Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve thank u E9-15 (Algo) Computing and Interpreting the Fixed Asset Turnover Ratio from a Financial Analysts Perspective [LO 9-7) The following data were

please solve thank u

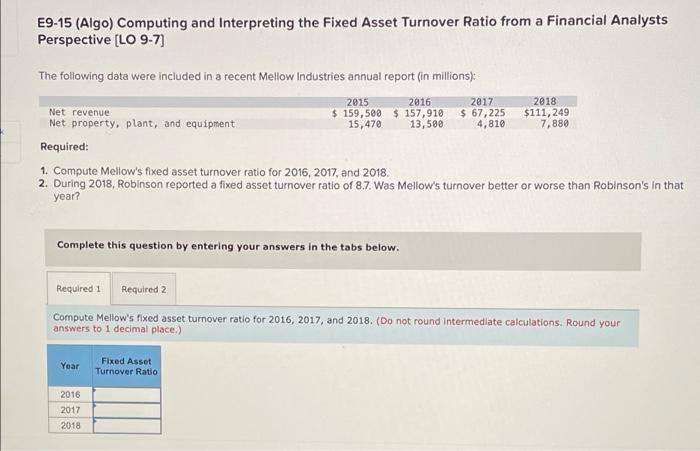

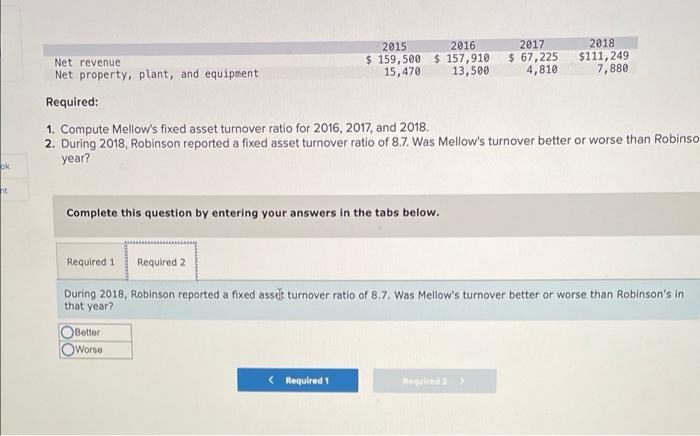

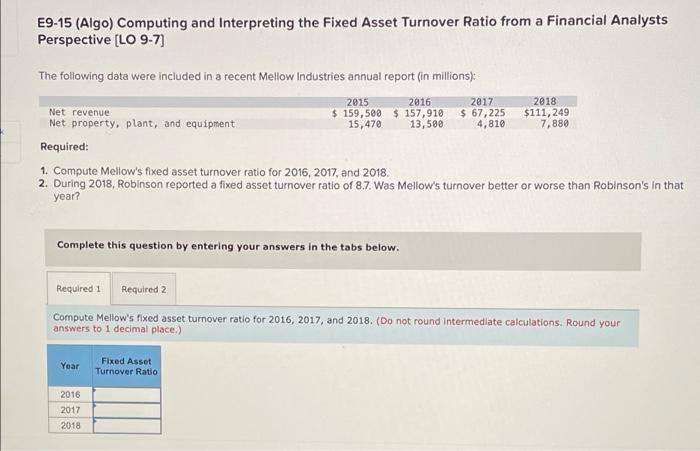

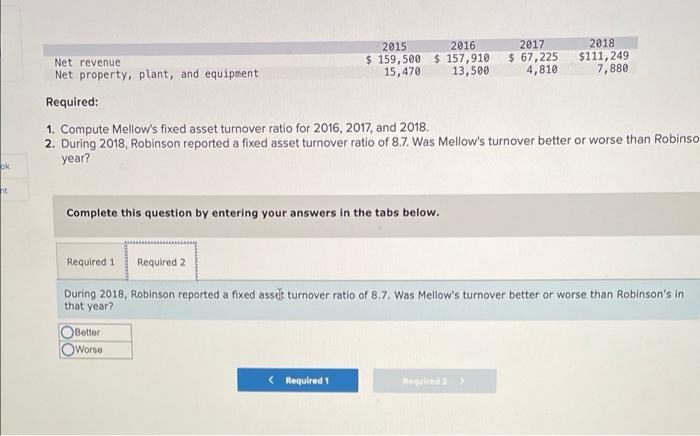

E9-15 (Algo) Computing and Interpreting the Fixed Asset Turnover Ratio from a Financial Analysts Perspective [LO 9-7) The following data were included in a recent Mellow Industries annual report (in millions): 2015 2016 2017 2018 Net revenue $ 159,500 $ 157,910 $ 67,225 $111,249 Net property, plant, and equipment 15, 470 13,500 4,810 7,880 Required: 1. Compute Mellow's fixed asset turnover ratio for 2016, 2017 and 2018. 2. During 2018, Robinson reported a fixed asset turnover ratio of 8.7. Was Mellow's turnover better or worse than Robinson's in that year? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute Mellow's fixed asset turnover ratio for 2016, 2017, and 2018. (Do not round intermediate calculations. Round your answers to 1 decimal place.) Year Fixed Asset Turnover Ratio 2016 2017 2018 2015 $ 159,500 15,470 Net revenue Net property, plant, and equipment 2016 157,910 13,500 2017 $ 67,225 4,810 2018 $111,249 7,880 Required: 1. Compute Mellow's fixed asset turnover ratio for 2016, 2017, and 2018, 2. During 2018, Robinson reported a fixed asset turnover ratio of 8.7. Was Mellow's turnover better or worse than Robinso year? OK ht Complete this question by entering your answers in the tabs below. Required 1 Required 2 During 2018, Robinson reported a fixed asset turnover ratio of 8.7. Was Mellow's turnover better or worse than Robinson's in that year? Better Worse

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started