Answered step by step

Verified Expert Solution

Question

1 Approved Answer

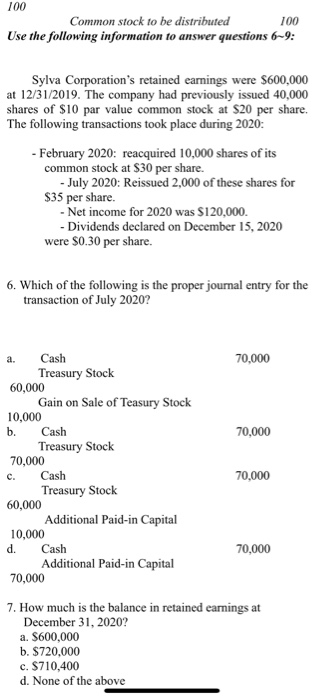

please solve the 6,7,8,9 questions 100 100 Common stock to be distributed Use the following information to answer questions 69: Sylva Corporation's retained earnings were

please solve the 6,7,8,9 questions

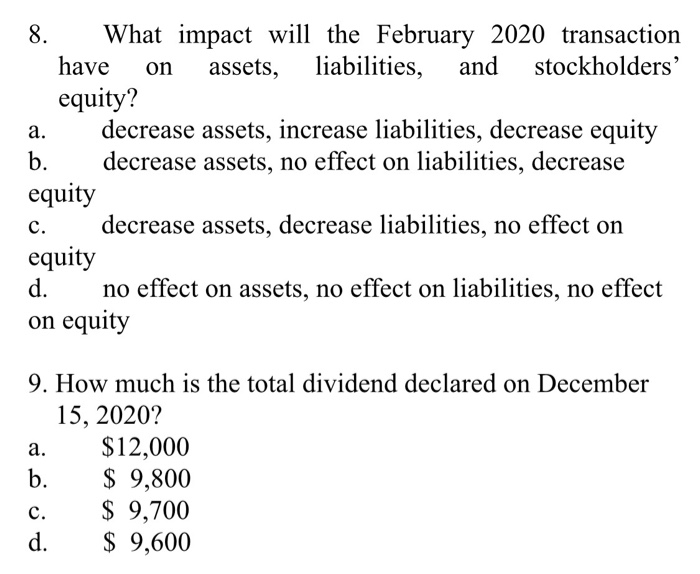

100 100 Common stock to be distributed Use the following information to answer questions 69: Sylva Corporation's retained earnings were $600,000 at 12/31/2019. The company had previously issued 40,000 shares of $10 par value common stock at $20 per share. The following transactions took place during 2020: - February 2020: reacquired 10,000 shares of its common stock at $30 per share. - July 2020: Reissued 2,000 of these shares for $35 per share. -Net income for 2020 was $120,000. - Dividends declared on December 15, 2020 were $0.30 per share. 6. Which of the following is the proper journal entry for the transaction of July 2020? a. 70,000 b. 70,000 Cash Treasury Stock 60,000 Gain on Sale of Teasury Stock 10,000 Cash Treasury Stock 70,000 Cash Treasury Stock 60,000 Additional Paid-in Capital 10,000 d. Cash Additional Paid-in Capital 70,000 c. 70,000 70,000 7. How much is the balance in retained earnings at December 31, 2020? a. $600,000 b. $720,000 c. $710,400 d. None of the above a. b. 8. What impact will the February 2020 transaction have on assets, liabilities, and stockholders' equity? decrease assets, increase liabilities, decrease equity decrease assets, no effect on liabilities, decrease equity decrease assets, decrease liabilities, no effect on equity d. no effect on assets, no effect on liabilities, no effect on equity c. 9. How much is the total dividend declared on December 15, 2020? a. $12,000 b. $ 9,800 c. $ 9,700 d. $ 9,600

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started