Feel free to pose additional questions that you would like to ask Jeff and Mary as a way of making sure you as a financial planner understand their situation D B C D Jeff Mary $0 $0 $0 $0 1 2 EASY Method 3 Current Income (salaries) 4 Insurance need 5 Current Life Insurance Coverage 6 Additional Life Insurance Needed (EASY METHOD) 7 8 DINK Method 9 Funeral Expenses 10 One-half of mortgage 11 One-half of auto loan 12 One-half of credit card balance 13 Other Debts 14 Insurance Needed 15 Current Life Insurance Coverage 16 Additional Life Insurance Needed (DINK Method) 17 John $10,000 Mary $10,000 $10,000 $10,000 $10,000 $10,000 B Jeff Mary $0 $0 $10,000 $10,000 17 18 Family Need Method 19 What They Have Now: 20 Bank Accounts (Checking) Investments, Savings, Portion of Deceased's Retirement Account (not 21 including home) 22 Life Insurance Policies (Death Benefit) 23 Total 24 What Dependents Need 25 Funeral Expenses 26 Mortgage and Loans 27 Credit Card Debt 28 Subtotal 29 Living Expenses 75% of family income x Number of Years dependents will need it 30 (assume 15 years) 31 Emergency Fund 32 Total of what the dependents will need 33 Additional Life Insurance Needed (Family Need Method) 34 35 Most Coverage required from the three methods $10,000 $10,000 $0 $10,000 $0 $10,000 $10,000 $10,000 > Q1 Personal Balance Sheet Questions 2, 3, &4 Question 5 Question What do you recommend for death benefit amounts for each person (Jeff and Mary)? What is your 37 rationale for the amount of coverage you recommend? 38 Jeff Mary 39 Recommended Life Insurance Need 40 41 Rationale for recommendation 42 43 44 45 46 47 48 49Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started