Please solve the following:

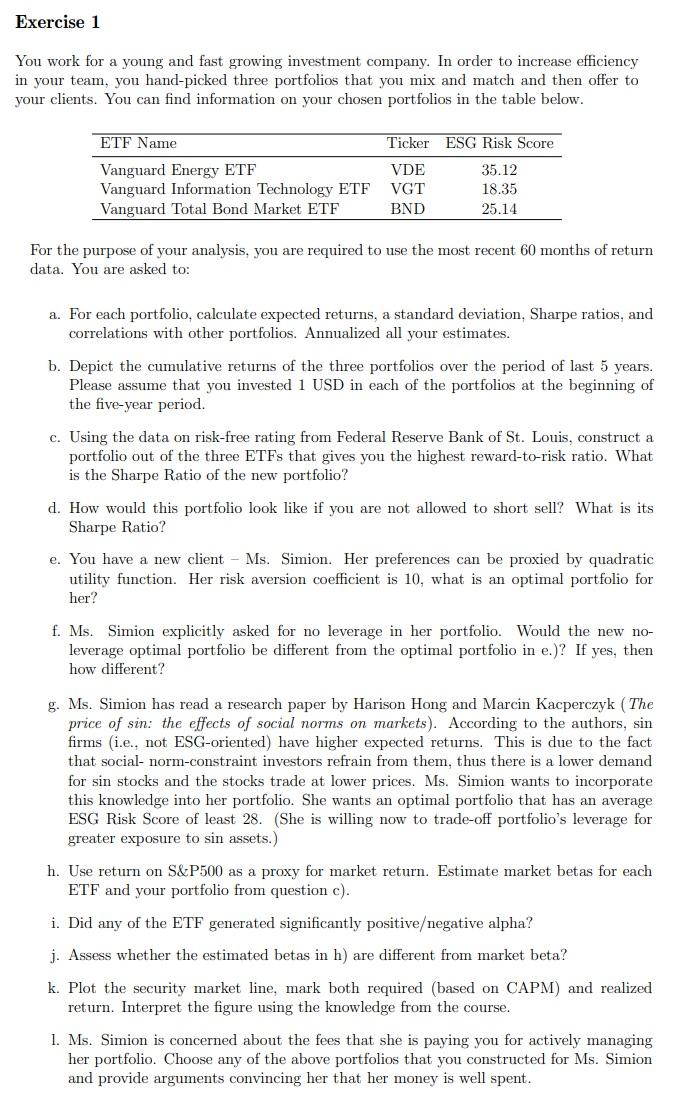

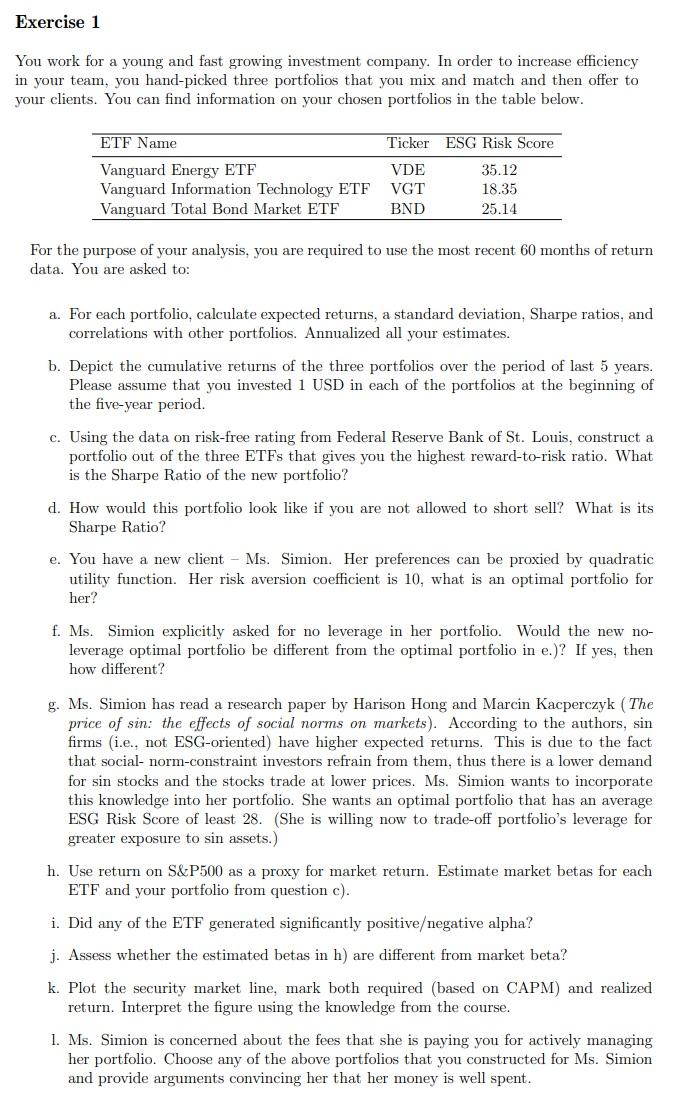

Exercise 1 You work for a young and fast growing investment company. In order to increase efficiency in your team, you hand-picked three portfolios that you mix and match and then offer to your clients. You can find information on your chosen portfolios in the table below. Ticker ESG Risk Score VDE ETF Name Vanguard Energy ETF Vanguard Information Technology ETF Vanguard Total Bond Market ETF VGT BND 35.12 18.35 25.14 For the purpose of your analysis, you are required to use the most recent 60 months of return data. You are asked to: a. For each portfolio, calculate expected returns, a standard deviation, Sharpe ratios, and correlations with other portfolios. Annualized all your estimates. b. Depict the cumulative returns of the three portfolios over the period of last 5 years. Please assume that you invested 1 USD in each of the portfolios at the beginning of the five-year period. c. Using the data on risk-free rating from Federal Reserve Bank of St. Louis, construct a portfolio out of the three ETFs that gives you the highest reward-to-risk ratio. What is the Sharpe Ratio of the new portfolio? d. How would this portfolio look like if you are not allowed to short sell? What is its Sharpe Ratio? e. You have a new client Ms. Simion. Her preferences can be proxied by quadratic utility function. Her risk aversion coefficient is 10, what is an optimal portfolio for her? f. Ms. Simion explicitly asked for no leverage in her portfolio. Would the new no- leverage optimal portfolio be different from the optimal portfolio in e.)? If yes, then how different? g. Ms. Simion has read a research paper by Harison Hong and Marcin Kacperczyk (The price of sin: the effects of social norms on markets). According to the authors, sin firms (i.e., not ESG-oriented) have higher expected returns. This is due to the fact that social- norm-constraint investors refrain from them, thus there is a lower demand for sin stocks and the stocks trade at lower prices. Ms. Simion wants to incorporate this knowledge into her portfolio. She wants an optimal portfolio that has an average ESG Risk Score of least 28. (She is willing now to trade-off portfolio's leverage for greater exposure to sin assets.) h. Use return on S&P500 as a proxy for market return. Estimate market betas for each ETF and your portfolio from question c). i. Did any of the ETF generated significantly positiveegative alpha? j. Assess whether the estimated betas in h) are different from market beta? k. Plot the security market line, mark both required (based on CAPM) and realized return. Interpret the figure using the knowledge from the course. 