Answered step by step

Verified Expert Solution

Question

1 Approved Answer

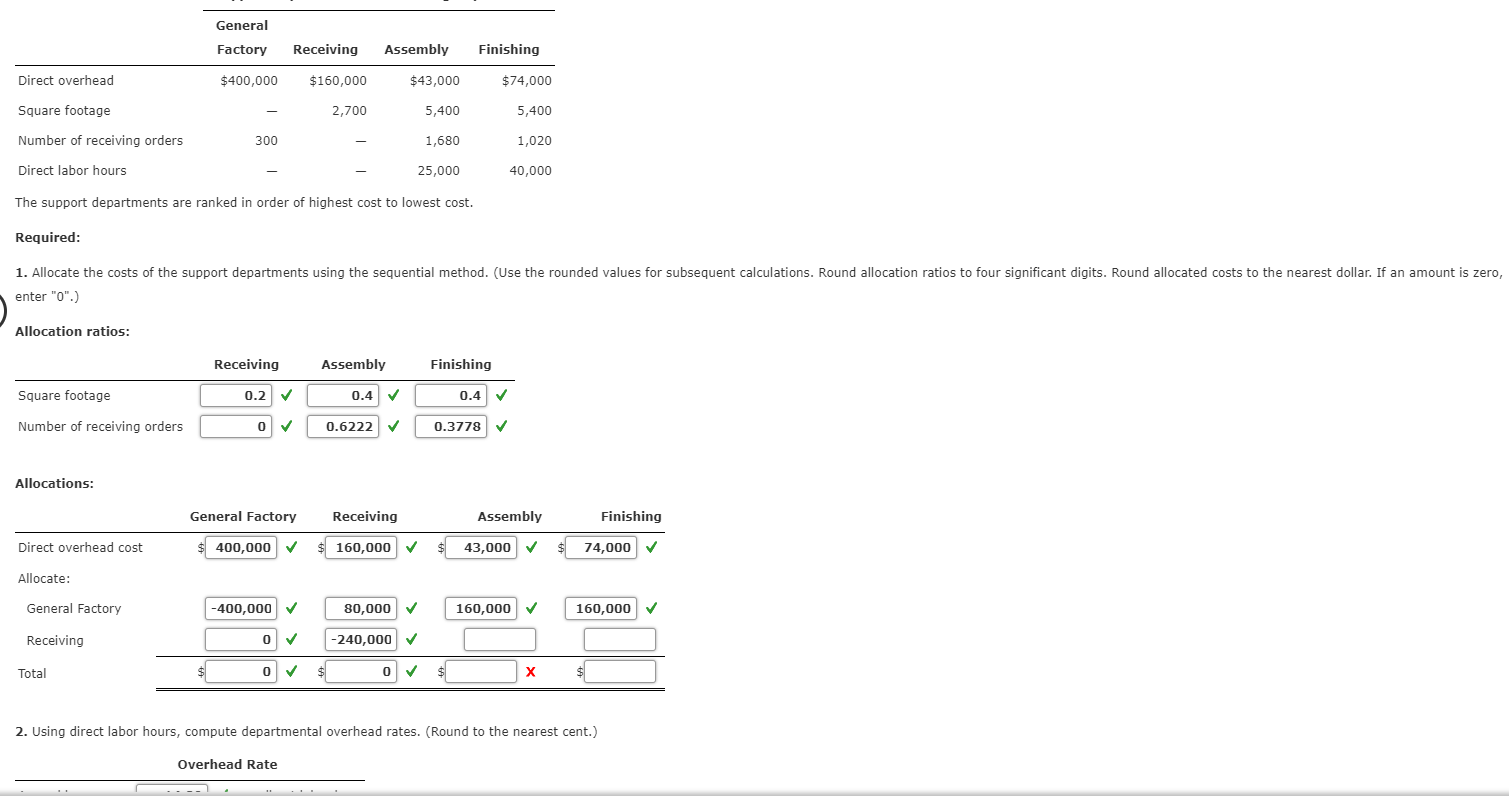

Please solve receiving for assembly and finishing. Also total for both. General Factory Receiving Assembly Finishing Direct overhead $400,000 $160,000 2,700 $74,000 5,400 Square footage

Please solve receiving for assembly and finishing. Also total for both.

General Factory Receiving Assembly Finishing Direct overhead $400,000 $160,000 2,700 $74,000 5,400 Square footage $43,000 5,400 1,680 25,000 Number of receiving orders 300 1,020 Direct labor hours - 40,000 The support departments are ranked in order of highest cost to lowest cost. Required: 1. Allocate the costs of the support departments using the sequential method. (Use the rounded values for subsequent calculations. Round allocation ratios to four significant digits. Round allocated costs to the nearest dollar. If an amount is zero, enter "0".) Allocation ratios: Receiving Assembly 0.4 Finishing 0.4 Square footage 0.2 0 Number of receiving orders 0.6222 0.3778 Allocations: General Factory Receiving Assembly Finishing Direct overhead cost $ 400,000 $ 160,000 $ 43,000 $ 74,000 Allocate: General Factory 160,000 160,000 -400,000 0 80,000 -240,000 Receiving Total 2. Using direct labor hours, compute departmental overhead rates. (Round to the nearest cent.) Overhead RateStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started