1. Ms. Simion is concerned about the fees that she is paying you for actively managing her portfolio. Choose any of the above portfolios that you constructed for Ms. Simion and provide arguments convincing her that her money is well spent. Exercise 1 You work for a young and fast growing investment company. In order to increase efficiency in your team, you hand-picked three portfolios that you mix and match and then offer to your clients. You can find information on your chosen portfolios in the table below. Ticker ESG Risk Score VDE ETF Name Vanguard Energy ETF Vanguard Information Technology ETF Vanguard Total Bond Market ETF VGT BND 35.12 18.35 25.14 For the purpose of your analysis, you are required to use the most recent 60 months of return data. You are asked to: a. For each portfolio, calculate expected returns, a standard deviation, Sharpe ratios, and correlations with other portfolios. Annualized all your estimates. b. Depict the cumulative returns of the three portfolios over the period of last 5 years. Please assume that you invested 1 USD in each of the portfolios at the beginning of the five-year period. c. Using the data on risk-free rating from Federal Reserve Bank of St. Louis, construct a portfolio out of the three ETFs that gives you the highest reward-to-risk ratio. What is the Sharpe Ratio of the new portfolio? d. How would this portfolio look like if you are not allowed to short sell? What is its Sharpe Ratio? e. You have a new client Ms. Simion. Her preferences can be proxied by quadratic utility function. Her risk aversion coefficient is 10, what is an optimal portfolio for her? f. Ms. Simion explicitly asked for no leverage in her portfolio. Would the new no- leverage optimal portfolio be different from the optimal portfolio in e.)? If yes, then how different? g. Ms. Simion has read a research paper by Harison Hong and Marcin Kacperczyk (The price of sin: the effects of social norms on markets). According to the authors, sin firms (i.e., not ESG-oriented) have higher expected returns. This is due to the fact that social- norm-constraint investors refrain from them, thus there is a lower demand for sin stocks and the stocks trade at lower prices. Ms. Simion wants to incorporate this knowledge into her portfolio. She wants an optimal portfolio that has an average ESG Risk Score of least 28. (She is willing now to trade-off portfolio's leverage for greater exposure to sin assets.) h. Use return on S&P500 as a proxy for market return. Estimate market betas for each ETF and your portfolio from question c). i. Did any of the ETF generated significantly positiveegative alpha? j. Assess whether the estimated betas in h) are different from market beta? k. Plot the security market line, mark both required (based on CAPM) and realized return. Interpret the figure using the knowledge from the course. 1. Ms. Simion is concerned about the fees that she is paying you for actively managing her portfolio. Choose any of the above portfolios that you constructed for Ms. Simion and provide arguments convincing her that her money is well spent